Specialty and generic drugmakers have had a banner year in 2014. Top names like Actavis (AGN), Mylan, (MYL) and Teva Pharmaceutical Industries Ltd. (TEVA 0.69%), for example, have all beat the broader markets over the past year.

This rising tide among generic drug manufacturers is due mainly to the ongoing patent cliff, which has opened up a diversity of new opportunities for these companies. Even so, the rapid rise of this group of stocks has in some cases out-paced their underlying fundamentals, especially from a top-line growth perspective.

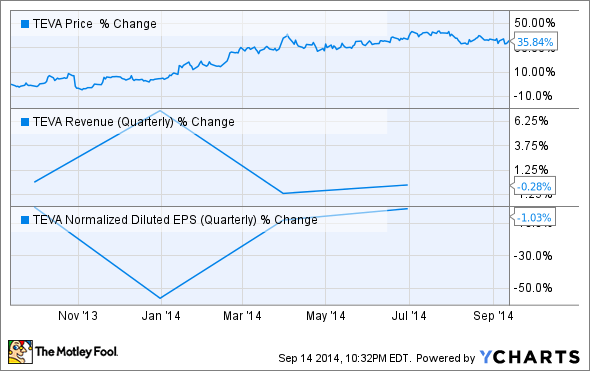

Teva Pharmaceutical, for instance, has seen its stock soar by 35% year-to-date, even though revenue and diluted earnings per share have flat lined for the most part, as shown by the chart below.

Given the strong performance of Teva's share price so far this year in light of its anemic top and bottom line growth, I think it's prudent to consider the following three reasons why this stock could falter moving forward. Keep in mind, of course, that nobody can predict the future -- Teva's stock could also rise.

Reason No. 1

Teva's top-line growth may continue to erode in the wake of generic versions of its best-selling multiple sclerosis drug, Copaxone, coming on the market. In the second-quarter, the company revised guidance for the year taking the possibility of generic launches into account, suggesting that EPS could come in as low as $4.50 for the full year.

Looking ahead to the third quarter, the Street is expecting EPS to fall by 10.6% compared to the same period a year ago, presumably reflecting the impact of generics. And given that Copaxone accounts for roughly half of the company's profits, this decline could accelerate in a hurry.

Teva is hoping to avoid a dramatic downturn in Copaxone sales by switching patients to a longer-acting formulation of the drug. However, Mylan, among others, have already filed ANDAs with the Food and Drug Administration for this new formulation.

Teva does have legal options to block, or at least delay, the commercial launch of these longer acting generics. But there is no telling how this protracted fight will ultimately play out. In sum, Teva's top revenue generator is under attack and the company's best legal efforts to date haven't gained much traction.

Reason No. 2

Generic drug launches have devastated the sales of many branded top-sellers and caused free cash flow streams to dry up seemingly overnight. If this same story plays out for Copaxone and Teva, this could mean a reduction in the dividend.

Teva's total dividend payouts to shareholders already appear out of line with its cash flow based on the graph below.

What's important to understand is that a reduction, or in the worst case an outright suspension, of the dividend would hurt the company's chances of attracting income-oriented investors. With a current yield of 2.28%, the stock is already below the sector's average yield of 2.69%. All told, the potential drop in revenue and yield would give investors little reason to consider this stock for their portfolio moving forward.

Reason No. 3

Despite what looks like a fundamentally sound company that is reasonably valued at current levels, some top investors like George Soros have begun to migrate out of the stock. In the second-quarter, for instance, the Soros Fund Management sold off 29.4% of its stake in Teva, suggesting that they believe a trend reversal could be coming soon.

Although institutional investors buy and sell stocks for myriad reasons, such a large sell-off of a former top-holding by a well-known fund is noteworthy, to say the least.

Foolish wrap-up

No one can say for sure how any stock will perform going forward. That said, Teva does have serious issues to contend with for its biggest profit driver and the Street tends to weigh uncertainty heavily when valuing companies.

My biggest concern for Teva is the impact generic rivals will have on the company's free cash flow. The company doesn't offer a particularly high dividend yield compared to its peers, and its ability to maintain even this level is questionable over the long-term.

Teva may therefore have to look toward Actavis' aggressive M&A activity as way forward. The problem is that Teva has been mired in a losing legal battle to maintain Copaxone's exclusivity status, instead of focusing on exploring avenues to inject new blood into its product pipeline. Again, Actavis' business model has proven to be wildly successful in terms of generating growth and Teva would be wise to follow suit, sooner rather than later.

All told, Teva may have a hard time gaining the attention of income and growth investors alike going forward, at least until the generic Copaxone question is resolved or a new revenue driver is acquired. As such, I think the stock could start to lose momentum.