In partnership with Glassdoor, our investment analysts are taking a closer look at some of the most popular companies in Glassdoor's career community.

Apple (AAPL 0.64%) is a great company. In fact, the overall quality of Apple's stakeholder relationships puts it squarely among the best companies in America. While the tech giant doesn't do everything perfectly, Apple's overall relationship with customers, employees, investors, and the world at large certainly paint this company as a class act.

Apple retail store. Image source: Apple.

Customer loyalty is off the charts

It's no surprise to see Apple ranked first in the Forbes' latest World's Most Valuable Brand list. Customers matter deeply to Apple -- and it shows. One of the key reasons Apple has grown the value of its brand so rapidly in the last decade and a half is because the company has both acquired and retained customers by building products that focus on a top-notch user experience.

Apple is known for exceptionally high customer satisfaction across its products. It topped J.D. Power's 2014 customer satisfaction studies for smartphones and tablets, the two categories that make up Apple's two largest businesses. And consider these impressive numbers: In a May survey conducted by ChangeWave, the iPad Air and iPad mini with Retina display registered impressive 98% and 100% customer satisfaction rates, respectively. Apple's emphasis on building products, software, and services that always put the customer experience first has been a long-term driver for sales -- and nothing suggests this trend is eroding in any way.

Employees are happy

Overall, Apple employees seem optimistic about the company. Of 3,704 employee reviews at Glassdoor, the Cupertino, Calif.-based tech company has about a four-star rating out of five. The rating is based on four factors: culture and values, work-life balance, senior management, compensation and benefits, and career opportunities. Among these factors, Apple scored highest in culture and values (four stars) and lowest in work-life balance and career opportunities (both at 3.3).

Two more important highlights from Glassdoor:

- Employees rate Apple's compensation and benefits 24% higher than the average compensation and benefits at other companies.

- 92% of employees approve of Apple CEO Tim Cook, putting him in 18th place among Glassdoor's 2014 highest-rated CEOs of large companies.

Investors are in luck

Investors in Apple stock have made out like a bandit. The stock's performance has absolutely crushed the S&P 500 over the past five years.

Even zooming in a bit closer to Apple stock's three-year performance, it has outperformed the S&P 500 by more than 15%.

But investors know past performance isn't usually an indicator of what is to come. Instead, Apple management's decisions -- those that impact the underlying business -- will make or break the stock in the coming years. Two areas, in particular, will be key for Apple management in growing intrinsic value: innovation and fiduciary responsibility. How is the company performing on these fronts?

As a product-focused company, Apple's innovation is the most important aspect in building shareholder value. Until the company's latest product rollout this month, doubts persisted about whether Apple could truly innovate without co-founder Steve Jobs at the helm. In 2013, Apple's board even had concerns about the company's pace of innovation, according to Fox Business. But the introduction of a well-executed Apple Watch that puts the company into an entirely new product category, and introduces a new revenue stream, demonstrates that innovation is still at Apple's core.

Apple Watch. Image source: Apple.

Apple's impressive cash flow makes fiduciary responsibility key to shareholder returns. Given Apple's enviable lucrative gross profit margin of 38%, the company rakes in loads of cash. In fact, Apple converts about $0.27 of every dollar into free cash flow. In the trailing 12 months, Apple brought in $48 billion in free cash flow.

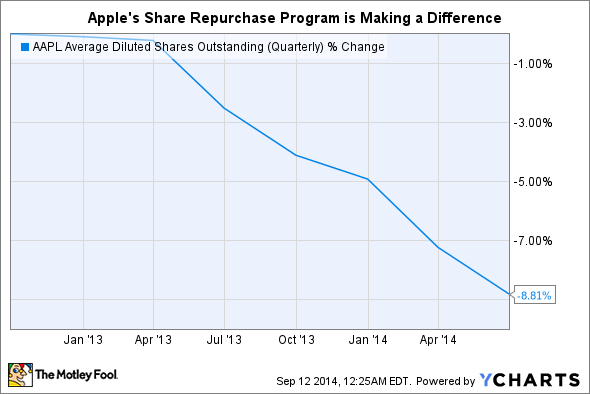

Fortunately, when it comes to fiduciary responsibility, Apple is the gold standard. Thanks to an unprecedented stock repurchase program, Apple has reduced its share count by 9% in the past two years.

AAPL Average Diluted Shares Outstanding (Quarterly) data by YCharts.

Best of all, Apple repurchased many of these shares at a significant discount to today's price, making the program extremely shareholder-friendly. And, while we're talking about fiduciary responsibility, we can't forget Apple's dividend. Not only does it yield a meaningful 1.9% return on a cost basis today, but management has said it expects to increase the dividend payout every year.

The larger world matters to Apple

Earlier this year, environmental activist group Greenpeace dubbed Apple an "green energy innovator" in a report on Internet cloud brands. Greenpeace ranked Apple first among the tech companies listed in the report, ahead of Google and Facebook.

"Apple's commitment to renewable energy has helped set a new bar for the industry," the Greenpeace report read, "illustrating in very concrete terms that a 100% renewable Internet is within its reach, and providing several models of intervention for other companies that want to build a sustainable Internet."

Apple is setting the standard in environmentalism among its peers in a growing number of ways. Another example: Apple's iPads account for over 100 of the 140 tablets on the Electronic Product Environmental Assessment Tool's registry of environmentally preferable products. Apple's products are also represented in the EPEAT registries for desktops, notebooks, displays, and integrated desktop computers.

Furthermore, Apple shows that it cares about the world at large by enforcing increasingly strict standards at its suppliers. When it comes to dealing with its sprawling global supply chain, Apple has made significant improvement under Cook. One of the biggest changes is a new supplier responsibility report that is regularly updated. Apple is more transparent than ever before about its suppliers and the progress it is making in removing hazardous substances, reducing use of conflict materials, not tolerating underage workers, and enforcing maximum 60-hour workweek policies.

Overall, Apple has the marks of an enduring high-quality company. Stakeholders are clearly important to Apple today, and this will likely be the case for years to come. Not only is Apple's current relationships with key stakeholders notable, but the company also is clearly trying to improve its interactions with these stakeholders.