Activision Blizzard (ATVI) stock has been riding high in the lead-up to the Sept. 9 release of its premier new IP, Destiny. The game's $500 million production and marketing budget have set expectations sky-high, and the title is a near-lock to be the biggest new IP in the gaming industry this year. The past week has seen the hype drive Activision's valuation to an all-time high, and a massive performance for the game is probably already built into the company's share price.

Is Activision's stock a smart buy even at these levels? How does the company look when compared with competitors such as Electronic Arts (EA -0.19%) and Take-Two Interactive (TTWO -1.57%)?

What does Destiny mean for Activision Blizzard?

Looking at pure plays, Activision Blizzard stands as the largest publisher in gaming, and Destiny is essential to the company's growth in the short term and beyond. In addition to being a near-lock for the biggest new property launched this year, analysis of pre-order numbers suggests that the title might be the year's best-selling game.

To achieve this feat, the game would have to outperform Activision's own Call of Duty: Advanced Warfare. While the Call of Duty franchise continues to be a massive seller, there are signs that it's starting to lose a bit of steam. A decline in sales for the most recent release in the franchise has highlighted the need to introduce the next big thing in the first-person-shooter genre.

Destiny is sure to generate huge revenue as a stand-alone release, but it's the game's potential to create additional business through downloadable content expansions and micro-transactions that elevates it to a new level of importance. The sale of expanded game content has been standard practice in the industry for years; however, the Destiny experience has been built to encourage participation in these additional products in a way that is somewhat atypical in the genre.

Two DLC expansions for the game have already been announced, the first of which will launch in December. A price of approximately $35 for the first two content expansions, or approximately $20 for each individual update pack, only hints at the type of revenue that Activision looks to generate from selling additional in-game content.

Source: DestinyTheGame.com.

To put things in perspective, early estimates for the amount of revenue that Take-Two's Grand Theft Auto Online could generate in a year came in at around $100 million. Revenue from online transactions after roughly a quarter on the market came in at approximately $66.4 million. Activision's Destiny won't match the approximately 33 million units that Grand Theft Auto 5 has sold, but the upcoming game is even more optimally structured for additional DLC business than Take-Two's megahit.

Activision has more than Destiny on its side

Activision expects that the final two quarters of calendar 2014 will be its biggest half-year earnings period on record, and for good reason. Destiny stands as the company's most important release for the year, but the publisher will also debut huge releases in major franchises like Skylanders, Call of Duty, World of Warcraft, and Diablo.

These are industry-leading properties that look especially strong when stacked against competitors' offerings this year. Electronic Arts delayed the next title in its hugely popular Battlefield series into 2015, and Take-Two chose to push its new IP Evolve into the next calendar year. There are also rumors that Take-Two's updated version of Grand Theft Auto V will slip to next year.

Further sweetening the pot, Activision Blizzard is making significant inroads to the mobile market, and the company has been rapidly increasing the percentage of its revenue that comes from high-margin digital transactions. The company's last fiscal quarter saw approximately 73% of the company's revenue come from digital sales.

Activision has strong valuation metrics and industry position

With a market capitalization of approximately $17 billion, Activision Blizzard is priced at approximately 25 times 12-month trailing earnings. That compares favorably with EA's P/E of approximately 104, at a market cap of approximately $12 billion. Additionally, Activision has significant cash reserves, and the past fiscal year saw Activision generate $974 million in free cash flow, while EA's turn for the period came in at $615 million.

Destiny's publisher enjoys resource and positional advantages over its competitors in the games market, putting it in good shape for continued growth. There has even recently been some speculation that the company is interested in acquiring Take-Two. Such a move would add some of gaming's biggest properties to Activision's stable and would also allow the company to move in on the sports games segment that rival EA is currently dominant in. Acquiring the smaller, approximately $2 billion market cap company could also play well with Activision's reported designs on having a bigger presence in the movie business.

Foolish final thoughts

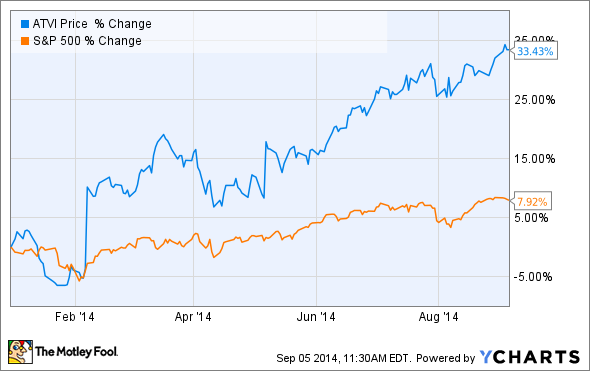

The level of success that Destiny achieves should provide a strong indicator as to what the future holds for Activision Blizzard. The company will probably dominate the games market this year, and it appears well positioned for long-term growth as the gaming industry continues to expand. Near-record high prices for the stock may deter some investors, but the strength of its properties and fundamentals provide strong reasons to believe that Activision can continue its upward trajectory.