Source: Restoration Hardware

After seeing shares rise nearly 3% on June 11, Restoration Hardware (RH 0.19%) investors were rewarded by an even greater amount after the market closed and the retailers latest results were released. The business, whose revenue and earnings surpassed what analysts had been expecting, saw its share price soar 12% in post-market trading to $80.06. At this price, the company's stock is trading roughly 47% above its 52-week low, which might give some investors reason to cash in and opt for another specialty retailer like Lumber Liquidators (LL -2.47%). Is this a logical choice, or is it likely that Restoration Hardware still has plenty of room to run?

Restoration Hardware smashed forecasts!

For the quarter, Restoration Hardware reported revenue of $366.3 million. In addition to representing a 22% rise compared to the $301.3 million management reported for the same quarter last year, the retailer's results blew past the $347.7 million Mr. Market wanted to see.

According to the company's press release, the main driver behind this growth was its comparable-brand sales, which jumped 18%. This was, however, partially offset by a 1% reduction in store count to 69 locations compared to the 70 locations the business operated during the first quarter of its 2013 fiscal year.

Source: Restoration Hardware

From a profitability perspective, the business' improvement was even better. For the quarter, Restoration Hardware saw its earnings per share skyrocket from zero to $0.04. After adjusting for one-time expenses like a legal claim, non-cash expenses, and estimated taxes the company would have paid without these charges, the retailer's earnings per share would have come out to $0.18. This represents a 200% increase over the $0.06 in adjusted profits recorded for the same quarter a year earlier and blew past the $0.11 analysts expected.

Is Lumber Liquidators any better?

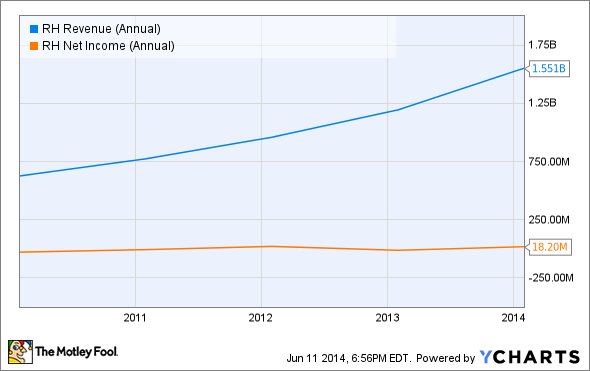

The past few years have been pretty good for Restoration Hardware. Between 2009 and 2013, the retailer saw its revenue climb 148% from $625.7 million to nearly $1.6 billion. According to its most recent annual report, this rise in revenue came from a 125% aggregate increase in comparable-store sales and a 140% improvement in aggregate comparable-brand revenue. This was, however, partially offset by a 26% reduction in store count from 95 locations in operation to just 70.

Restoration Hardware revenue (annual) data by YCharts

Although revenue growth was amazing during this period, the company's bottom-line improvement wasn't quite as impressive because of its volatility. Over the past five years, management was able to turn the company's 2009 net loss of $28.7 million into a gain of $18.2 million in 2013. This may have been due, in part, to the company's rising sales; but it must also be attributed to its cost of goods sold falling from 65.9% of sales to 64.1%, while its selling, general, and administrative expenses declined from 38.2% of sales to 32.4%.

Over a similar time frame, Lumber Liquidators saw its revenue climb an impressive (but subpar when compared to Restoration Hardware) 84% from $544.6 million to $1 billion. This increase in sales can be chalked up to a combination of a higher store count and rising comparable-store sales. During this five-year period, Lumber Liquidators saw its store count soar 71% from 186 locations to 318, while its aggregate comparable-store sales rose 29%.

Lumber Liquidators revenue (annual) data by YCharts

From an earnings perspective, the company's results crushed Restoration Hardware's performance. Between 2009 and 2013, Lumber Liquidators saw its net income leap 188% from $26.9 million to $77.4 million. Part of this was due to the business' rising revenue, but another big contributor was its cost of goods sold, which declined from 64.2% of sales to 58.9%.

Foolish takeaway

Mr. Market is estremely happy with Restoration Hardware right now. In addition to posting strong revenue gains, the business saw its earnings fly past expectations. Moving forward, there's no guarantee that the retailer will see this trend continue, but the real kicker that the Foolish investor should look at as an indicator of performance is the company's rising profits. If this can persist, Restoration Hardware will probably be a very attractive prospect to analyze.

However, for the Foolish investor who is uncertain about management's ability to grow profits while maintaining a strong revenue growth rate, Lumber Liquidators might make for a very appealing alternative. On top of seeing sales expand at a nice clip, the business' soaring profits imply that management is more focused on the bottom line than the top line, which can be good for shareholders looking for margin growth.