Goldman Sachs (GS 0.22%) has a reputation for being "the smartest guys on Wall Street", and Warren Buffett himself has even gone so far as to refer to an investment in Goldman Sachs as "a bet on brains."

However, Goldman has lagged the overall market over the past year, having risen by less than 7% as compared to 15% for the S&P 500. In the financial sector, there is still a lot of risk, which has been keeping valuations low for several years.

Despite this, there are several very compelling reasons to consider getting into Goldman. While there is no way of knowing for sure what will happen with the stock in the future, here are three of the most compelling reasons why the next few years could be very good for Goldman Sachs.

Impressive growth in investment banking

Banks across the board have reported excellent growth in investment banking, but Goldman is simply in a different league.

When Goldman Sachs reported its second quarter earnings in July, net investment banking revenues grew 15% year-over-year, mainly due to increased underwriting revenues reflecting the very strong IPO market. In fact, equity underwriting revenues (from new stock issues) rose by an incredible 47% in the past year.

The debt underwriting market (bond issues) was relatively weak, but Goldman still managed to increase revenues 5% year-over-year at a time when rivals like J.P. Morgan Chase are experiencing declines. Check out Goldman Sachs performance in various areas of investment banking compared to its peers.

As long as the market remains strong we should see high IPO activity, and as long as interest rates remain relatively low, there is a good possibility we'll see debt underwriting revenues pick up.

Legal issues could be cleared up soon

Unlike some of the other big financial institutions; Goldman Sachs has not settled its case with the Federal Housing Finance Administration (FHFA) over allegations of bad mortgage practices. Pending lawsuits (especially in the billions of dollars) always create uncertainty, so once it's finally in the past there is a good chance shareholders will see some upside.

According to the FHFA's complaint, Goldman sold about $11.1 billion in mortgage-backed securities to Fannie and Freddie. Many other banks have settled similar cases for between 12% and 20% of the total value of securities sold, but it sounds like Goldman might get off a little easier. According to people close to the settlement discussions, Goldman will probably pay between $800 million and $1.25 billion to settle.

Regardless of the actual amount, the company (and the market) will breathe a sigh of relief once this mess is behind them. Goldman is set to face the charges at a September 29trial date, but it is likely to settle before that date.

It's still really cheap

By pretty much any valuation metric, Goldman looks like a very cheap stock right now. The company trades for just 10.4 times 2014's expected earnings, and is expected to make even more money over the next few years, with earnings expected to grow by about 6% annually.

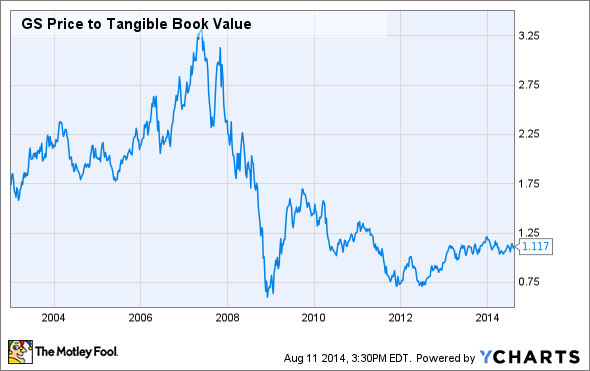

Despite the excellent growth in investment banking and other key areas of its business, Goldman trades for just 1.1 times its tangible book value, the lowest of its similarly sized peers. While the pre-crisis valuations of upwards of three times TBV were probably a bit inflated, the company has historically traded (in non-bubble times) for between 1.75 and 2.25 times tangible book, which would mean a share price between $269 and $346.

While the stock won't get there overnight, I believe this is a very reasonable target for the next few years, especially as the leftover litigation and other fallout from the financial crisis dissipates.

Patience could pay off

As is the case with much of the rest of the financial sector, the wounds of the financial crisis will take time for Goldman Sachs to fully recover from. However, for the reasons mentioned here, as the company continues to grow its business, shareholders could be handsomely rewarded.