Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Yingli Green Energy (NYSE: YGE) fit the bill? Let'slook at what its recent results tell us about its potential for future gains.

What we're looking for

The charts you're about to see tell Yingli's story, and we'll grade the quality of that story in several ways:

- Growth: are profits, margins, and free cash flow all increasing?

- Valuation: is share price growing in line with earnings per share?

- Opportunities: is return on equity increasing while debt to equity declines?

- Dividends: are dividends consistently growing in a sustainable way?

What the numbers tell you

Let's look at Yingli's key statistics:

YGE Total Return Price data by YCharts.

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

8.8% |

Fail |

|

Improving profit margin |

(208%) |

Fail |

|

Free cash flow growth^ > Net income growth |

36.4% vs. (217%) |

Pass |

|

Improving EPS |

(219%) |

Fail |

|

Stock growth (+ 15%) < EPS growth |

(72.1%) vs. (219%) |

Fail |

Source: YCharts and Morningstar. * Period begins at end of Q1 2011.

^ Free cash flow data only available on an annual basis.

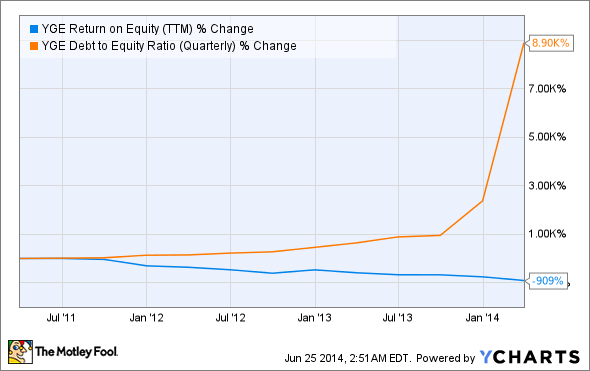

YGE Return on Equity (TTM) data by YCharts.

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(909%) |

Fail |

|

Declining debt to equity |

8,900% |

Fail |

Source: YCharts. * Period begins at end of Q1 2011.

How we got here and where we're going

Yingli's miserable bottom-line results in recent years haven't done it any favors -- and despite showing the necessary positive momentum on free cash flow to score a single passing grade and avoid the big goose egg on our assessment, Yingli has nothing to crow about in this regard, either, as nominal free cash flow was still over $100 million underwater for 2013. Even its top line has been anemic, as Yingli has battled the same oversupply problems plaguing the rest of the Chinese solar sector. Is there any hope for Yingli's future, or should investors turn the lights out on this solar-panel supplier? Let's dig a little deeper to find out.

Despite enjoying a few good days this year, Yingli's overall trend has been profoundly negative, as shares are nearly 30% lower today than they were at the end of 2013. Fool solar specialist Travis Hoium, who's long been bearish on Yingli, points out that the company and peer Trina Solar (NYSE: TSL) have been hammered by punitive import tariffs set by U.S. authorities. Both stocks soared in 2013 on surging U.S. demand -- Yingli doubled and Trina tripled -- but both have fallen hard this year as tariffs tack on an additional 27% and 19% to panel costs, respectively. Yingli's harsher penalties go a long way toward explaining its steeper slide. However, since Yingli has focused more on pumping out panels in volume to overcome its weaker cost structures, it also makes sense that it would be more harshly targeted to begin with.

Yingli continues to pump out panels this year, and investors rewarded increased volume projections with a big pop earlier this month. The company has done a good job at filling in the holes created by U.S. tariffs with demand from other countries, with significant capacity destined for projects right in China. However, Yingli trails behind peer JinkoSolar (JKS 1.27%) in manufacturing costs, and it lacks the technological edge of American manufacturer SunPower (SPWR -1.02%), which has priced its panels higher than most on the strength of its industry-leading energy conversion efficiencies. In a largely commoditized industry, Yingli must do something other than lead the world in volume to justify further gains -- particularly if that volume isn't the most cheaply produced on the market.

Putting the pieces together

Today, Yingli Green Energy has few of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.