Newfield Exploration (NFX) has jettisoned around $2 billion worth of non-core assets over the last five years or so. It's used the cash to help fund its efforts to refocus on four key U.S. regions. The heavy lifting is largely complete, and management wants you to know how well it's doing now.

Production is growing

One of the most important things for an oil and gas exploration company is growth. That means more drilling and, hopefully, more production. And on that front, CEO Lee Boothby was quick to point out that, "Our second quarter oil production averaged 50,000 barrels of oil per day and has increased 32% year-over-year."

That's important because one of the big reasons for Newfield's remake was to increase its oil exposure. Oil and natural gas liquids (NGLs) now make up roughly half of the company's production. And, clearly, oil is growing strongly. In fact, this shift isn't done yet. By the end of next year, the company hopes that oil and NGLs will make up 60% of its production, with a six percentage point increase in oil's contribution driving the shift.

(Source: Public domain, via Wikimedia Commons)

Our wells are killing it

And things are going well toward that goal, with the CEO noting during the second quarter call, "Each of our 4 focus areas is exceeding our beginning-of-year expectations ... Two weeks ago, we raised our 2014 guidance and raised the midpoint of our oil forecast above the upper end of our original guidance for the year."

COO Gary Packer offered up some highlights. "Our production in the Anadarko Basin is more than 40,000 barrels of oil equivalent per day, up more than 10,000 barrels of oil equivalent per day over our first year average."

And in the company's SCOOP South area, "our wells continued to perform above play average type curves ... Year-to-date, our production in the Uinta Basin is running ahead of forecast, primarily due to the improved production profile from our SXL wells in the Central Basin."

These are just a few of the positives pointed out by Packer, but they clearly show that good things are happening on the ground.

We aren't growing just to grow

CFO Lawrence Massaro, meanwhile, noted the company's recent agreement to sell Newfield's Granite Wash assets. He pointed out that the proceeds from the sale will be used to "call and retire our $600 million of senior subordinated notes due in 2018." So while the oil and gas driller is looking to get bigger, it isn't doing so at the expense of its balance sheet.

Buying back these notes will "reduce our long-term debt to under $2.6 billion and lowers our debt-to-EBITDA by approximately $2 billion to $1.5 billion. As I articulated before, we believe that managing growth and balance sheet strength need to go hand-in-hand." Clearly, Newfield Exploration is putting its money where its mouth is when it comes to balancing growth and financial strength.

We're fixing China

All of that said, Newfield still has one foreign asset (in China) left to sell. There have been some complications along the way, but CFO Massaro reports progress:

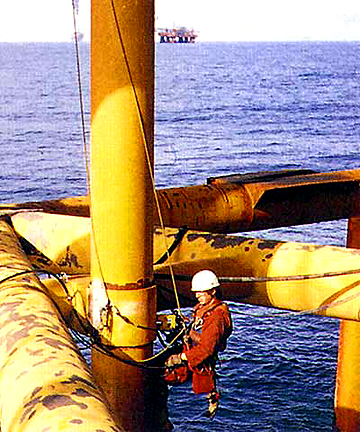

"We've completed our underwater repairs to the jacket and are finalizing above-water repairs today. We recently loaded our topside facilities on the installation barge, and our plan is to find a suitable weather window to install the topside over the next month. This will keep us on schedule for first oil production in the fourth quarter and 40,000 barrels a day of gross well from Pearl in late 2014 or early 2015."

(Source: Inspector on offshore oil drilling rig, via Wikimedia Commons)

More importantly, "We continue to work with our bid group on the planned sale of our China business and anticipate a resolution later this year." And once that sale is complete, Newfield will be able to focus all of its attention back home on its four core markets. Watch what the company uses the proceeds for, though, since at least some debt reduction would be nice to see.

We are a new company

At the end of the day, CEO Boothby summed it up: "Our transformation period is clearly behind us, and there are great things happening throughout our company today." That includes everything noted above, but also the fact that, "We're on a path toward balancing our annual investments with cash flow."

In other words, Newfield is proud to report that it's made a huge amount of progress toward its long-term plan of paying its own way without having to sell assets or tap the capital markets. And everything it's done so far is getting it that much closer to this goal.