From a big stumble during the financial crisis, Huntington Bancshares (HBAN 0.84%) has not only climbed its way back to profitability but is bringing in more from its loans than ever before.

But at what cost has it reached such success?

Increased loan profitability allows banks to cover up inefficiencies that may be taking place in other parts of the company, meaning Huntington just might be its own worst enemy.

Revamping profitability

In 2007, Huntington was raking in nearly $900 million more from loans than it is today; however, Huntington is now making $600 million more than it was then.

How is this possible?

It all goes back to the foundation that those loans are built on -- Huntington's deposit base.

Since the financial crisis, Huntington has supercharged its loan making stock, not only growing total deposits by 49% since 2009 but also revamping its entire composition with an emphasis on low cost deposits.

By doing so it has been able to increase the net margin on interest for its loans by 25 basis points. When dealing with $40 billion in deposits, this amounts to hundreds of millions of dollars.

Overall, Huntington has figured out that more deposits, sourced more inexpensively, equals more profitability for the company. In fact, since the transformation began, Huntington has been able to deliver an average annualized return on assets of 1.1%. For reference, generally anything over 1% is good news for the sector.

To see how it got this new and improved deposit base, you need to look at its retail business.

Attracting deposits

Huntington's retail operations have done a killer job at attracting new deposits over the last few years, especially highly coveted noninterest demand deposits.

But this doesn't tell the whole story. Typically, for a bank to increase its deposits, especially low cost ones, it has to step up its customer service. This, of course, costs money.

Flickr // redspotted

As expected, when Huntington launched major initiatives in 2009 to attract more funds, a higher cost structure began to take shape.

It's not necessarily a bad thing for a bank to have a higher cost structure like this, just as long as increased expenses are being justified by increased revenue. We can gauge this by looking at the efficiency ratio.

At 63%, the bank's efficiency measure is at the high end of where it should be. The key to a good efficiency ratio is finding the delicate balance between noninterest expenses that attract loans and profit making net interest margin. Now that the bank has been able to goose net interest margin, we should expect them to start tackling excessive noninterest expenses.

In looking at minimizing these, three in particular stick out.

Growing expenses

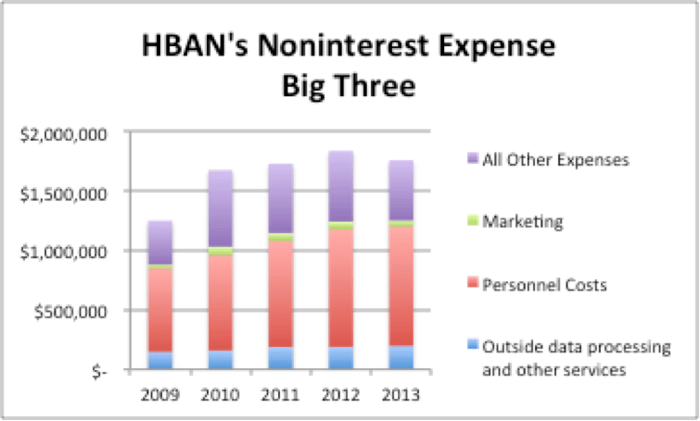

The largest increases in noninterest expenses over the last five years for Huntington have come from marketing, personnel costs, and outside data processing.

This makes sense -- increased marketing attracts more deposits, meaning more personnel to handle the deposits, and finally an increase in data processing with the increased deposit volume.

Out of these three, the only one likely to see a reduction in the near future is marketing which can benefit from economies of scale. The other two are likely to climb, especially as the bank plans to increase its footprint in Michigan over the next decade.

Keep a watchful eye

It's a bit of a paradox, but too much profitability can be a company's downfall. Increasing income on better margins is good but should be done so wisely.

Those interested in Huntington should keep a watchful eye on profitability masking inefficiencies in other parts of the company. Make sure profitability isn't the downfall of your investment.

The Liabilities: How Huntington Bancshares Found the Holy Grail of Banking