Nucor (NUE -1.04%) just released earnings, and it was a solid beat across nearly all of the most important metrics, including higher earnings per share of 53 cents, well above the 35 to 40 cent range the company forecast just last month. Total sales also increased, up 10% versus the year-ago period. However, the domestic steel business is still a mess, with utilization rates across the industry at or below 70%, meaning the incredibly high fixed costs of operation weigh heavily on most of the competition.

There is good news: Lots of steel-intensive companies like Caterpillar are bringing manufacturing back to the U.S., and the automotive industry is experiencing a renaissance as well. Add in that the steel-consuming domestic oil and gas business will hit record levels of production over the next decade, and there are a lot of positive catalysts. Will they help Nucor, and competitors AK Steel Holding (AKS) and U.S. Steel (X -0.49%) to new heights? Let's take a closer look.

Record investments over the downturn

The steel business is incredibly cyclical, and Nucor's fortress-like balance sheet has allowed the company to invest heavily since the current downturn began in 2008. Management has invested $4.4 billion on capital improvements, and acquired $3.6 billion in new assets. It's the company's ability to do this during a major downturn in the steel business that sets is apart from the competition. CEO John Ferriola, from the Q4 earnings call:

I am pleased to report a number of impressive achievements in the ongoing implementation of our capital projects. These initiatives grow Nucor's long-term earnings power by providing us new higher-margin product offerings, cost reductions and quality improvements ... Our industry-leading product diversity continues to grow as we move up the value chain in all of our businesses.

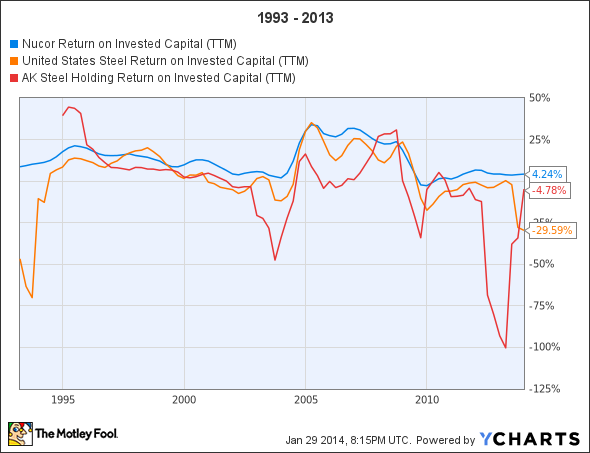

This kind of disciplined approach -- managing the business well during both the upturns and downturns -- is reflected in the company's industry-leading ROIC, or return on invested capital:

NUE Return on Invested Capital (TTM) data by YCharts

Not only has Nucor generated strong returns during the good times, its ability to invest in better capability and efficiency during downturns has led to less negative impact on ROIC when times are tough. AK Steel and U.S. Steel just don't have the same track record of effective investment in improving their businesses, which leads to even lower lows when the market goes south.

Financial strength makes all the difference

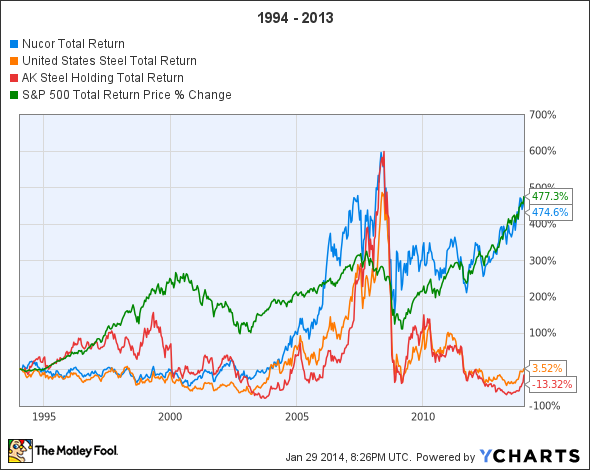

Over long periods of time, Nucor has absolutely crushed its competitors as an investment:

NUE Total Return Price data by YCharts

While Nucor has only matched the S&P 500 for total returns over the past 20 years, it's worth noting something very important: Over the past five years, the U.S. stock market has had one of its best periods ever, while the steel industry has been in a historic rut, and Nucor has still managed to give investors a reasonable rate of return. Once the cycle turns, Nucor should outperform the market handily.

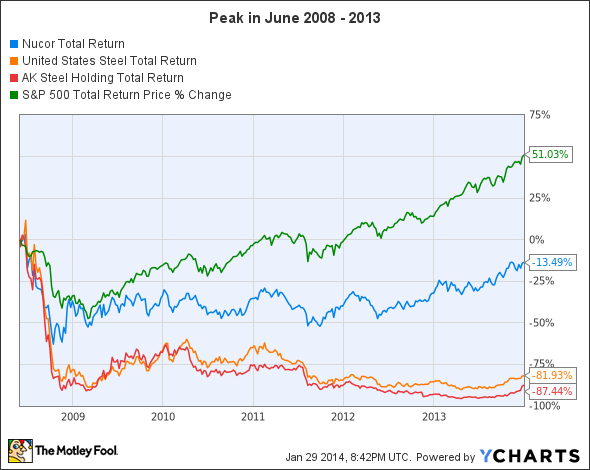

U.S. Steel and AK Steel have seen their stock prices destroyed since their peak in mid-2008; both are down more than 83% while Nucor's stock has fallen "only" 29%. Nucor's financial strength -- again -- turns the tide even further, however, because its ability to generate free cash flow and earnings -- even in the bad times -- means that it still pays a dividend, and has for more than four decades. This nearly guaranteed income means the losses since the peak are cut in half:

NUE Total Return Price data by YCharts

But before you say, "it's still a loser, pal," remember that we are still in the throes of a challenging time in the steel business, and as Peter Lynch told us in One Up on Wall Street, the downturn is the best time to invest in cyclical industries like steel production.

Competitive advantages, input costs, and sustaining a lead on the competition

Nucor's deal with Encana to produce its own natural gas offers more than just the ability to hedge against rising natural gas prices, and create income via sales of natural gas beyond its needs. The direct-reduced iron, or DRI, that is produced using NG-powered furnaces, is giving Nucor a number of competitive advantages beyond just cost, and the company sees the advantages as sustainable. Ferriola, from the Q4 earnings call (emphasis mine):

...if a competitor was to move forward with plans in DRI production, right now, it would take them probably a minimum of two or three years, by the time they gathered all the permits and went through the ordering of equipment and the construction phase ... So we think we would have a two to three year time advantage, and with that comes a lot of knowledge and a lot of experience that we think would give us a competitive advantage. So we believe that the way we went into this and being first into it and going into it in a big way as we have done, is going to give us a long-term ability to have a competitive position.

Final thoughts

Steelmakers face continued pressure, but eventually the market will come back; when it does, Nucor is easily the best positioned in the business, and the best run. The long-term results don't lie:

NUE EPS Diluted (TTM) data by YCharts

AK Steel and U.S. Steel have both had higher highs, but when the market turns south on steel, they bleed cash, costing investors big losses. If you want to invest in the impending return of steel, Nucor is the best American bet, and it's not even close.