Source: Southern Company

As the S&P 500 (^GSPC -0.88%) has soared 40% over the past couple years, Southern Company's (SO 2.24%) stock has flatlined. With its oh-so-low valuation, now is the perfect time for wise investors to weigh the upside to this dividend stock. Here are three reasons Southern Company's stock could climb out of its rut and start to rise.

1. American economy recovers

While utilities can't control America's future, they're more directly impacted by its rise and fall than almost any other sector. Since electricity production and sales are highly regulated and price controlled, utilities need more Americans to use more electricity to grow profits.

Many utilities saw an artificial boost during the first quarter of 2014 when a colder-than-expected winter pushed residents to ramp up their thermostats.

But for Southern Company, higher sales have continued into Q2. The utility reported two weeks ago that retail energy sales increased 2.1% compared to Q2 2013, with industrial sales alone jumping 3.0%.

"Southern Company's second quarter industrial sales growth is an indicator of the potential for a broader economic recovery across the Southeast," said Southern Company Chairman, President, and CEO Thomas Fanning in a earnings press release. "Our commitment to provide clean, safe, reliable, and affordable energy has enabled us to continue to meet the needs of a region that's growing faster than the U.S as a whole."

If Southern Company's southern sales aren't just a fluke, but the beginning of an economic trend, then Fanning can expect to make many more self-congratulatory statements in the coming quarters.

2. Clean coal makes a comeback

Source: Southern Company

From its coal-centric roots, Southern Company has striven hard to reinvent itself as a more diversified, dynamic energy company. Natural gas now claims more (42%) of its 45,500 MW of generating capacity than coal (38%) or nuclear (16%).

But it has kept one foot in its old stomping grounds with its Mississippi Kemper power plant. Initially lauded as the solution to turning low-quality coal into clean electricity, the Kemper plant has been harangued with hold-ups and higher prices over the past couple years. From an initial price tag of $2.4 billion, Kemper's costs are now estimated at $5.5 billion. That makes it one of America's most expensive fossil-fuel power plants ever built, according to The Wall Street Journal.

But the plant went operational this week using natural gas, a major milestone toward its eventual coal operation. If Southern Company can get its plant online with no additional delays and costs, and if national policy continues to be conducive to clean coal technology, Southern may essentially have exclusive access to a cheap fuel source. Its generation costs will benefit, undoubtedly, but the real money-maker could come as other utilities scramble to solicit Southern for its lucrative technology, all the while burning volatile natural gas to keep power pumping to their own customers.

3. Dividends, dividends, dividends

Utilities have long been considered some of the best dividend stocks around – and Southern Company is no disappointment.

In July, the utility paid out its 267th consecutive quarterly dividend – not a bad track record for an interested income investor. And while other companies reduced or cut distributions during the Great Recession, Southern Company managed to steadily increase its payout, keeping debt decently in check throughout.

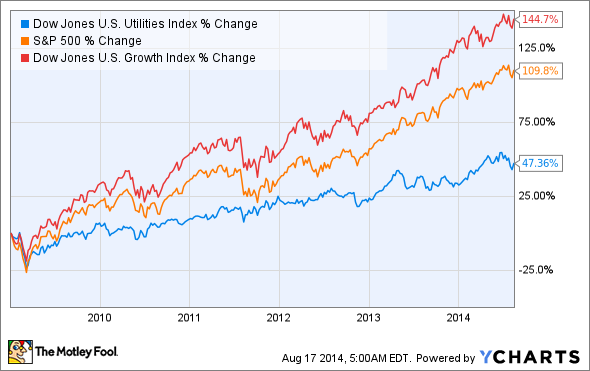

But since the dog days of the Great Recession, a "Great Recovery" has caused many investors to lose interest in dividend stocks. Since 2009, the S&P 500 has doubled its value compared to the Dow Jones U.S. Utilities Index, while the Dow Jones U.S. Growth Index has tripled.

Source: YCharts

There may or may not be a tech bubble, a real estate bubble, or a [insert rapidly expanding sector here] bubble, but investors' sentiment isn't likely to remain bullish forever. As growth-hungry traders come to their senses, dividends could come back in vogue – and Southern's stock price, along with it. Over the long-run, dividend stocks have continually beat out their counterparts, and rejecting today's trends for tomorrow's returns could mean major moves for Southern Company's stock.