I recently detailed the reasons Prospect Capital Corporation's (PSEC -0.36%) share price has dropped lately and why the stock is an extremely cheap investment right now.

Source: pixabay.

In a nutshell, Prospect has traditionally declared its dividends during every quarterly report, and it does so well ahead of time. For instance, when the company reported earnings back in May, Prospect declared its monthly distributions all the way through December. However, when the company issued its latest quarterly report in August, no such announcement was made, leading to speculation that the dividend wouldn't be sustained at the current level beyond the end of the year.

Yesterday, Prospect issued a press release, and while the situation still isn't perfect, investors have a much clearer picture of how the company expects to perform for the rest of 2014.

Disappointing results caused shares to drop

Prospect's most recent earnings certainly missed the mark. Analysts were expecting $0.32 per share, but the company missed by seven cents. However, the earnings miss all by itself isn't what alarmed Prospect's investors.

As I mentioned, for the first time in years, Prospect failed to declare another three months' worth of dividends at the time of its quarterly report. Combined with the fact that the company's earnings weren't enough to cover the roughly $0.33 in dividends paid out during the quarter, it's no wonder the sustainability of the dividend was brought into question.

The dividend guidance isn't what we hoped for, but it's something

The latest development is the press release issued on September 24, which didn't deliver the three months of dividend guidance the market hoped for, but did declare January 2015's distribution to calm the market's fears of a 2015 dividend cut.

Also, the dividend followed Prospect's usual pattern of slightly increasing the payout each month, indicating the company has no intention of chopping the dividend any time soon. The dividend is generally approximated to be $0.11 per share, but the exact payout for September is $0.110525, rising to $0.110550 in October, and increasing by the same amount in the following months.

Enough income to pay the dividend

In addition, Prospect attempted to settle investors' fears regarding the sustainability of the dividend. According to the press release, the current quarter's income will "substantially exceed" the dividends it pays out.

This is due to an "aircraft monetization event" within Echelon Aviation LLC (one of Prospect's portfolio investments), which the company says will produce a $38 million ($0.11 per share) increase in income for the quarter.

Despite this, the stock barely moved

On the day of the press release, Prospect's share price rose by just 1% to about $10.17, still well below the $11 level it touched prior to the August earnings announcement.

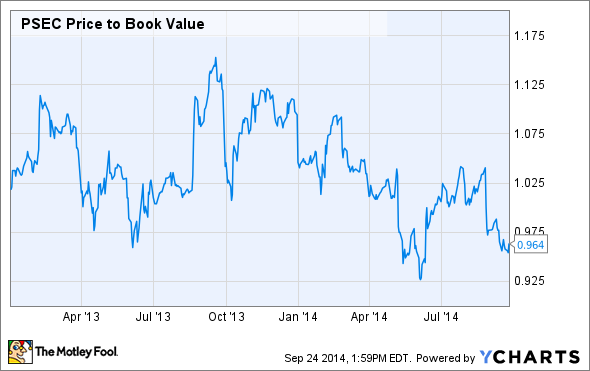

And, as you can see from the chart above, Prospect still trades for a discount to the value of its assets, which is currently $10.56 per share. Historically, Prospect trades at a slight premium to its book value, so this definitely looks like a nice buying opportunity caused by the dividend uncertainty.

However, if Prospect delivers on its claim of earnings well in excess of its dividend payments, and decides to declare several more months of dividends at its next earnings report in November, the valuation could easily jump back to the more typical level of slightly more than NAV, or right around the $11 per share price we saw before the recent report.