Source: CSX.

Overall, the railroad industry has seen some improvement recently, as CSX (CSX -3.02%) and its peers have bounced back from tough times a few years ago. Yet even though the stock has climbed to record-high levels, CSX shareholders still have a few potentially damaging issues to worry about. Let's take a look at three of the most significant factors that could send shares of CSX falling in the near future.

1. More problems with crude-oil transport could lead to tough regulation.

One of the saving graces for CSX -- as well as Union Pacific (UNP -1.82%), Norfolk Southern (NSC -3.60%), and other railroad peers -- has been the emergence of transporting crude oil by rail as a major method of delivering energy products to market. Traditionally, oil and gas companies have preferred pipeline transport, but with all the production activity taking place in remote areas that currently lack pipeline service, producers have had to find alternatives. As a result, railroads have increasingly relied on oil and energy-related materials to take the place of falling shipping volumes in coal.

The problem, though, is that accidents have occurred with crude-carrying trains. In late April, a CSX derailment in Lynchburg, Virginia, involved 15 cars, with CSX confirming that three of those cars were on fire after the accident. Nearby residents and businesses were evacuated, and CSX later took heat after regulators found that a CSX inspection had discovered a defect in a nearby track. Moreover, thousands of gallons of crude spilled into the nearby James River, sparking environmental worries about the advisability of shipping crude by train.

CSX isn't the only railroad to suffer oil tanker-car accidents, but each time an incident occurs, it raises the chance of greater regulation down the road. That wouldn't necessarily be fatal to CSX, as ordinary upgrades to railcars aren't unusual. But harsher regulation that limits speed and volume could take away growth in one of the most important areas for CSX lately.

Photo credit: Flickr/Roy Luck.

2. Investors could give up on CSX and its eastern-based peers in favor of better-placed railroads.

Geography is an important component of the competitive advantages that railroads have. CSX long profited from its eastern U.S. location, with proximity to important transportation customers like the coal fields of the Appalachian Mountains and countless industrial manufacturers needing shipping services. Yet coal has become less important, and many of the most promising shale oil and gas plays are located beyond CSX's direct network reach. Moreover, as Europe goes through recession, Asia has become a key growth market, and that makes Pacific-reaching railroads like Union Pacific look more attractive than their eastern counterparts.

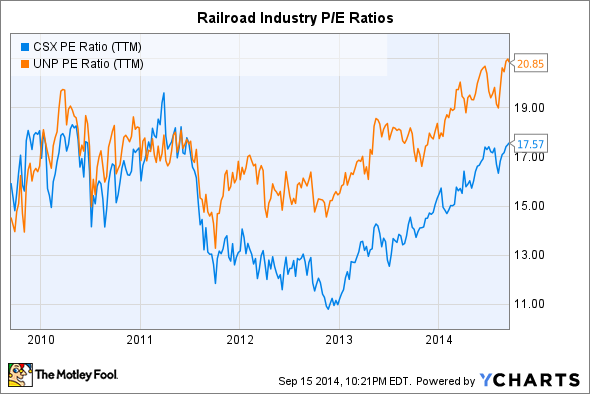

Already, Union Pacific boasts a higher earnings multiple than CSX, perhaps reflecting the perception of greater growth potential from the more western-focused railroad. But if those fundamental differences become clearer in the railroads' financial results, then CSX could come under more pressure as investors shift toward railroads that are closer to where they can find the best business prospects.

CSX PE Ratio (TTM) data by YCharts.

3. Pipelines represent a long-term threat to growth in oil transport for CSX.

Even though the booming energy industry has helped keep CSX moving in the right direction, it's unclear in the long run whether railroads will be able to sustain their role in oil transport. Pipelines take a long time to get approved and to build, but they nevertheless offer a legitimate alternative to crude oil-carrying trains. Once built, they tend to be cheaper to use than alternative forms of transportation, and it's also much quicker to move the same volume of product.

The question, though, is whether new areas of oil and gas supply will keep getting discovered. If so, pipeline construction could find itself constantly behind the curve, giving railroads the chance to cash in on their greater flexibility in reaching those new areas first. However, if the current sources of major production remain the most lucrative, then eventually, pipelines will replace rail -- or at least take away a good part of railroads' business.

Even though CSX stock has generally performed well lately, investors should remember the potential negatives for the company in the future. If these scenarios start coming true, then CSX could give up some of its recent gains.