Amazon.com's (AMZN -1.64%) stock has appreciated 50% over the past year. When you combine that strong performance with the stock trading at 151 times forward earnings, it presents a difficult decision for investors. Did you miss it? Answers below.

Important numbers

Do you know how many customers Amazon serves per day? Answer: 19.5 million. Ironically, I would have expected this number to be higher. But it being lower than I expected is actually a positive.

Since most people are still shopping at brick-and-mortar retailers, it leaves a lot of room for growth for Amazon, especially considering Amazon owns a 10% e-commerce market share in North America. Wal-Mart (WMT 1.32%) is doing everything it can to catch Amazon online, even purchasing eight technology labs over the past three years. And while Wal-Mart is growing online, it's still not growing as fast as Amazon.

In the third quarter, Amazon's sales jumped 31% to $10.3 billion year over year. The big negative is that Amazon's growth comes at a price, which is a lack of profits. Fortunately, Amazon isn't the type of company to bleed money, but it's still wildly inconsistent on the bottom line. For example, the company reported losses in two of its last four quarters. If we weren't living in a raging bull-market environment, it's unlikely Amazon's stock would be performing so well based on these circumstances.

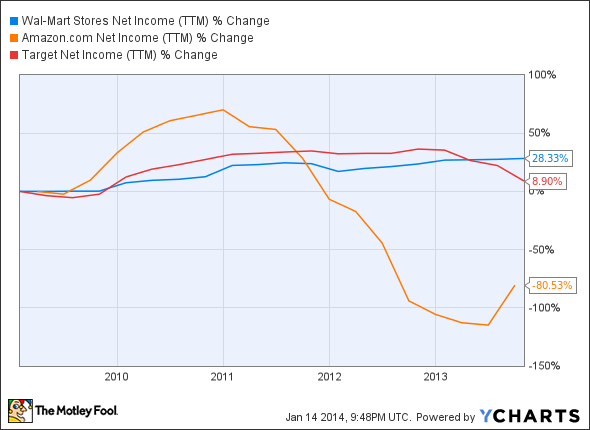

The chart below compares net income performances for Amazon, Wal-Mart, and Target (TGT -0.70%) over the past five years. You will see that Wal-Mart is by far more consistent than Amazon on the bottom line, which makes it a superior investment for value investors. Also notice that Wal-Mart has outperformed Target on the bottom line, even well before the data breach:

WMT Net Income (TTM) data by YCharts

If you're concerned about the lack of profitability for Amazon, then perhaps Amazon's clear domination in one area will help support your optimism for this online behemoth.

The new low-price retailer

When you think of a low-price retailer, you likely think of Wal-Mart. That makes sense based on its everyday low prices, but Amazon now uses a price engine system that automatically adjusts Amazon product prices to beat its competitors, including Wal-Mart. Therefore, while many consumers currently shop online for convenience, some of them might gravitate toward Amazon in the future once they learn that it's the best place to find the lowest prices.

The catch here is shipping. An Amazon Prime customer can receive free shipping, but consumers looking to cut costs (easy to find in today's world) aren't likely to sign-up for Amazon Prime. Plus, many consumers don't like commitments. The good news for some consumers is that Amazon's Locker service allows customers to pick up their products from secure locations.

All of this is exciting, but it's not the biggest news for Amazon.

Making noise

Amazon recently made a deal with United States Postal Service, which will allow Amazon to deliver packages on Sundays (only in select cities for now). This is a massive move, adding more convenience for Amazon customers. But it's still not the biggest potential news.

Remember when Amazon's CEO, Jeff Bezos, was on CBS's 60 Minutes? If you recall, the big news from this interview was about Amazon using unmanned drones to deliver packages to customers. Of course, if this took off, it would be a tremendous advantage for Amazon. However, the FAA is a slow-moving operation, which is a positive. Safety first. And when it comes to unmanned drones, there are many safety concerns, including the potential for drones to crash into power lines, cars, kids, and to disrupt flights taking off and landing at nearby airports.

This was the basis of the story. And it's possible that it will eventually all work out. But look deeper into this event, as in the 60 Minutes segment. When did this story air? December 1, 2013. When was Cyber Monday? December 2, 2013. Hmm.... Looks to me like Jeff Bezos is even more brilliant than people give him credit for. Whether unmanned drones are a realistic goal or not, what better time to create a buzz than the night before the company's biggest shopping holiday?

The bottom line

Could Amazon's stock price come crashing down? Yes. The valuation is extremely high, especially given the company's inability to consistently deliver profits. On the other hand, if you're only looking at the underlying business, it's an enormous success, and it's going to keep growing. Consistent profits are likely at some point down the road, although they might not be large profits. Personally, I'd keep Amazon on my watchlist, hoping for a significant pullback in the stock price that would present an opportunity to get involved. If this significant pullback never occurs, it's OK. A missed opportunity is better than a loss.