SamsClub.com

"Sam's Club had a tough quarter." This statement was made by Wal-Mart Stores' (WMT -0.12%) CEO Doug McMillon on the retailer's first-quarter conference call. Since Sam's Club accounts for approximately 12% of Wal-Mart's net sales, investors should listen. On the other hand, there are reasons why the poor performance of Sam's Club shouldn't lead to investor panic.

Recent results and future strategy

Sam's Club delivered a rise in membership income for the quarter, but this was thanks to a fee increase from last year, not because the company is bringing in new members. . According to Wal-Mart's 10-Q filing, the basic strategy is for Sam's Club to elevate its merchandise assortment to highlight newness, which is expected to drive sales growth. Easier said than done, especially following one of Sam's Clubs worst quarters in history.

Reasons for the poor quarter included severe weather and a reduction in government assistance for the poor (i.e. reduced food stamp benefits) . Combined, these two factors contributed to a 90 basis point impact on comps (sales at stores open at least year), which declined 0.5% year over year (excluding fuel).

Membership fees help offset a decline in traffic and average ticket. The increased membership fees are nice, but without product sales, Sam's Club is going to have a difficult time sustaining growth.

The Alternatives

If you're looking to invest solely in a membership warehouse, then you're likely to be better off in Costco Wholesale (COST -0.45%), which delivered a 4% comps gain in the first quarter despite the severe weather. Costco also targets a higher-end consumer than Sam's Club, which helps a great deal in today's economic environment. In regards to Costco, take a look at the following Morgan Stanley chart for Costco locations and notice that many of them are located in California and Florida -- two states with many high-net-worth consumers:

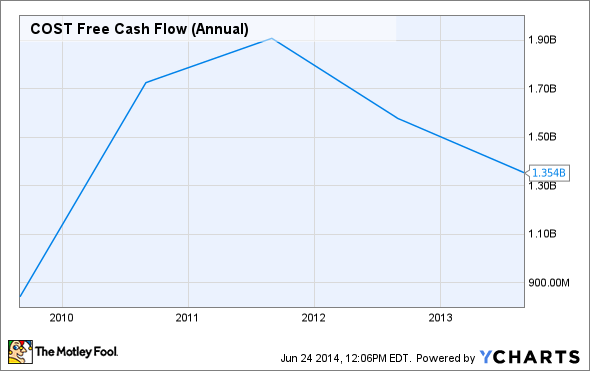

And while free cash flow generation hasn't been stupendous of late, Costco has consistently delivered strong positive free cash flow over the past five years:

Costco Free Cash Flow (Annual) data by YCharts

Getting back to Sam's Club, the soft sales led to a 7.6% increase in inventory levels. The biggest buildups came in home and health and wellness. Operating income declined 1.4% for the quarter, and Sam's Club's recent investments combined with gross profit pressure is expected to lead to operating profit headwinds in the near term. But what about the long term? Are those investments likely to pay off, or is Sam's Club in trouble?

Strategic investments

Sam's Club's focus on newness will be primarily be about fresh, fast, and fit. This strategy has already been implemented, and it has led to strong performances in a new assortment of snacking options, better-for-you choices, on-trend activewear, and enhanced private-label offerings.

As far as member base goes, Sam's Club recently rolled out its Sam's Club Plus Member cash rewards on June 12. The cash reward is $10 for every $500 spent on qualifying purchases, up to $500 per year. The initiative has likely been implemented so Sam's Club can keep up with Costco. With Costco, Executive Members receive a 2% reward on most purchases. The reward is capped at $750 per year.

Sam's Club also just launched its new cash-back credit card program with MasterCard on June 23. This will allow members to earn 5% cash back on gas, 3% cash back on travel and dining, and 1% cash back on all other purchases. This, in turn, is expected to increase the value of being a Sam's Club member.

These are indeed strategic initiatives, and they just might work since Sam's Club's target consumers are looking for value. On the other hand, Sam's Club still has an uphill battle in the brick-and-mortar space due to fierce competition. At least SamsClub.com is performing well.

Online growth

SamsClub.com delivered another quarter of strong sales growth, contributing 20 basis points to Sam's Club's overall comps. One major contributor to this growth was Click & Pull, which is basically in-store pickup when you order a product online. SamsClub.com is also testing My Subscriptions, which will allow members to purchase basic consumer products online. Sam's Club doesn't have much of a choice here since retailers like Amazon.com are beginning to threaten physical retailers in an area that was once deemed safe.

Piecing it all together

Sam's Club faces competition from Costco and other membership warehouses in the brick-and-mortar space, and it must contend with Amazon and other retailers online. Recent investments might pay off, but Sam's Club shouldn't be seen as a high-potential segment for Wal-Mart.

Given current trends, one potential scenario is that Wal-Mart closes underperfoming Sam's Club locations, which will then free up capital for investments in higher growth areas, such as small-box stores and e-commerce. By doing this, Wal-Mart's revenue and overall operating income would improve. This is just speculation at the moment, but if Sam's Club isn't performing well and likely won't be a key growth driver in the future, it's not necessarily a net negative. Any retailer that possesses strong cash flow and profitable revenue streams should be considered by investors, especially when it can add freed up capital to aid those profitable revenue streams in the future.