There are lots of choices for investors looking to put some money in the market in October. Keep reading to find out what some of our top contributors in Fool.com's consumer goods bureau had to say when asked about a top stock to buy for October.

Anders Bylund: Toy producer Mattel (MAT 0.08%) is looking like a Mickey Mouse stock in 2014. The stock has plunged 35% year-to-date, punctuated by three straight earnings misses. The second-quarter report in July, for example, unleashed a 10% price drop overnight.

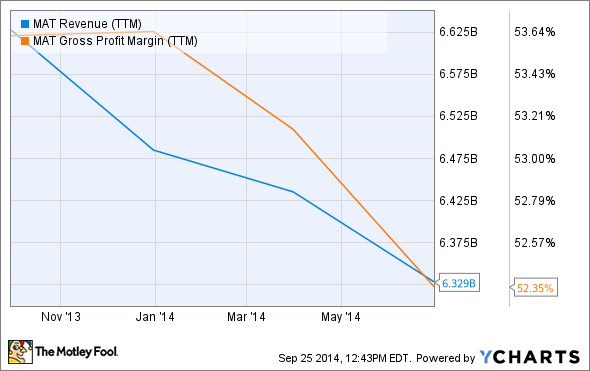

Things look bad on Mattel's surface. Sales are plunging in nearly every product category, including stalwart brands like Barbie and Hot Wheels. That wouldn't be so bad if profit margins were holding up -- but Mattel's gross margins are shrinking, too:

MAT Revenue (TTM) data by YCharts

So why would I recommend buying Mattel stock right now, while these key metrics would tell most investors to run the other way?

First, the margin and revenue slumps are actually fairly small retreats from the all-time records Mattel set on both counts in 2013. It won't take much of a bounce to get this long-term story back on track.

Second, Mattel is still digesting the $423 million MEGA acquisition. When Mattel completes that huge integration, the company will unlock cost-saving synergies alongside a much-needed revenue surge. This is just a matter of time and logistics. MEGA focuses on construction toys, games and puzzles, and arts and crafts.

Third, Mattel's 2014 correction calmed down an overheated stock. Mattel shares traded at a historically high 19 times trailing earnings at the start of the year, and have retreated to a far more affordable 13.4 P/E ratio now.

In short, Mattel has become a great long-term value thanks to short-term worries. Foolish investors love these unreasonable discounts.

Tamara Walsh: Football and fall weather make Under Armour (UAA 0.53%) the perfect stock to own in October. Not only is it a market leader when it comes to high-performance apparel and cold weather gear, but its affiliation with collegiate athletic departments including the likes of Notre Dame mean football fans everywhere will have Under Armour top of mind this month. This should help boost sales for the athletic company in the quarters ahead. The company grew its revenue a whopping 36% to $642 million in the first quarter. Moreover, Under Armour has strong revenue growth with very little debt on the books today.

Under Armour is a cyclical stock, which means sales typically decline during economic slowdowns and thrive when the economy is good and people are willing to spend money. With the all-important holiday shopping season around the corner, Under Armour should see a significant bump in sales in the months ahead. The holiday season is critical for retailers, with most brands generating between 20% and 40% of their annual revenue during the holidays. In fact, November and December sales account for 20% of U.S. retailers' annual profit each year, according to the National Retail Federation .

Given these factors and where the stock currently trades, Under Armour is a top stock to buy in October. As of this writing, Under Armour stock was trading 8% below its 52-week high at around $67 a share, which I believe creates a favorable entry point for long-term investors.

Nathan Hamilton: Amazon.com (AMZN 0.17%) is a top stock in October because of Amazon Prime, the company's all-encompassing service for free two-day shipping and streaming video and music. Amazon.com is pushing Prime from many different angles. It recently packaged a free Prime subscription with AT&T's (T -1.45%) unbundled cable offering. Also, Amazon.com's recent hardware releases such as the Fire phone, Fire tablet, and Fire TV, are all boosting Prime subscribers.

Here's why Prime is so important to Amazon.com investors: On average, Prime users spend $1,340 annually compared to $650 for regular Amazon.com shoppers, according to a 2013 report from Consumer Intelligence Research Partners. Amazon.com has been tight-lipped about subscriber counts, but did allude to "tens of millions of subscribers" previously. Most analysts originally pegged the number at 20 million, but a recent report from RBC estimates the true number is closer to 50 million globally. Extrapolating the numbers out, 50 million Prime subscribers could add $34.5 billion in additional revenue annually – a large sum for a company with just over $82 billion in trailing-12-month revenue.

With Prime subscribers growing rapidly, Amazon.com should maintain its current trajectory of double-digit revenue growth. This is one reason why I believe the stock is a long-term buy.

Andrés Cardenal: Las Vegas Sands (LVS 0.13%) stock is down by roughly 20% year to date, as concerns over falling VIP gaming revenues in Macau are scaring investors away from the company. Increased regulations and credit restrictions on VIP gamblers, in addition to slowing economic growth in China, have created considerable headwinds for Las Vegas Sands and other Macau casinos over the last several months.

However, the recent decline looks like a buying opportunity for investors. Las Vegas Sands owns a leadership position in the lucrative Macau market. Management estimates that it will own 43% of all gaming operators' hotel rooms in the region by 2017. Short-term considerations aside, a rising Chinese middle class and improved infrastructure mean that demand in Macau should expand materially in the years ahead.

The company is also exploring opportunities for growth in countries like Japan, South Korea and Vietnam, leveraging its track record and reputation as a successful operator in the Asian region.

Las Vegas Sands has increased sales at an impressive rate of 25.7% annually through the last five years, and the business generates huge profit margins, in the area of 26% of sales at the operating level. The dividend yield of 3% is quite attractive for such an exciting growth company. These are all reasons I think Las Vegas Sands stock is a buy now.