Bring back the what?!

On March 31, we discussed the disappointing trend of both new-home and existing-home sales in conjunction with mortgage rates. Sales of both are either declining or stagnant despite historically low mortgage rates.

With mortgage rates so low, what's holding back housing? What's preventing more Americans from buying homes? While we conceded that there are several reasons, we also speculated that despite whatever reason, it may be time to give the market a bit of a jolt.

"To lift sales, perhaps it's time again to consider a housing tax credit arrangement, ala 2009-2010, but done differently?" said Keith Gumbinger, vice president of HSH.com.

Bring back the homebuyer tax credit

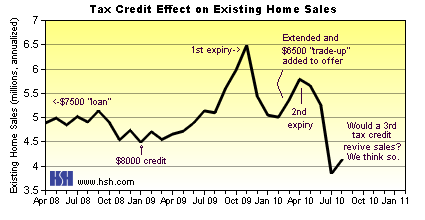

This isn't the first time HSH.com has proposed bringing back the homebuyer tax credit in a different form in an effort to boost home sales. Back on September 24, 2010, in the wake of dismal home sales following the expiration of the tax credit, we proposed reviving it in a different form so to not produce a mad dash of sales near the expiration deadlines.

Here are two graphs which show the effect the tax credit had on new and existing sales:

Time for something different

"It's hard to say what might help kick-start the market, but it may be time to start considering options, especially since the Realtors reported [recently] that pending sales of existing homes are still sliding," said Gumbinger.

Here are a few ideas for how we could revamp the homebuyer tax credit:

- A taper tax credit: This is an idea we first had back in 2010, but the logic still applies: "A year-long tax credit offer, which starts at $12,000 and falls by $1,000 per month until it naturally ends a year down the road. Given the extraordinarily weak sales environment at present, it is likely that some — but relatively few — borrowers will want or be able to take immediate advantage, so the actual cost to the government might be minimal. By the time month 11 is reached, the credit is only worth $2,000, so to the advantage of rushing to get a deal in under the deadline would be slight, and the program would come to a soft end without the huge distortion in demand we have seen from the past two credit expiries."

- Equity filler: Perhaps some federal dollars could be used to fill in an "equity hole" to some degree for an underwater borrower so that someone who wants to sell might be able to without further delay. This idea would benefit both buyers and sellers.

Housing helping housing

Concerned about a growing deficit? What if we used some of the profits coming in from Fannie Mae and Freddie Mac to fund another tax credit? In a sense, that would be housing helping housing.

Another federal homebuyer tax credit might be a solution that's ignored for the rest of time given its past downfalls (prisoners and deceased claiming the credit, the market distortion, improper filing), but Gumbinger is right, if home sales continue to decline and lending standards don't budge, it's time to once again think outside the box in order to help real estate turn the wheels of our economy.

The original article: Is it time to bring back the homebuyer tax credit? appeared on HSH.com.

Additional mortgage articles can be found on HSH.com.

First-time homebuyers guide to open houses

10 ways to get the best mortgage rates

How much of your mortgage payment goes toward principal and interest?