Choosing the right home for your retirement savings is as important as saving for retirement in the first place. Your retirement plan dictates how much you can contribute annually, how it's taxed, how withdrawals work, what you can invest in, and how much you pay in fees.

To help you decide which retirement plans work best for you, consider the following options:

- 401(k)

- 403(b)

- 457

- IRA

- Roth IRA

- Nondeductible IRA

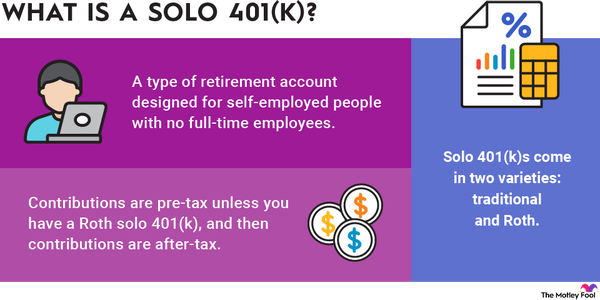

- Solo 401(k)

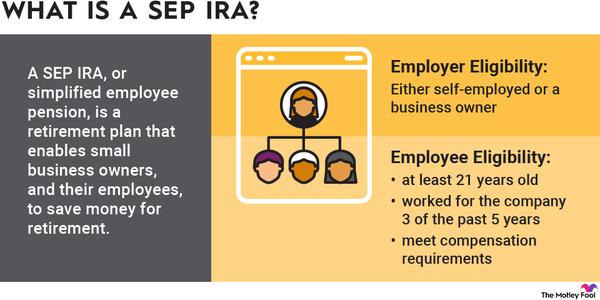

- SEP IRA

- SIMPLE IRA

- Keogh plan

We’ll cover employer-sponsored plans, individual retirement accounts, and plans for self-employed individuals and small business owners.

401(k)

401(k)

A 401(k) is the most common type of employer-sponsored retirement plan. Your employer preselects a few investment choices and you defer a portion of each paycheck to the account. If you leave your job, you may take your 401(k) funds with you or leave them where they are.

In 2023, you can contribute up to $22,500 to a 401(k), plus an additional $7,500 if you're 50 or older. In 2024, the 401(k) contribution limit is $23,000, plus $7,500 if you're 50 or older.

Some employers also match a portion of employee contributions. With few exceptions, you cannot withdraw funds from your 401(k) before 59 1/2 without penalty.

| 401(k) pros | 401(k) cons |

|---|---|

| High contribution limits | Limited investment options |

| Tax savings | Fees can be high |

| Employer matching | Early withdrawal penalties before 59 1/2 |

| Loans available with some plans | Loans are taxed as early distribution if they aren’t paid back on time. |

If you hope to get the most out of your 401(k), contribute as much as you are able to and choose your investments carefully to minimize fees. You should also claim any employer match that's available and watch out for your company's vesting schedule, which determines when you get to keep employer-matched funds.

- Tax benefits: Most 401(k)s are tax-deferred, which means your contributions reduce your taxable income this year but you pay taxes on your distributions. This is usually smart if you believe you'll be in a lower tax bracket in retirement than you are today.

But Roth 401(k)s are also growing in popularity. Contributions to these accounts don't reduce your taxable income for the year, but distributions are tax-free. You'll save more in taxes with a Roth 401(k) if you're in the same or a lower tax bracket today than you'll be in once you retire. Employer-matched funds are still tax-deferred with these plans. - 401(k) loans: Some plans allow 401(k) loans. This enables you to borrow against your retirement savings and pay back that money with interest over time. But if you fail to pay back everything by the end of the loan term, the government taxes the outstanding balance as a distribution.

Other employer-sponsored retirement plans

Other employer-sponsored retirement plans

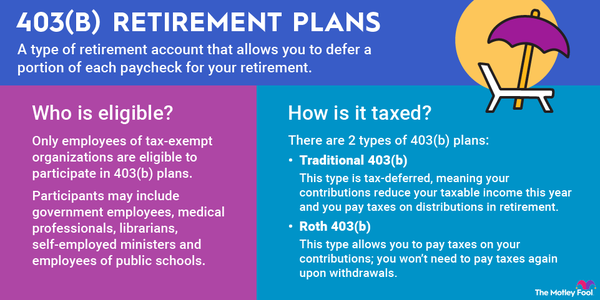

403(b) and 457 plans are other types of employer-sponsored retirement plans you may come across.

IRA

IRA

An IRA is a retirement account anyone may open and contribute to, as long as they are earning income during the year or are married to someone who is. IRAs offer a greater variety of investment options than most employer-sponsored plans.

IRAs offer a much greater variety of investment options than most employer-sponsored retirement plans.

That, coupled with the fact that you can open an IRA with any broker, means you may be able to keep your fees lower with an IRA than you could with the plans listed above.

| IRA pros | IRA cons |

|---|---|

| Wide variety of investment options | Low contribution limits |

| Almost anyone can contribute | High-income earners cannot contribute to Roth IRAs |

| Tax savings | Early withdrawal penalties before 59 1/2 |

| Fees can be lower than with employer-sponsored plans | No employer matching |

Getting the most out of your IRA involves choosing your broker and investments carefully to minimize fees, while keeping your investments diverse and well-matched to your risk tolerance. You should also choose the right type of IRA -- traditional or Roth -- based on which you think will give you the greatest tax advantages, and contribute as much as you can each year.

- Tax savings: Traditional IRAs are tax-deferred -- that is, your contributions are pre-tax, so they lower your taxable income for the year and you pay taxes on distributions. Roth IRAs use after-tax dollars, so your contributions have no effect on your taxes this year, but you can then withdraw your savings tax-free in retirement.

- Contribution limits: You can only contribute up to $6,500 to an IRA in 2023, and $7,000 in 2024. If you're 50 or older, you can contribute an extra $1,000 in both 2023 and 2024. You may contribute to an employer-sponsored retirement plan and an IRA in the same year, and you may contribute to tax-deferred and Roth accounts at the same time, but you may not make more than $6,500 (or $7,500 if 50+) in combined traditional and Roth IRA contributions in 2023, and $7,000 ($8,000 if 50+) in 2022.

Types of IRAs

Types of IRAs

In addition to traditional IRAs, there are several types of IRAs to consider. Here are a few key alternatives.

Retirement plans for the self-employed and small business owners

Self-employed individuals and small business owners may contribute to an IRA, but there are also several special retirement plans available just for them that enable them to contribute more money per year, since they don't receive the benefit of an employer-sponsored retirement plan. Here's a look at some of the most common retirement plans for small business owners and the self-employed.

Expert Q&A on Retirement Plans

The Motley Fool touched base with retirement expert Jialu Streeter, Ph.D., a Research Scholar at the Stanford Center on Longevity. Jialu’s research primarily focuses on the economics of aging, retirement security, and financial security and mental wellbeing of older adults.

Expert Advice

Jialu Streeter, PhD,

The Motley Fool: There are no hard and fast rules about when to retire or how much we should have saved, but what three pieces of advice would you give someone who is just starting their first retirement savings account?

Streeter:

- Start saving early.

- Save more than the default rate.

- Max out on the retirement contribution if you expect that your retirement income will be lower than your current income, and of course, if it doesn’t interfere with your other financial goals.