On Tuesday, United Airlines stock hit a new all-time high at $50 on the dot. Falling oil prices and an analyst recommendation helped United Continental Holdings (UAL 0.08%) reach that symbolic plateau.

United Airlines stock hit a record high this week (Photo: The Motley Fool)

However, investors should consider using the recent rally as an opportunity to sell and get out. While bulls think United Airlines stock is cheaper than that of network carrier rivals Delta Air Lines (DAL 1.18%) and American Airlines (AAL 1.53%), it doesn't trade at a big enough discount given its weak financial track record and future prospects.

United vs. its peers

Most analysts who recommend United Airlines stock do so because it is cheap relative to other major airlines. United was named a top pick on Tuesday by Hunter Keay of Wolfe Research. Keay admitted that United lags far behind Delta Air Lines in terms of earnings, but sees that as an opportunity. If United can close its margin gap with Delta, the stock will rise.

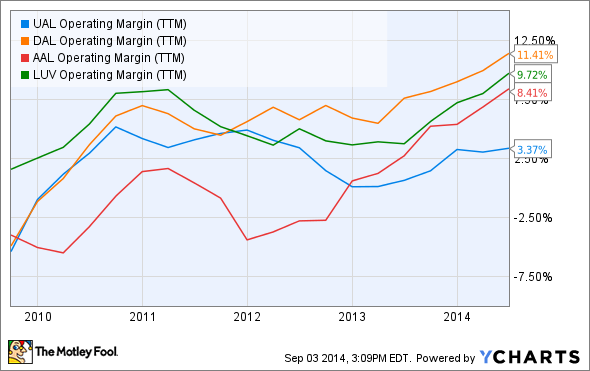

So far, United hasn't made much of this supposed opportunity. To be sure, United's operating margin improved in 2013, and its operating margin is on track to grow solidly again in 2014 (and perhaps 2015). But every other major airline has posted even bigger margin expansion.

Major Airline Operating Margin Trends, data by YCharts

Despite starting 2013 in last place among the "big 4" from a margin perspective, United has been falling further behind. The bleeding has slowed, but United may struggle to close the margin gap, causing United Airlines stock to continue lagging its peers. In the next few years, United will face three distinct challenges.

More competition in Greater China

United's first challenge is its heavy exposure to the Greater China market. Given the expected long-term growth of air travel to and from China, executives have touted this as a strength to United Airlines stock holders. As of last fall, United operated 77 weekly flights to China -- significantly more than all other U.S. carriers combined.

However, the flip side to this is that United is facing ever-increasing competition in China. This year, Delta and American have both added flights to China as they look to challenge United's dominance there.

American Airlines is one of many carriers adding flights to China (Photo: American Airlines)

An even bigger problem is the rapid growth of Chinese carriers. U.S. carriers have been very focused on improving profitability in recent years, driving tight capacity discipline and higher fares in domestic markets. By contrast, Chinese carriers appear to be more interested in gaining market share.

A variety of Chinese carriers have been adding flights to the U.S., increasing competition on routes with existing service and opening up new nonstop options. Air China and China Eastern -- two of the "Big Three" Chinese airlines -- have big order books for long-haul jets. Many of these will be used for new flights from Beijing and Shanghai to the U.S.

United currently gets about 13%-14% of its passenger revenue from transpacific routes, and the Greater China region (including Hong Kong and Taiwan) accounts for nearly half of this total. These routes are likely to face unit revenue pressure for the foreseeable future as other carriers rapidly add competing flights.

Large regional jet deficiency

Another reason to be cautious about United Airlines stock is the carrier's limitations on using large regional aircraft with more than 50 seats. A few years ago, Delta received permission from its pilots to add 70 more large regional jets if it also added 88 small mainline jets.

Delta received a sweetheart deal on 88 used Boeing 717s from Southwest Airlines, and is using those jets as well as its new 76-seat regional jets to retire the vast majority of its inefficient 50-seat jet fleet. This will substantially reduce unit costs while also providing a much better product for customers.

United has a similar agreement with its pilots. However, to add 88 small narrowbody aircraft, it would probably have to spend $3 billion or more, whereas Delta got its 717s at a great price since Southwest was looking to unload them. In effect, this means that United can't add the 70 additional 76-seat jets that Delta has the right to deploy.

Delta and American will be less reliant on 50-seat jets than United in the future (Photo: Republic Airways)

American Airlines has an even more favorable "scope clause" due to its recent bankruptcy, and is in the midst of rapidly growing its large regional jet fleet. This will leave United with the most exposure to cramped, fuel-guzzling 50-seat jets -- a recipe for financial underperformance.

Less cash for shareholders

United's financial underperformance in recent years also means that it has less cash available to return to shareholders than rivals. In July, the company announced plans to repurchase $1 billion of United Airlines stock by the end of 2016. However, this falls well short of what American and Delta are doing.

American also announced a $1 billion buyback in July, but its buyback will be completed a year earlier. It also began a quarterly dividend, which United has avoided. Meanwhile, Delta added $2 billion to its buyback plan earlier this year and boosted its dividend by 50%.

Delta's industry-leading free cash flow will allow it to devote even more money to buybacks after 2016, when it expects to reach its $5 billion adjusted net debt target. By contrast, United has posted negative free cash flow for the past two years, and even with its recent profit improvement, it will generate very little free cash flow in 2014 due to high capex.

Whereas United bulls note that Delta Air Lines' market cap is nearly twice as high as United's, Delta is likely to produce more than twice as much free cash flow as United for the next 5 or even 10 years. This suggests that United Airlines stock may already be overvalued relative to Delta's.

Foolish bottom line

United Airlines' recent margin growth has been driven entirely by improvements in the broader airline industry. In fact, United has fallen further behind its competitors. Thus, it's no anomaly that United Airlines stock has underperformed the other three big airlines this year even as it has risen 30%.

United Airlines stock performance vs. peers, data by YCharts

The airline industry is a cyclical business, and history shows that the current high-margin environment won't last forever. Southwest Airlines has already announced plans to resume its growth next year, and other smaller carriers are also ramping up growth plans.

In the long run, competition probably won't return to the destructive levels of 2008 and earlier, but the environment may not be as favorable as what airlines are seeing today. In other words, the rising tide that has lifted United Airlines stock in the past couple of years may be nearing its peak.

United trades for about 11 times its expected 2014 pre-tax income -- a generous multiple for a company with a mediocre balance sheet and weak cash flow. The three challenges listed above -- rising competition in China, a low cap on large regional jet usage, and little cash flow available to return to shareholders -- mean that United's luck will run out as soon as the airline industry settles into a sustainable (lower) level of profitability.