Over 8 million people signed up for health care insurance through public insurance exchanges during the Affordable Care Act's first open enrollment period, and more than 7 million people were approved for Medicaid coverage too.

The increased enrollment is helping drive shares in insurers higher, but that may not mean it's the right time for investors to buy. With the second open enrollment period looming, let's take a look at Cigna Corporation (CI) and see if now is a good time to consider adding it to a portfolio.

Debating valuation

Historically, investors have shied away from paying up for revenue at insurers like Cigna because insurers are continuously battling one another for market share.

However, Cigna's trailing-12 month price to sales ratio has been trending higher over the past few years as investors have grown increasingly comfortable with the potential impacts of healthcare reform. The ratio is now at its highest levels since before the Affordable Care Act's passage and is north of competitors UnitedHealth Group (UNH 1.46%) and WellPoint (ELV 0.52%)

CI PS Ratio (TTM) data by YCharts

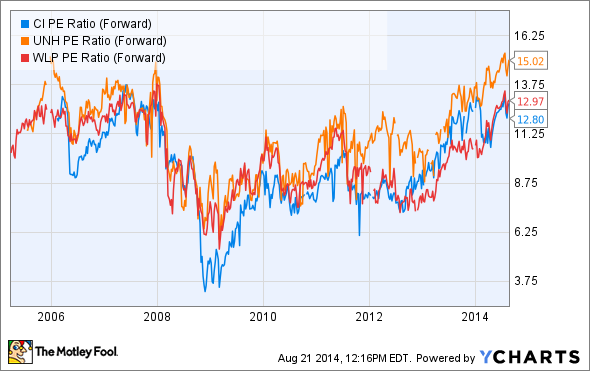

Having said that, Cigna's forward price to earnings ratio is at its highest levels since 2008, but the ratio is below UnitedHealth and WellPoint and that may suggest that Cigna is the cheapest of the three -- at least relative to expected earnings.

CI P/E Ratio (Forward) data by YCharts

Debating earnings

There's little question that reform is boosting insurance membership, and that's good news for insurer's top line. At Cigna, for example, second quarter revenue climbed 9% year over year to $8.7 billion.

While revenue growth is important, it's the bottom line that investors need to be watching, especially since insurers are being squeezed on one side by members demanding lower monthly premiums and on the other side by pharmaceutical companies eager to get top dollar for next generation medicine.

Exiting the second quarter, Cigna increased its full year earnings per share guidance by $0.10 to $7.20-$7.40 per share in part because of solid second quarter EPS of $1.96, which outpaced the $1.78 the company earned a year ago. For comparison, UnitedHealth Group's second quarter EPS totaled $1.42, up from $1.40, and WellPoint's EPS was $2.44, down from $2.60 a year ago.

As you can see in the following chart, Cigna's trailing 12 month earnings per share have been growing faster than its competitors'.

CI EPS Diluted (TTM) data by YCharts

Cigna's earnings momentum has come as its operating margin has improved to 9.2%. Thanks to higher margin businesses including disability, life, and accident insurance, Cigna's margin outpaces both UnitedHealth and WellPoint's, which have operating margins of 7.7% and 5.2%, respectively.

Looking ahead

Cigna participated in just five states' health care exchanges last enrollment season -- far fewer than WellPoint, which offered plans in 14 states, and similar to UnitedHealth, which also approached the exchanges cautiously.

Going forward, however, Cigna appears to remain a bit timid relative to UnitedHealth in increasing its exposure to Obamacare. The company plans to offer plans in three additional states next year, while UnitedHealth plans to offer plans in nearly two dozen states.

Shareholders could argue that Cigna's deliberate approach to the exchanges is wise given that Cigna reports that business remains unprofitable. However, investors should also recognize that Cigna still expects the exchanges to turn into viable markets with 3%-5% margins over time. If that assumption holds true, Cigna may find it more difficult to win away members from more established competitors down the road.

Fool-worthy final thoughts

Cigna is guiding for membership growth of just 1%-2% this year and that membership growth isn't likely to provide investors with the potential upside surprise that could come from the likes of UnitedHealth or WellPoint. But given that Cigna offers a diverse stable of insurance products, the company would seem to have plenty of opportunity for future growth. If so, investors may find this is a good time to consider shares.