The Dow Jones Industrial Average (^DJI -1.26%) was up about 35 points in early afternoon trading Friday, putting it on track to gain at least 100 points on the week.

That modest gain comes as investors and policymakers are refocusing on a suddenly weakened housing market. Federal Reserve Chairwoman Janet Yellen reflected the concern in statements this week on Capitol Hill, even as she expressed optimism for the overall economy.

Here are five charts that explain exactly what's happening in housing.

1. Sales of new and existing homes have weakened

2. The homeownership rate is at its lowest level in 20 years

US Home Ownership Rate data by YCharts.

3. New home construction has also slowed

Single-family housing starts through the first three months of this year were 1.6% below their year-ago pace, and starts of multifamily units were down 3.8%.

Source: US Census Bureau.

4. Industry surveys show that the players in the market are feeling the problems

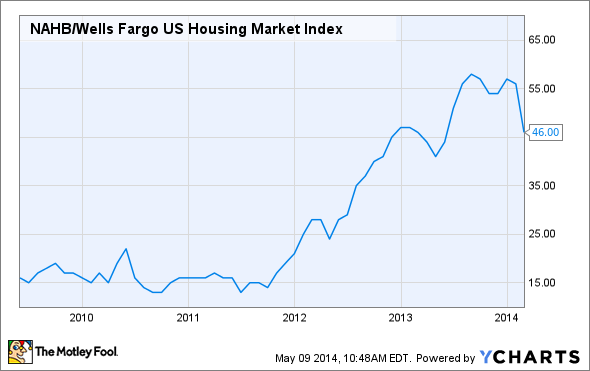

The drop in housing starts and sales corresponds with the recent reversal in the National Association of Home Builders/Wells Fargo Housing Market Index.

NAHB/Wells Fargo US Housing Market Index data by YCharts.

5. Prices are holding up

The Case-Shiller home price indices show a slight deceleration in the year-to-year change. However, home prices in the Case-Shiller 20-city composite index still rose 12.9% year over year in February.

Case-Shiller Home Price Index: Composite 20 data by YCharts.

What's the takeaway?

The most obvious conclusion from this broad view of the housing market is that trouble is brewing.

Sales are down (not graphed here, but mortgage applications are also sharply down), fewer people own their own home, and new construction is down. Industry participants are responding to surveys with increasingly pessimistic views.

Prices are holding steady, but it seems likely that they too will soon regress. The country still has yet to fully digest the excess inventory built in the real estate bubble six to eight years ago, so even as new supply declines there will remain an imbalance in supply and demand.

Source: Mark Moz

However, even if prices do succumb to downward pressure, this is not a huge long-term concern. There is no apparent overleveraging at this point -- and certainly nothing close to what we experienced in the real estate bubble and subsequent crash. So for the national economy, I don't see this slack in housing permeating through to other industries like we saw in '08 and '09.

Lastly, it's always a mistake to overgeneralize a market as large and diverse as U.S. housing. If you're planning to buy or sell in the next 12 months, it's probably best to focus on local factors and ignore the macro trends. Some housing markets are extremely hot right now. In those markets it's irrelevant what the national average is doing; if your neighborhood is booming, then it's booming. Period.