It was just a few weeks ago that E. I. DuPont (DD), which has experienced its share of ups and downs, announced that its results for the second quarter would slip below the $1.28 per share it earned a year earlier. Coincidentally, that announcement followed by just a day news of a strong third quarter at Monsanto (MON), the company that a restructuring DuPont is clearly seeking to emulate.

The primary question now becomes whether DuPont should be quarantined from Foolish portfolios, or constitutes a sensible long-term holding. The first thing to know in responding to that query is that the primary culprit for the disappointing quarter involves lower-than-expect corn seed sales, which the company called a "short-term trend."

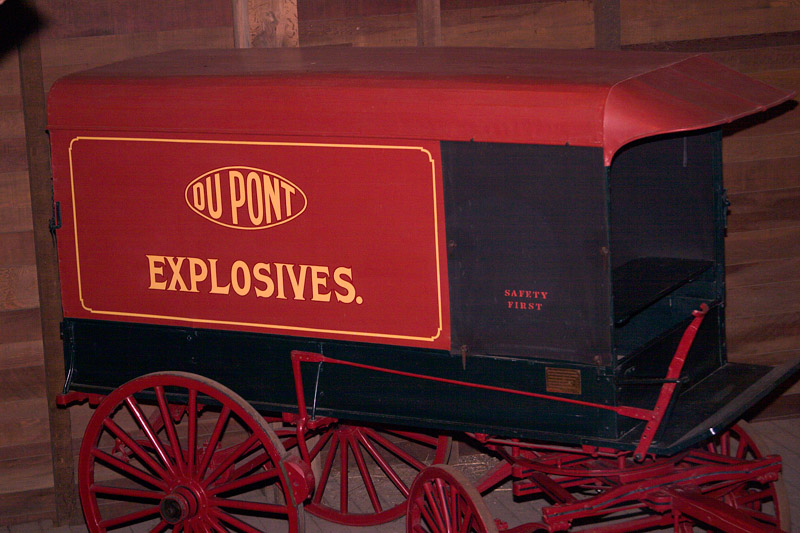

Source: Wikipedia.

Also having an impact, probably to no one's surprise, will be soft results from the performance chemicals unit, which is headed for a 2015 spinoff. On those bases, it's probable that a return of upward momentum isn't beyond the realm of possibility for the venerable company, which was formed as an explosives manufacturer way back in the Jefferson Administration.

Company reconstruction

You likely realize that DuPont is undergoing a major restructuring, moving from its longtime chemicals concentration to a greater weighting in agricultural, food products, and industrial biosciences. Last year, to make room and capital for that directional change, it sold its automotive paint unit for $5 billion and announced an agreement to sell a portion of its performance materials segment. As noted, it's also preparing to shed its erratic performance chemicals operation through a spinoff to DuPont shareholders.

As CEO Ellen Kullman pointed out at a Stanford Bernstein conference about a month ago, acquisitions during the same approximate period have included Danisco, a Danish producer of enzymes and specialty foods. In addition, about a year ago, DuPont bought a majority stake in Pannar Seed, the biggest seed producer on the African continent.

Agriculture's increasing share

For 2013, while Monsanto derived essentially all its revenues from agriculture-related products, DuPont's agriculture and biosciences sales accounted for a pro forma 57% of its total. As I've noted in the past, it appears likely that the group's contribution could reach 70% or more by 2016. In that connection, Kullman said at the Bernstein gathering that, "Market demand in this area is driven by both population growth and economic development, creating a myriad of needs and requirements among our customers."

For now, DuPont resembles an HGTV house in the throes of a serious renovation. Nevertheless, there are a couple of disparate ways to judge the company. Some are convinced that Kullman's promises have far outstripped DuPont's performance. Others, however, anticipate increasing valuations as the restructuring progresses. The corn problems that manifested themselves in the second quarter are likely temporary, and the company will clearly benefit from jettisoning its volatile performance chemicals segment.

A look at the numbers

While there's a bevy of legitimate question marks concerning DuPont's structure and composition, say, three years hence, it's enlightening for investors to examine some of the company's key current metrics. Let's compare a few of its numbers and ratios with those of Monsanto. And for added perspective, I'm inclined to include comparable metrics from Syngenta (NYSE: SYT). While smaller than either DuPont or Monsanto, Basel, Switzerland-based Syngenta also produces herbicides, pesticides, seeds, and plants.

|

Metric |

DuPont |

Monsanto |

Syngenta |

|---|---|---|---|

|

Market Cap |

$60.2B |

$65.4B |

$34.1B |

|

Trailing P/E |

20.9 |

24.7 |

20.9 |

|

Operating Margin |

12.3% |

25.6% |

15.4% |

|

Return on Equity |

20.3% |

18.5% |

18% |

|

Total Debt to Equity |

68.8 |

21.6 |

33.7 |

|

Forward Annual Yield |

2.60% |

1.40% |

N/A |

Sources: Yahoo! Finance and TMF calculations.

As is clear, DuPont is of a similar size to Monsanto, with both topping Syngenta. Monsanto surpasses the others in the all-important P/E metric, and also leads handily from a margin perspective. While the returns on equity for all three are similar, DuPont produces the highest forward dividend yield. (From a trailing perspective, however, DuPont and Sygenta are about equal.)

The Foolish bottom line

Quarterly hiccup or not, then, I'm inclined to keep close tabs on DuPont. Once performance chemicals has been dispatched, the company's margins are likely to escalate meaningfully, which, in turn, will produce a salutary effect on its valuations. Having said that, I'd continue to reserve DuPont for investors with patience and longer-than-usual investment time horizons.