Image source: Bitcoin.org.

For a while there, it looked like Bitcoin had settled down, grown up, stabilized. The cryptocurrency hovered between $900 and $1,000 per virtual coin for months, which is a radical change from the hyper-volatility of the previous three months.

But in February, Bitcoin took a turn for the worse. In a firestorm of controversy, Bitcoin's trading volumes have skyrocketed -- and valuation plummeted.

Bitcoin trading dipped as low as $302 per coin this morning. That's a 33% value plunge in one morning, starting from a closing price of $451 on Feb. 13. And it came on a truly epic wave of high trading volumes. Bitcoin has also gotten a 54% haircut in five days and a 67% decimation over the last two weeks.

Here's what it looks like:

Source: Bitcoin Charts.

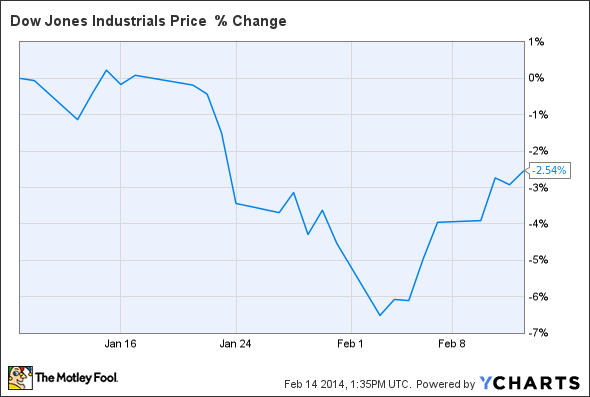

To put this extreme volatility into perspective, the Dow Jones Industrial Average (^DJI 0.17%) has lost 2.5% of its value over the same period you see in the chart above. At worst, it was a 6% drop. And that's enough to make my fellow Fools wonder if high volatility isn't back in vogue.

So it's all relative. The one obvious takeaway here is that Bitcoin clearly isn't ripe for serious investing yet.

Sure, the digital currency gained a staggering 5,900% in 2013, so it's easy to get carried away by the promise of another massive surge.

But anything that can lose two-thirds of its value in two weeks is profoundly unsuitable for real investing. You can gamble, you can play around with Bitcoin, but don't call it "investing." And for goodness' sake, if you insist on dabbling in this newfangled payment vehicle, only use money you could afford to live without.

Bitcoin may still have its chance as an everyday replacement for coins, bills, and credit cards. But that's a long way away, and is by no means a guaranteed conclusion to this saga. Even if digital currencies do become a mainstream standard, Bitcoin itself could very well go under before then and be replaced by some even newer-fangled version of the same concept.

That said, I wouldn't complain if you wanted to buy me a coffee in Bitcoin. By the time I find a coffee shop that accepts Bitcoin as payment, that donation might either get me a tray full of lattes -- or nothing at all.