Potash Corp (POT) released its monthly market data report for May this week. The report shows mixed results in potash operations through the first two months of the second quarter for the North American potash producers, which also include Mosaic (MOS 1.40%), Agrium (NYSE: AGU), Intrepid Potash (IPI -0.10%), and Compass Minerals (CMP -1.32%). While the supply and demand picture for U.S. phosphate producers is always tighter than it is for potash, the revenue picture is a bit more negative than expected so far in the current quarter.

Potash

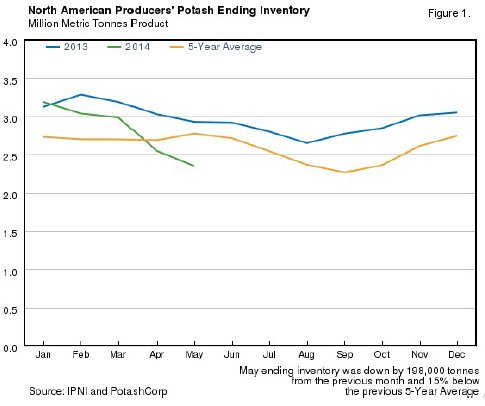

Production continues to fall as producers try to get a handle on inventories. May production dropped 3% from the previous month and year over year is down 14%. It is having the desired effect as potash inventories are well below year-ago levels and 15% lower than the 5-year average as figure 1 shows.

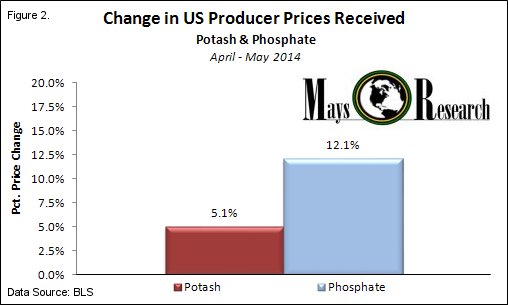

In my opinion, North American producers believe that lower inventories will help firm pricing. I recently penned a report entitled "Why a Uralkali & Belaruskali Reunion May Not Lift Potash Prices" that discussed potash price sensitivity. Notably, through the first two months of the second quarter potash prices have risen by 5.1% as illustrated in figure 2.

The good news for both Intrepid Potash and Compass Minerals is that they price their specialty fertilizers at a premium off the major producers. However, despite their market positions as specialty fertilizer producers they are still subject to demand sensitivities in my opinion.

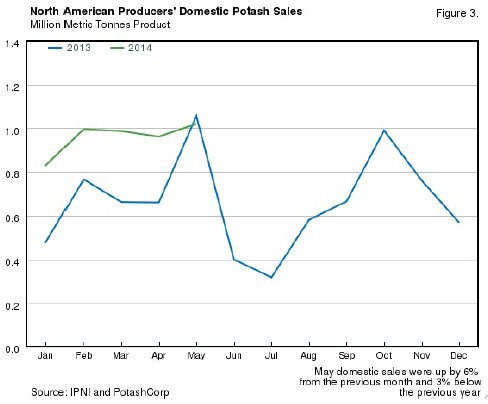

In May, domestic producers reported that potash sales were up 6% over the earlier month. However, domestic revenues remain down 3% year over year as figure 3 shows.

Potash export sales were another bright spot, up 5% year over year and 2% sequentially. However, export sales are generally at a significant discount to prices in North America. In the first quarter, Potash Corp's average price received per metric ton in North America was $295 while the average price received for offshore sales was a more modest $217 per ton. Export sales volumes represented 57% of all potash tons sold for Potash Corp. and roughly half of Mosaic's. Agrium sold more tons of potash in North America than it did internationally during the first quarter.

Phosphate

North American phosphate production occurs mostly in the U.S. with Mosaic and Potash Corp. being the primary producers. Production was up 10% in May compared to April but still down 4% year over year. Despite a 46% surge in exports during May inventories are still above their 5-year average. However, they have fallen year over year.

Sales were down 9% in May and still 12% lower than a year ago. In my opinion, this is at least partly due to the 12% increase in phosphate prices so far in the quarter as figure 2 above shows.

Mixed picture impacts each firm differently

Lower potash production along with weak domestic sales and stronger but lower priced export sales will certainly pressure margins and have the largest impact on Potash Corp. Mosaic will withstand the worst of the weakness in the lower-margin phosphate business. Agrium will be less affected than the others because of its presence throughout the value chain and its spring retail business during planting season in North America. The fertilizer business is in the midst of a very tough point in business cycle just prior to the cyclical upturn, in my opinion. For the time being, it is not likely to get any easier.