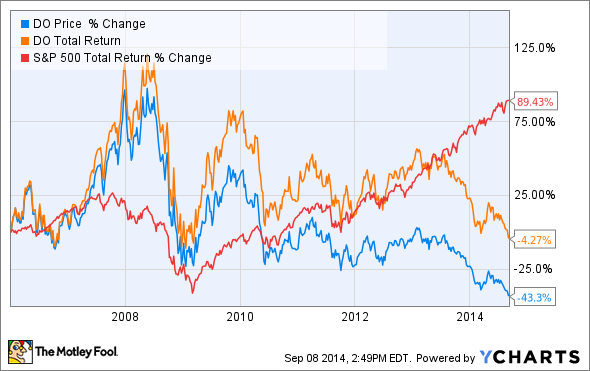

The market has not been kind to offshore drilling companies this year, and Diamond Offshore Drilling (DO) has fared the worst of all the diversified offshore rig suppliers. Shares of Diamond are down 27% from the beginning of 2014. What is probably more troubling about owning shares in Diamond is that if you had bought shares all the way back in 2006, you would still be at a loss even on a total return -- dividends included -- basis.

So, what exactly has been going on at Diamond that has resulted in it trailing all of its peers? And what should investors look for as a sign of better times ahead?

Some things aren't meant to be bought at a vintage store

One of the benefits of being an oil and gas equipment and services supplier is that unlike producers that need to constantly spend money for new production sources, equipment and supplier companies' assets can last for years without major spending. Still, companies need to be able to spend some money to update and expand, but that is something Diamond has been very hestitant to do over the past several years. Looking at the company's fleet of rigs pretty much tells the entire story.

| Company | Average Age of Stationary fleet (Jackups and Platforms) | % of Stationary Fleet Less Than 10 Years | Average Age of Floating Fleet | % of Floater Fleet Less Than 10 Years |

|---|---|---|---|---|

| Diamond Offshore Drilling | 33.4 years | 14% | 25.5 years | 18% |

| Transocean (RIG -1.12%) | 12 years | 50% | 23.9 years | 22% |

| Noble (NEBLQ) | 16.4 years | 58% | 20 years | 37% |

| Ensco (VAL) |

27.7 years |

11% | 13.3 years | 48% |

|

Seadrill (SDRL) |

4.8 years | 97% | 5.7 years | 90% |

Source: Company fleet status reports.

Not only does Diamond have the oldest fleet out there, only 25% of its higher-earning rigs -- floating semi-submersibles and drillships -- are designed to handle the more challenging environments, such as ultra-deepwater (greater than 7,500 feet). With so few of the company's assets able to handle tougher jobs and several of its competitors' rigs able to do so, it has been harder and harder for Diamond to keep its rigs employed or get a competitive day rate for its rigs.

These factors, over time, have slowly eroded Diamond's profits. Since 2009, earnings per share have slowly declined from a high of $9.90 to $3.06 over the past 12 months.

Can it turn things around?

One of the more discouraging things about Diamond's performance is the apparent lack of strategic changes in recent years to address some of these structural issues. In this year alone, both Noble and Transocean have announced deals to spin off aging rigs into separate entities so both can focus more on higher-value assets. Diamond has not made any indications as of late of plans to do something similar, and its two ultra-deepwater capable rigs under construction will only make minor changes to the company's overall fleet.

The one thing the company has going for it, though, is that it has a clean balance sheet. Its debt to capital ratio of 32% means that the company has the flexibility to take on some debt at a relatively decent rate to grow its fleet without severely compromising the financial health of the company. The one problem, though, is that the overall rig market is slightly oversupplied today as many new rigs from competitors have come online, and the total orders for new rigs is quite low.

Source: Bloomberg Industries.

When the market does pick back up, Diamond may be in a better position financially than many others to start a robust fleet upgrade, but it may be a few years before that happens.

What a Fool Believes

As long as Diamond's competitors have better rigs that can handle the more challenging demands of today's offshore drilling, it's likely that Diamond's earnings -- and share price -- will continue to decline. A quick uptick in rig demand could help stave off some of the recent woes, but it certainly won't cure the underlying issues with Diamond's aging fleet.

Overall, it's probably best for investors to shy away from this stock. If Diamond were to announce a significant change to its fleet through a spinoff, a sale, or a newbuild program, it may be worth revisiting. For now, though, even with it trading at a price to earnings ratio of 14, it seems a bit pricey for a company with declining earnings.