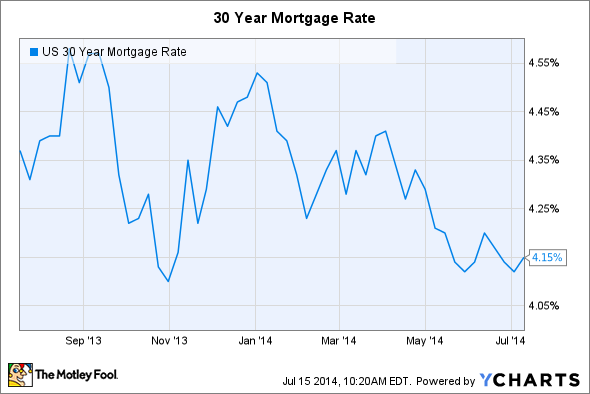

Despite all of the predictions we heard surrounding the Federal Reserve's "tapering" of quantitative easing, mortgage rates have not risen in 2014. In fact, rates are actually lower than they were at the beginning of the year.

There are several explanations for this, such as lower-than-expected housing demand and comments from the Fed indicating that the low federal funds rate will continue for a while longer. Even though the unemployment rate in the U.S. has steadily improved and inflation is right around where it should be, the truth is that the Fed is scared to death of prematurely taking action and derailing the progress made so far. Because of this, we may see low rates stick around until at least 2016.

Inflation and unemployment

The Federal Reserve has stated several times that it intends to keep rates low until the inflation rate rises to 2%. The formal unemployment target of 6.5% was dropped several months ago, and the rate has now fallen below this amount.

We're definitely getting close to the inflation target, and unemployment is steadily improving. It seems like a rate hike could be right around the corner. However, I'm not so sure.

The unemployment rate has steadily dropped since peaking in late 2009 and now sits at 6.1%, just above the Fed's goal. According to the Fannie Mae Economic Forecast, unemployment will level out around 6%, dipping to 5.9% at the end of 2015.

Similarly, inflation is not expected to jump any higher than it already is. While the annualized change in the consumer price index is expected to remain above 2% for the next two quarters, it is expected to fall below that amount for the foreseeable future, reaching just 1.7% by the end of 2015.

U.S. Unemployment and Inflation Projections 2014-2015 | Create Infographics

What will need to happen before rates rise?

The word to remember here is "sustained." The Fed's main priority is to facilitate an economic recovery that can continue for a while, and it won't consider the inflation target met until we see sustained annualized inflation of over 2%.

As far as unemployment is concerned, it's not all about the good-looking 6.1% unemployment rate. This fails to account for certain groups of people, such as the underemployed and those who are willing and able to work but have given up trying to find a job.

A more accurate measurement is the U-6 unemployment rate, which takes these groups into account and is still very high. Notice in the chart below that the gap between the two is extremely large on a historical basis.

Currently, there is a 6.3% difference between the two, meaning 6.3% of the population is either underemployed or has given up looking for work. Before the financial crisis, the spread was closer to 3%.

You can bet the Fed is well aware of this and will take the true employment picture into account before making any decisions.

Furthermore, in April the Fed said that even after unemployment and inflation reach the desired levels, economic conditions could make it necessary to continue to keep interest rates below "normal" levels.

What it means to you

Basically what it means to you as a consumer is that you shouldn't rush to make any big purchases, like a house.

Recent data shows the housing market could be slowing, and Fed Chair Janet Yellen recently said housing activity has been disappointing lately. And you can be certain the Fed will absolutely not make any policy changes that could hurt the fragile housing market.

Analysts are revising earlier calls for rates to rise. For example, Goldman Sachs recently wrote in a note to investors that it now expects mortgage rates to rise to just 4.5% by the end of the year. A credit strategist from RBS doesn't expect the first rate hike until the second half of 2015, and the Fed's clues have indicated rate hikes will be done in small steps.

So, if you were considering buying a house because you're worried that mortgage rates might shoot up soon, relax. You probably have at least another year and a half to take advantage of historically low mortgage rates.