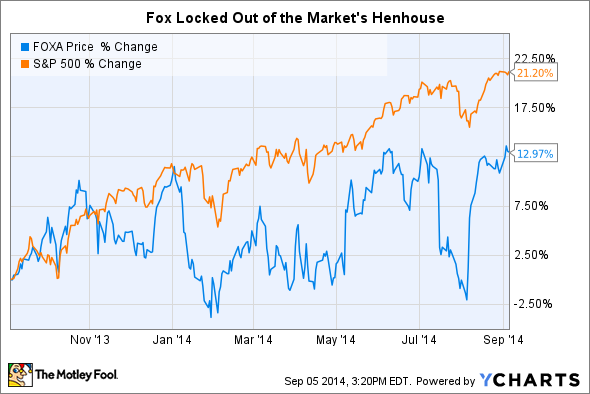

For all the hubbub about potential deals and worries over changes in the TV advertising business, Twenty-First Century Fox (FOXA) stock still trades near a 52-week high as of this writing. There's just one problem. Investors holding S&P 500 index funds have done better:

Will the tide turn in the year ahead? I'm inclined to believe so. Here's why.

A budding sports franchise with serious assets

While Disney's (DIS 0.16%) ESPN is a powerhouse when it comes to sports programming, Fox isn't shying away from the competition. If anything, executives welcome the chance to win more viewers away from ESPN and global competitors. Here's how Fox President Chase Carey described the upside in the most recent earnings call:

Fox Sports 1, FXX, and STAR Sports, which require investments in 2015, then turn around to be a tailwind to growth in 2016. The underlying growth of our core business, if we exclude these new channel initiatives, is actually both stable and strong. Excluding these new channels, we would have solid low to mid level double-digit growth in both 2015 and '16. In fact, that solid double-digit growth would carry through into 2017, too.

Investors will need to remain patient as these investments take hold, though Fox is making progress in the meantime. For example, in its first year on air, Fox Sports 1 is attracting 41% more viewers than its predecessor, SPEED.

Major League Baseball is responsible for a good portion of the gains. In a press release, Fox said its audience for Fox Sports 1 was tracking 29% higher than ESPN2 over the first five months of the baseball season -- 409,000 viewers versus 318,000. MLB, NASCAR, UFC, and other sports programming could drive significant ad revenue for Fox Sports 1 and 2 in the coming years.

Fox's big bet on sports is paying off with strong viewership numbers for Major League Baseball. Source: Wikimedia.

Cable cash can fund expansion

Of course, cashing in on that catalyst would be difficult if Fox wasn't also generating enough capital to run the business and fund new growth. But that's exactly what the cable business does -- Fox News, Fox Business, and FX, in particular.

"At Fox News, we continue to see new shows like The Kelly File and The Five grow to complement our established franchises and become market leaders in their own right," Carey said during the conference call. "The network shows continue to dominate the cable news competition, with The O'Reilly Factor, Special Report, and Fox & Friends all remaining No. 1 in their respective time slots for over 100 consecutive months."

FX, meanwhile, is enjoying strong ratings and critical acclaim for new original programming:

-

Movie adaption Fargo has drawn around 2 million viewers per episode while winning the approval of 98% of critics and 97% of audiences who've rated the show at Rotten Tomatoes. Similarly, the 50,000-plus to rate the show at IMDB give it a 9.1 out 10 possible stars.

-

Season 1 of horror drama The Strain has thus far earned the approval of 87% of critics and audiences who have tuned in, according to Rotten Tomatoes. The show also scores an 8.1 out of 10 at IMDB and is drawing 2 million or more viewers regularly. FX has scheduled the inaugural season finale for Oct. 5.

For investors, Fox's cable programming produces a bounty that's useful for reinvesting in the business. Cable accounted for 70% of earnings before interest, taxes, depreciation, and amortization in fiscal 2014. Every new success in the cable segment helps fund growth elsewhere, including movies from 20th Century Fox.

Franchise frenzy

Through Sept. 4, the studio is enjoying its best nine-month performance of the 14 years of comparative tracking data Box Office Mojo has available. Two major franchise extenders deserve credit for that performance: Dawn of the Planet of the Apes and X-Men: Days of Future Past. Combined, they have accounted for $1.37 billion in global box office receipts.

Investors can expect at least one more Apes film and a lot more from the X-franchise, which Days of Future Past has helped to reboot. Another planned do-over -- Josh Trank's The Fantastic Four -- is due next summer. Fox is aiming to cash in on its Marvel characters as well as Disney has.

Benjamin J. Grimm -- The Thing -- will get another turn on screen when The Fantastic Four arrives in theaters in June 2015. Credit: Marvel Entertainment.

Finally, there's the Avatar franchise, which includes three new films to be released back-to-back-to-back in 2016, 2017, and 2018. The first film still ranks as the biggest grosser in box office history, earning $2.79 billion worldwide over a 34-week run at the box office.

Foolish takeaway

Even so, Fox stock trades for a tech-stock-like multiple of 26 times earnings. Isn't that too big a premium, especially when Disney still trades for 23 times earnings? Perhaps. But it's worth noting that CEO Rupert Murdoch is so confident in the business that he's persuaded the board to authorize $6 billion for repurchasing stock.

"We believe buying our own stock, when it is underpriced, represents a unique opportunity to maximize shareholder value over the long term. And at these levels, we believe our stock is severely undervalued," Murdoch said on the earnings call.

If he's wrong, Fox stock will keep on losing to the index as it has. But if he's right? Investors will be reap the rewards for years to come. I think that's a risk worth taking, which is why I've rated the stock to a five-year outperform in my CAPS portfolio.