Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does IPG Photonics (IPGP -1.57%) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

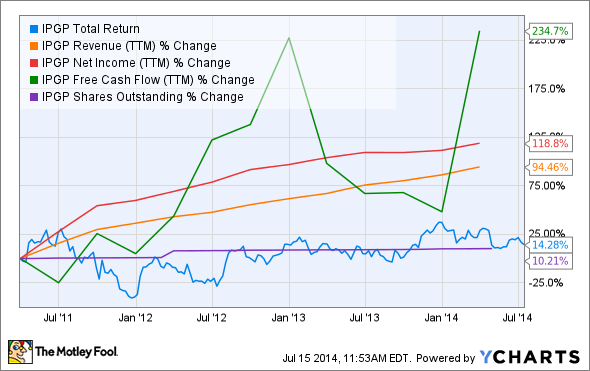

The graphs you're about to see tell IPG Photonics' story, and we'll be grading the quality of that story in several ways:

- Growth: are profits, margins, and free cash flow all increasing?

- Valuation: is share price growing in line with earnings per share?

- Opportunities: is return on equity increasing while debt to equity declines?

- Dividends: are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at IPG Photonics' key statistics:

IPGP Total Return Price data by YCharts

|

Passing Criteria |

Three-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

94.5% |

Pass |

|

Improving profit margin |

12.5% |

Pass |

|

Free cash flow growth > Net income growth |

234.7% vs. 118.8% |

Pass |

|

Improving EPS |

100.9% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

14.2% vs. 100.9% |

Pass |

Source: YCharts. * Period begins at end of Q1 2011.

IPGP Return on Equity (TTM) data by YCharts

|

Passing Criteria |

Three-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(26.3%) |

Fail |

|

Declining debt to equity |

(78.3%) |

Pass |

Source: YCharts. * Period begins at end of Q1 2011.

How we got here and where we're going

IPG Photonics nearly achieved a perfect score when we looked at it last year, and it's finished with the same six-out-of-seven score this year -- but over the past year, free cash flow growth has finally surpassed the growth of IPG's net income, while its abnormally high return on equity bounce has fallen back to earth. However, the biggest change from last year to this year seems to be a virtual flatlining in IPG's share-price performance. Last year, IPG was nearly a three-bagger in three years, but from 2011 through today its stock has barely budged. What gives? And more importantly, can IPG overcome this weakening of perceptions to again become a favorite of growth-stock investors? Let's dig a little deeper to figure out what's ahead.

IPG hasn't had a very good 2014, as shares have yet to reclaim the price they closed at on the first trading day of the year. Its two quarterly reports filed this year have both produced underwhelming market reactions -- the company's fourth quarter showed shrinking profit margins and weaker-than-expected earnings, and its first quarter report sparked a sell-off as investors began to worry that the company's history of strong growth might be coming to an end. IPG's second-quarter guidance (the company is set to report that quarter's results at the end of this month) projected single-digit growth rates for its top and bottom lines, and while that wouldn't represent the company's weakest growth rates, it certainly continues what's become an ongoing trend of ever-lower year-over-year growth rates over the past two years:

IPGP Normalized Diluted EPS (Quarterly YoY Growth) data by YCharts

The company's weakening progress has caused even longtime IPG shareholder (and Fool writer) Brian Stoffel to reconsider his position, pointing out that IPG has faced heightened levels of competition in the fiber-optic laser market from Rofin-Sinar (RSTI), Coherent (COHR), and JDS Uniphase (NASDAQ: JDSU). IPG's vertically integrated production model poses a risk in such an environment should demand dwindle -- it alone among these four companies manufactures all its component parts in-house, which adds additional fixed-cost pressures that could tank margins in the event of a supply glut.

Fool writer Erik Eason has highlighted this issue by pointing out that IPG's capital expenditures are more than three times higher as a percentage of its sales than either Coherent's or Rofin-Sinar's. This higher spending places IPG at a bit of a research disadvantage, since both competitors can (and do) spend more of their revenue on R&D. However, IPG's focus on fiber lasers has been rewarded with a top- and bottom-line growth rate far greater than either of its competitors:

IPGP Normalized Diluted EPS (Quarterly YoY Growth) data by YCharts

A tighter focus certainly has its advantages, but despite this superior performance, IPG's P/E ratio is now the lowest of the three companies. On the other hand, its price-to-free-cash-flow ratio of 31 remains elevated well above either Coherent's P/FCF ratio of 25 or Rofin-Sinar's P/FCF of 18. On this metric, at least, IPG retains its growth premium over its peers, but it will need to sustain those higher growth rates going forward to avoid becoming yet another former growth stock going nowhere.

Putting the pieces together

Today, IPG Photonics has many of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.