tjx.com

Nothing is more annoying than watching a retailer blame the inclement weather for a poor quarter. This is often a ludicrous (yet convenient) excuse because stronger retailers will deliver strong results despite the poor weather. What's unique about TJX Companies (TJX 0.83%) is that the weather did drive its sub-par results. This will be proven below. If this angle is correct, then it could present an investment opportunity in a beaten down stock but an unbroken company -- which is what savvy investors like to see.

Quick update

TJX Companies delivered a solid net sales gain of 5% for its first quarter year over year. However, before you get too excited, this primarily resulted from new store openings. Between the company's two biggest brands -- T.J. Maxx and Marshalls -- the company opened 74 new stores. That's why it's better to look at comparable-store sales. In most cases, this pertains to sales at stores open for at least one year. For TJX Companies, it refers to stores open for at least two years.

TJX Companies reported a comps gain of 1% for the quarter. This isn't thrilling, but given the current retail environment, it's not terrible, either. Value of average ticket improved, but traffic weakened due to weather.

Atmospheric pressure

Traffic weakened in the U.S. and Canada, but didn't weaken in Europe. That's the first hint that weather might have truly played a role in the company's first-quarter results. But a more telling clue is that domestic T.J. Maxx and Marshalls stores on the West Coast, in the Southwest, and in Florida outperformed stores in other regions. The West Coast, the Southwest, and Florida didn't suffer inclement weather this past winter.

In other words, while there are no guarantees, don't be surprised if TJX Companies' stores show improved results in the second quarter. If you exclude the weather component, then TJX Companies is right where it needs to be as an off-price retailer offering significant discounts to today's (and likely future's) value-conscious consumers.

As an off-price retailer, TJX Companies sells quality products at 20%-60% off department store and specialty store prices. This format is appealing to today's consumers because it gives them an opportunity to purchase fashionable merchandise without paying full price. On top of that, the merchandise mix at TJX Companies changes rapidly. That being the case, a customer never knows what she is going to see the next time she enters the store. This, in turn, leads to repeat traffic and sales.

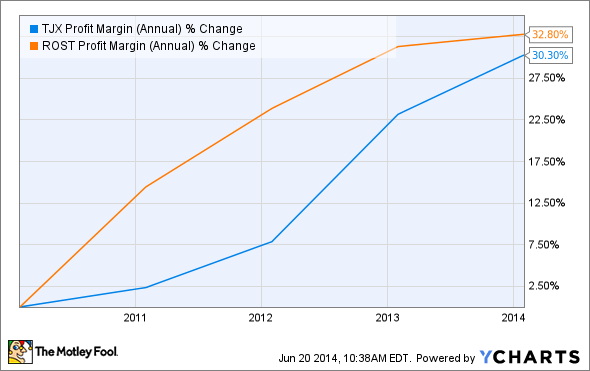

The changing merchandise mix has played a key role in the company's consistent profit margin improvements over the past five years, and consistent margin improvements is what long-term investors want to see. Also notice in the chart below that its biggest competitor and another off-price retailer with changing merchandise mix, Ross Stores (NASDAQ: ROST), has been even more impressive in this regard.

TJX Profit Margin (Annual) data by YCharts

Breaking down the 1% comps improvement, Marmaxx (T.J. Maxx + Marshalls) saw comps come in flat, HomeGoods delivered a 3% comps improvement (primarily thanks to an increased average ticket), TJX Canada's comps slid 1% (the Canadian dollar declined), and TJX Europe shot 8% higher (increased traffic and average ticket). Overall, diluted earnings-per-share increased 3%. Therefore, if you see the company's stock price suffering, then you might be looking at a long-term investment opportunity.

That said, the company's closest peer, Ross Stores has been driving earnings growth at a faster pace for years:

TJX EPS Diluted from Continuing Operations (TTM) data by YCharts

Before declaring Ross Stores the better investment option, let's look at some other comparisons.

TJX Companies vs. Ross Stores

TJX Companies is currently trading at 19 times earnings, whereas Ross Stores is trading at 17 times earnings. This makes TJX Companies slightly more "expensive," but Foolish investors don't get caught up in splitting hairs. Another note is that both companies offer dividend yields of 1.2%, but this isn't significant, and it's a wash anyway.

Neither company has shown an ability to consistently drive free cash flow higher over the past several years, but both companies do consistently drive positive free cash flow:

TJX Free Cash Flow (Annual) data by YCharts

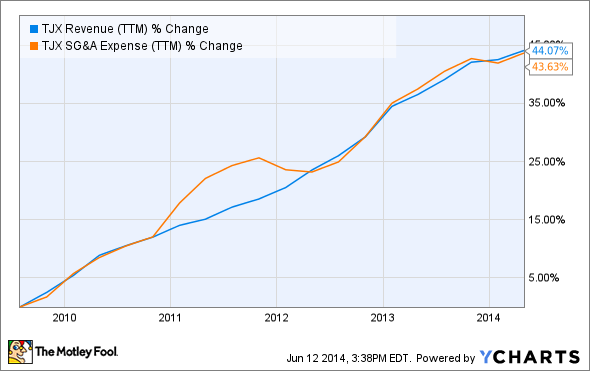

In addition to total free cash created, it's important to consider how efficiently a business converts sales into profits. A good way to determine efficiency is to see if a company's top line is outpacing its selling, general, and administrative expenses. TJX Companies has managed to deliver in this regard over the past five years, but only by a hair:

TJX Revenue (TTM) data by YCharts

Now compare that to the efficiency of Ross Stores:

ROST Revenue (TTM) data by YCharts

This is a much wider and more consistent gap, which is what investors want to see. As TJX Companies has kept expenses in check related to top-line growth, Ross Stores CEO Michael Balmuth, Vice Chairman and Chief Executive Officer, recently stated that the company has been "focused on strict inventory and expense controls." l

The Foolish conclusion

As off-price retailers, TJX Companies and Ross Stores are both in line with consumer trends by targeting the value-conscious consumer, but Ross Stores has been moderately more efficient over the past several years. That said, the sub-par first-quarter results of TJX Companies might relate to inclement weather, which would present an opportunity to invest in an unfairly punished company. Over the long haul, it would be difficult to go wrong with either TJX Companies or Ross Stores.