Source: RadioShack

After reporting revenue and earnings for the first quarter of its 2015 fiscal year on June 10, shares of RadioShack (RSHCQ) fell more than 10% to close at $1.38. In light of this decline, is now a good time to jump into the company's shares on the cheap, or would larger rival Best Buy (BBY -1.47%) make for a more promising prospect moving forward?

RadioShack fell far short of expectations

For the quarter, RadioShack reported revenue of $736.7 million. In addition to missing analyst forecasts of $764.3 million, the electronic retailer's sales came in 13% lower than the $848.4 million management reported the same quarter last year. According to its earnings release, its decline in revenue was driven largely by a 14% drop in comparable store sales.

Another contributor to the company's lower top line was its decision to close 22 retail locations during the quarter. This move by management represents the company's first wave of a plan to shut down 200 stores by the end of its 2015 fiscal year.

| Actual Results | Forecasted Results | Last Year's Results | |

| Revenue | $736.7 million | $764.3 million | $848.4 million |

| Earnings/Share | -$0.97 | -$0.51 | -$0.28 |

Source: Yahoo! Finance

From a profitability perspective, RadioShack's performance was even worse. For the quarter, the retailer reported a loss per share of $0.97. This was far lower than the $0.28 loss per share reported last year and nearly double the $0.51 loss analysts anticipated. In addition to being negatively affected by falling revenue, RadioShack's bottom line was hit by rising costs.

During the quarter, RadioShack's cost of goods sold came in at 63.5% of sales, up from the 59.8% reported the same quarter a year earlier. In its press release, the retailer attributed this rise to significant price competition in its postpaid and prepaid handsets. Even worse was the company's selling, general, and administrative expenses, which rose from 39.3% of sales to 45.6% as management was unable to reduce costs in spite of declining sales.

Is Best Buy any better?

The past few years have been anything but kind to RadioShack. Between 2009 and 2013, the company saw its revenue fall a jaw-dropping 16% from $4.1 billion to $3.4 billion. According to the company's 2013 annual report, this fall in revenue can be attributed in part to a 12% drop in aggregate comparable store sales, but must also be chalked up to a 16% reduction in store count from 6,563 locations to 5,519.

Source: Wikimedia Commons

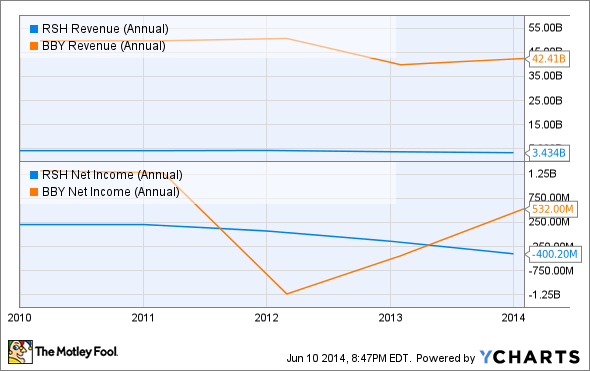

During this period, rival Best Buy also saw its top line decline, but not to the same extent that RadioShack has. Between 2009 and 2013, the company's revenue inched down just 3% from $43.8 billion to $42.4 billion. Like RadioShack, Best Buy also experienced a drop in aggregate comparable store sales (7%), but this was mostly offset by a 26% rise in store count from 1,565 locations to 1,968.

Looking at profits, we can see a similar trend between the two. During this five-year period, Best Buy saw its net income drop 60% from $1.3 billion to $532 million. This can largely be attributed to rising interest rates and impairment charges, but must also be blamed in part on the company's falling sales.

RSH Revenue (Annual) data by YCharts

While Best Buy's bottom line was hit hard between 2009 and 2013, RadioShack's profits were hit harder. During this timeframe, the retailer saw its net income of $205 million turn into a net loss of $400.2 million. Like Best Buy, RadioShack's falling profits are due to a falloff in revenue. However, the company's biggest problem has been its cost of goods sold, which has jumped up from 54.1% of sales in 2009 to 65.9% by the end of its 2013 fiscal year.

Foolish takeaway

Based on the data provided, Mr. Market was anything but enthusiastic about RadioShack's performance this past quarter. On top of seeing revenue and earnings fall precipitously, the retailer's track record shows an enterprise that is seemingly on the decline. While Best Buy isn't necessarily a beautiful company, its track record might make it a more appealing prospect for the Foolish investor to analyze.