Medtronic (MDT -1.12%) posted solid first-quarter earnings last month -- revenue climbed 5% year over year to $4.27 billion, while non-generally accepted accounting principles diluted earnings per share rose 6% to $0.93.

The medical-device maker reported 4% sales growth at its cardiac and vascular group, which accounts for over half of its top line. The restorative therapies group, which accounts for another 37% of sales, only rose 3% as a decline in the spine business offset growth in the neuromodulation and surgical businesses. The diabetes group, Medtronic's smallest business segment, grew 13% thanks to brisk sales of the MiniMed 530G, its first-generation "artificial pancreas."

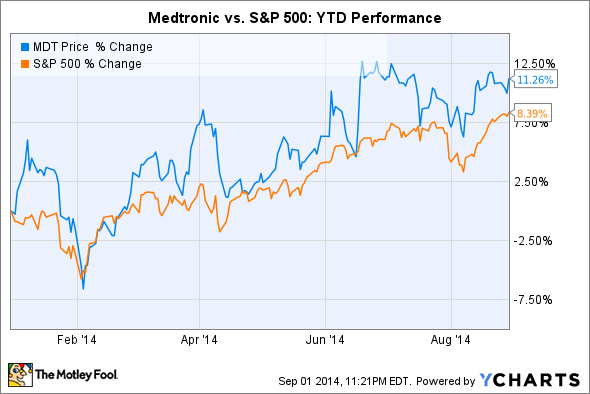

Source: YCharts.

Medtronic stock has remained flat since the earnings report, although it has outperformed the overall market to date in 2014.

While Medtronic's stock performance looks solid, investors should also understand the contrarian view to see why the share price might fall. But before we do so, note that while these points highlight Medtronic's vulnerabilities, they do not guarantee the stock will lose value.

Sluggish international growth

Last quarter, Medtronic's international revenue, which accounts for 45% of the company's top line, rose 3% year over year as reported, but only 2% on a constant currency basis. Comparing those results to growth in previous quarters, we can see that international growth is slowing as currency headwinds hurt Medtronic's top line.

|

Quarter |

2Q 2014 |

3Q 2014 |

4Q 2014 |

1Q 2015 |

|

International rev. growth (reported) |

3% |

5% |

4% |

3% |

|

International rev. growth (constant currency) |

5% |

7% |

7% |

2% |

Source: Quarterly reports.

Medtronic notably struggled in China and India, which respectively posted 6% revenue growth and a 7% decline in the first quarter. During the post-earnings conference call, CEO Omar Ishrak attributed that weak growth to challenges in distribution channels and management changes in China, along with distributor terminations and inventory rebalancing in India.

Although Ishrak said he believes both regions will eventually return to double-digit growth, sluggish performance in India and China could throttle international growth for a few more quarters.

The Covidien acquisition could fail

There are two reasons Medtronic wants to acquire Dublin-based Covidien (COV.DL) for $42.9 billion -- to lower its corporate tax rate with an inversion and to horizontally expand its medical device business across emerging markets.

Merging with Covidien would create a business that generates $13 billion in foreign revenue annually, with $3.7 billion coming from emerging markets. The combined company would help Medtronic expand its footprint by reaching 150 countries worldwide.

Although that sounds great for Medtronic, the company still must clear several hurdles to complete the deal. In addition to opposition in Congress, the merger will likely undergo an antitrust review by the Federal Trade Commission. Moreover, a Covidien shareholder recently sued to block the planned sale, claiming the Irish company intentionally blocked competing bids that could have raised its value.

While it is expected to close by the end of the year, or in early 2015, investors should remember that the Covidien deal isn't guaranteed yet.

Looming competition in the diabetes business

Finally, Medtronic's strong growth in its diabetes group might not last much longer.

Last September, Medtronic made history with FDA approval of the MiniMed 530G, which connects an insulin pump to a continuous glucose meter, or CGM, to produce a wearable artificial pancreas. The pump halts insulin delivery when glucose levels drop below a preset threshold. Medtronic is following up the 530G with the 640G, a second-generation device that can predictively shut off insulin before low thresholds are met. Although Medtronic dominates the U.S. market for now, competitors are quickly closing in.

The Animas Vibe and Dexcom G4 Platinum System -- two devices that work together, one from Johnson & Johnson (JNJ -0.69%) and the other from DexCom -- are already approved in Europe, Australia, and Canada, and could be approved soon in the U.S. When that happens, Medtronic's double-digit growth in the diabetes business -- which has continued for three consecutive quarters -- could cool off.

The Foolish takeaway

Medtronic is a solid company with three core businesses that aren't likely to fade away anytime soon.

However, prospective investors should do their due diligence and carefully consider the company's strengths against key weaknesses like sluggish international growth, the fate of the Covidien deal, and looming competitors in the insulin pump and CGM markets, before they dive in.