In recent years, off-price retail giant TJX (TJX 0.76%) has been returning cash to shareholders at a furious pace. In addition to offering a regular dividend with a 1.3% yield, TJX has spent at least $1 billion annually on stock buybacks for several years in a row.

TJX Stock Buybacks (TTM), data by YCharts

TJX is maintaining its focus on share buybacks this year. In the first half of FY15, TJX spent $800 million to repurchase 14 million shares of stock, and it plans to spend $1.6 billion-$1.7 billion on buybacks over the course of the full year. Share buybacks are a key part of TJX's strategy to drive consistent double-digit EPS growth for the foreseeable future.

Disciplined capital allocation

Some companies that spend heavily on share buybacks do so at the expense of investing in their businesses. A long period of under-investment can eventually undermine profitability, hurting long-term shareholders.

Fortunately, this isn't a problem for TJX. Whereas traditional department stores are expensive to build and care for, TJX can maintain and expand a massive store fleet on an annual capital budget of a little less than $1 billion. Recently, the company has been reinvesting about 30%-40% of its annual operating cash flow in CapEx.

TJX is investing in growth at the same time as it is buying back stock (Photo: The Motley Fool)

This budget has enabled TJX to grow its square footage by approximately 4%-5% annually. Last year, it increased its store count by 169 units, from 3,050 to 3,219. TJX is also reinvesting in its existing stores, and plans to remodel about 250 stores this year. Lastly, TJX opened up an e-commerce website for its popular T.J. Maxx brand last year.

In the long run, TJX believes it has an opportunity to grow its global footprint to 5,150 stores, using only its existing store concepts and existing markets. TJX's buyback activity has not disrupted its progress toward that long-term goal.

Maintaining a solid balance sheet

TJX has also been careful not to spend beyond its means despite buying back lots of stock. As of early August, TJX had nearly $2.2 billion of cash and investments on its balance sheet, compared to just $1.6 billion of debt. This strong financial position has earned it an A+ rating from S&P, a major credit rating agency.

TJX added to its debt burden earlier this year, but it did so in a very prudent way. The company issued $750 million of 7-year bonds with a 2.75% interest rate, and used the proceeds to redeem $400 million of 4.2% notes that were maturing next year.

This transaction allowed TJX to bring in some cash to fund its buybacks while locking in a low interest rate through 2021. In fact, because interest rates are so low, TJX's annual interest expense increased less than $4 million even though the company took on an additional $350 million of debt.

Driving long-term EPS growth

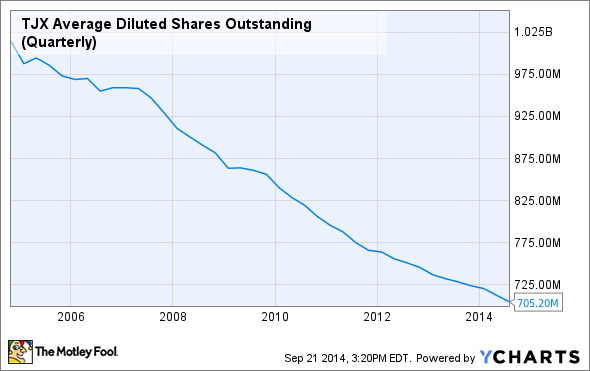

TJX has spent about $13 billion on share repurchases since 1997. These buybacks have played a key role in long-term value creation for shareholders. In the last 5 years alone, TJX has reduced its share count from around 1 billion to 700 million through share repurchases.

TJX Average Diluted Shares Outstanding (Quarterly), data by YCharts

For the next few years, TJX expects to reduce its share count by 3%-4% annually through share repurchases. This will drive roughly 30% of the company's projected 10%-13% annualized EPS growth.

TJX's enviable business model allows it to invest in growth initiatives while also paying regular dividends and steadily reducing its share count. This balanced capital allocation policy will help drive strong stock performance for long-term investors.