Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Enerplus (ERF 0.25%) fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Enerplus' story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Enerplus' key statistics:

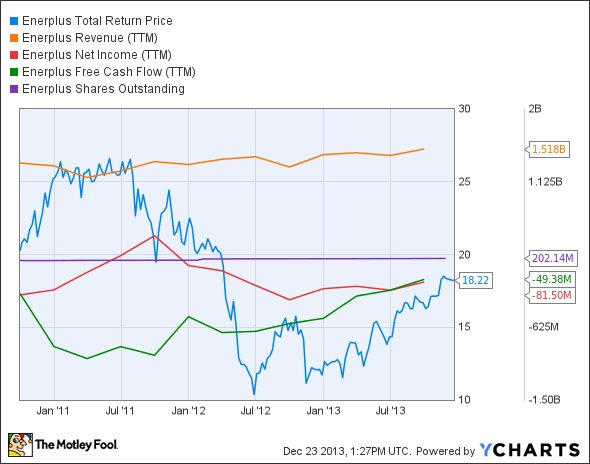

ERF Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

12.5% |

Fail |

|

Improving profit margin |

69.5% |

Pass |

|

Free cash flow growth > Net income growth |

77.5% vs. 65.7% |

Pass |

|

Improving EPS |

70.8% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

(10%) vs. 70.8% |

Pass |

Source: YCharts.

*Period begins at end of Q3 2010.

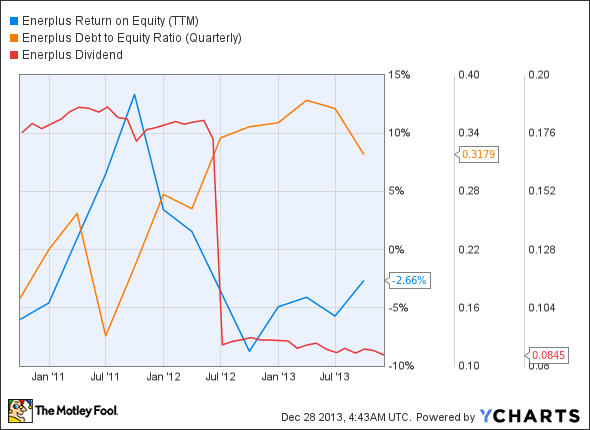

ERF Return on Equity (TTM) data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

55.7% |

Pass |

|

Declining debt to equity |

87.3% |

Fail |

|

Dividend growth > 25% |

(52%) |

Fail |

|

Free cash flow payout ratio < 50% |

Negative FCF |

Fail |

Source: YCharts.

*Period begins at end of Q3 2010.

How we got here and where we're going

Things look much better for Enerplus in its second assessment -- the Canadian oil and gas producer improved on last year's score by four passing grades to finish up with a solid five-out-of-nine score. The company has been able to benefit from the rise in natural gas prices this year, which has helped to improve its fundamentals, although not to the point of profitability as yet. Enerplus' net income and free cash flow levels are substantially higher than they were three years ago, as well as one year ago, but mediocre revenue growth remains a problem. How might Enerplus push its revenue growth further over the next few quarters while maintaining positive momentum on the bottom line? Let's dig a little deeper to find out.

Enerplus recently delivered market-topping third-quarter results thanks to major growth in crude-oil production at its North Dakota assets, which are now producing 20% more than they were a year ago. Fool contributor Nathan Kirykos notes that the company has also enjoyed strong performance from core areas in both the U.S. and Canada, especially at its Bakken, Fort Berthold, and Marcellus assets.

However, Enerplus and its peers have lately suffered from falling prices of West Texas Intermediate against the Brent Crude benchmark, which has dampened the profitability of unconventional North American producers. As a result, a number of North American oil and gas producers have been shedding non-producing acreage positions to refocus on core assets and reduce debt levels. Fool analyst Joel South notes that Enerplus recently sold off its oil assets in Manitoba for $220 million in order to reduce debt and expand its working interest in the Williston Basin. The company also unloaded Canadian oil and liquids properties in a deal worth $80 million. On the other hand, Enerplus recently purchased additional acreage in the Marcellus region for $153 million, which should help it to grow production from 88,000 BOE per day to an expected 95,000 BOE per day.

Fool contributor Dan Caplinger notes that Enerplus and fellow smaller-scale peer Kodiak Oil & Gas (NYSE: KOG) could both benefit from the substantial amount of recoverable resources in the Bakken shale through technological improvements to extraction processes, which help to trim high production costs in the region. EOG Resources (EOG 0.59%), for example, spends less than a third as much per Bakken well as Enerplus, which gives it a huge cost advantage (and also helps to explain why EOG is profitable while Enerplus is not).

Putting the pieces together

Today, Enerplus has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.