Bad news is coming out of Eastern Europe. Russia just decided to cut natural gas supplies to Ukraine after demanding fuel payments to be made in advance. From now on, Russia will only provide enough gas to Ukraine's pipeline system to meet demand from European customers and not the country's domestic supplies. The tension between the two countries is rising, and this shakedown in the energy market could mean serious asset price movements that could benefit some American energy companies. In fact, prices are moving already. U.K. front-month gas increased 8.8% on the ICE Futures Europe exchange in London, reaching a record for the July contract.

The opportunity

Even though the warm weather reduces seasonal demand for gas, the European Union is highly dependent on Russian gas piped through Ukraine. In fact, about 15% of its supply comes from this source.

Negotiations between Ukraine and Russia are taking place, but if the two countries do not find a solution soon it is highly possible that we might see a disruption in gas piped to the EU. Under this scenario, a possible direct consequence would be an increase in liquefied natural gas (LNG) prices. LNG is already experiencing strong demand coming from Asia, the biggest importer, so extra demand coming from Europe will likely push prices up, and there are a couple of U.S. companies that could make extra cash.

Well positioned

Given this scenario, an interesting American company to pay attention to is Cheniere Energy (LNG 0.51%), which holds a first-mover advantage in the U.S. LNG export business. The booming shale oil and gas production pushed midstream operation firms like Cheniere, and the company has been enjoying good organic growth opportunities since then. Now Cheniere holds enough infrastructure capacity to profit from new exports to the E.U. As a matter of fact, the company is now a step closer to getting another LNG terminal approved located in Corpus Christi, Texas, as a draft review issued by the Federal Energy Regulatory Commission concluded that the project will not lead to widespread harm to the environment.

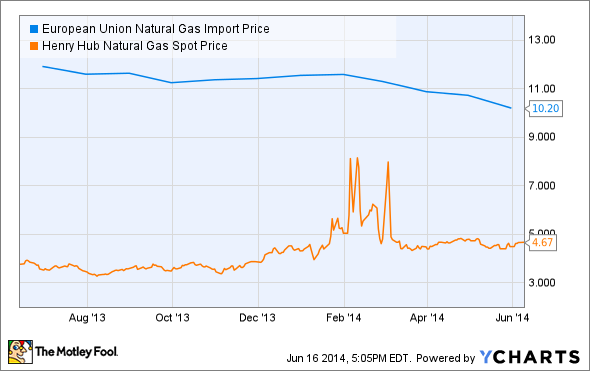

The gas price difference between the U.S. domestic market and the European market should make LNG exports very attractive for Cheniere. Check out the chart below -- the spread surpassing 50% is impressive!

European Union Natural Gas Import Price data by YCharts

Another power source

If gas supply to Europe is disrupted, there is another energy source that will experience price hikes. Recent history tells us that whenever gas has been expensive, the E.U. has burned greater quantities of coal to generate power, so American coal companies could seize this higher demand.

One example is Arch Coal (NYSE: ACI), which is the second-largest coal producer in the U.S. The company holds thermal coal operations in its Central Appalachia mine, but unfortunately, this mine holds high costs and is in secular decline. This is why Arch Coal is shifting its focus toward metallurgical coal, particularly higher-quality coking coals that hold lower costs compared to other competitors in the region. Hence, in the event of higher thermal coal demand, we might not see Arch Coal making extra cash.

But there's another coal producer that is better positioned than Arch Coal, Peabody Energy (BTU). The company holds an interesting asset that is located in one of the lowest-cost coal-mining regions in the world: the Powder River Basin. The geology in the area allows easier extraction and thus lower operation costs. So, with this abundant, low-sulfur, low-cost mine, Peabody could arrange coal shipments at competitive prices to meet a possible higher European demand.

Not so fast

Despite the turmoil, it seems that Europe could withstand some time without rushing to buy gas and or coal outside its borders. According to EU Energy Commissioner Guenther Oettinger, stocks in EU gas underground storage sites are larger compared to previous years, and the region should be able to cope with demand if problems escalate.

So, Europe could make it through a few weeks of gas interruption to the pipelines across Ukraine, assuming that other Russian gas keeps flowing.

Final foolish thoughts

Regarding the European gas market, two things must be taken into consideration. Although Europe is in a better position to handle a gas disruption than before, it cannot do without Russian gas. But at the same time, Russia cannot do without its European customers. So some way or another the two parties and Ukraine should find an agreement soon.

According to the Russian gas company, Gazprom, Ukraine owes $4.46 billion for gas already supplied. It is quite a sum for a country under serious problems like Ukraine. It is hard to know how things will evolve, but considering that Russia has cut gas supplies to Europe twice since 2006, a disruption scenario this time is clearly plausible -- especially when other political factors take place as well.

In the case of a disruption, Cheniere has approved LNG export infrastructure already functioning, so it should be one of the first energy companies to benefit from an event like this. Plus, the significant price difference makes exports to Europe very interesting.

Regarding Arch Coal, the company does not seem to be prepared to make a huge profit from higher demand of thermal coal. But Peabody Energy is in better shape and would be an interesting bet.