Image Courtesy Trinec Iron and Steel Works.

The steel industry is cyclical, expensive, and ultra-competitive. The demand for steel is still suffering from the effects of the recession, with utilization rates -- the measure of total capacity being used -- still below pre-recession levels. The effects of recessions and dynamic market changes can hit steelmakers hard, and last for years at a time. This makes it incredible that Nucor (NUE -1.08%) is a Dividend Aristocrat, which means that it's paid out -- and increased -- its dividend every year for at least 25 years.

While that tells us a lot about its past success, it's no guarantee of future returns -- especially in a challenging and competitive industry like steelmaking. Let's take a closer look at Nucor: Is now a good time to buy this industrial dynamo, or is it better to stay away? Is it even the best investment in its industry?

Making money in any market

This is something that has really separated Nucor from its competitors during the past several decades. The biggest challenge with steelmaking is managing fixed costs. This isn't a problem for steelmakers when demand is high and plant utilization rates are peaking. But when steel demand falls, the companies that remain profitable are the ones that can quickly reduce fixed costs without causing major future expenses.

Demand for steel and iron has rebounded moderately during the past couple of years, but a new challenge to domestic steelmakers -- low-cost imports from Asia that several industry executives have called "illegal dumping" -- has put further pressure on bottom lines. And while tariffs have been enacted to help reduce the impact of imports and help domestic steelmakers be competitive and profitable, this is a short-term fix for a long-term problem that only a few companies in the industry have been successful at managing.

Nucor has been the best in the industry at managing fixed costs when the industry cycle is on the downside, and it has done this largely through the way it manages its business -- via investing in better technology and capability, better processes, and expanding in markets in which it can best compete. As a result, it is better prepared to manage costs when things get bad.

One metric that's good to use is ROCE, or return on capital employed. Here's a look at the ROCE for Nucor and some peers:

NUE Return on Capital Employed (TTM) data by YCharts.

Only Steel Dynamics (STLD -3.16%) consistently performs at similar levels as Nucor. Not only do these two companies tend to maintain the highest ROCE, their return levels don't fall anywhere near as much as those of competitors AK Steel Holdings (AKS) and U.S. Steel (X -3.53%) in periods of economic recession (gray bars).

How does this translate to return for shareholders?

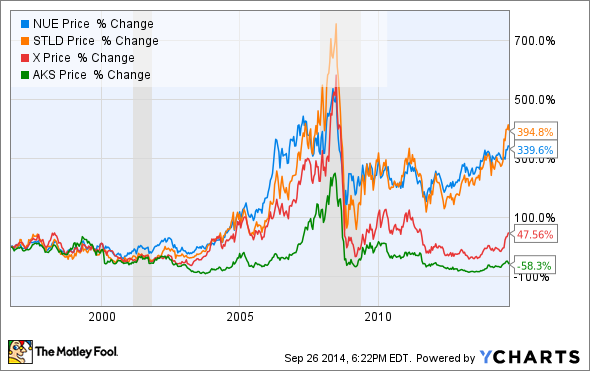

The two companies with the best historical ROCE have provided the best returns for investors. Actually, Steel Dynamics' stock has performed better than Nucor's during the past 20 years.

The power of Nucor's dividend

When we add dividends in, the two best stay on top -- but the returns are immensely better:

NUE Total Return Price data by YCharts.

Nucor's dividend history changes the story. While both have been phenomenal investments, every $100 invested would have netted $80 more in returns with Nucor.

Here are some other metrics that matter:

NUE Total Dividends Paid (TTM) data by YCharts.

While net income can swing wildly based on inventories and non-cash charges for an asset-heavy business like steelmaking, an analysis of free cash and cash from operations compared to dividends paid can help show how much cash is left over after paying the bills and operating costs. What do we learn from the data above?

In short, Nucor is giving a very significant portion of cash generated back to shareholders right now. Its payout ratio -- which measures how much of the company's earnings is paid out in dividends -- is 92%, meaning there isn't much wiggle room right now.

Looking ahead

Nucor's payout ratio is incredibly high, and it's also hard to ignore the high valuation multiples that Nucor stock is going for, with a price-to-earnings multiple higher than 30, well above historical norms closer to 20.

With that said, Nucor has been the best in its industry for decades and, by all accounts, will remain the best. The company has invested heavily in its mini-mills and Direct-Reduced iron production with natural gas, even entering into a joint venture with Encana to hedge gas costs. Nucor has also made more than $2 billion in acquisitions in recent years, most notably entering the scrap steel business in 2008 with the $1.4 billion David J Joseph acquisition, and expanding its distribution by acquiring Skyline Steel in 2012.

Is Nucor a buy?

Nucor is just one of many dividend stocks carrying a high multiple, largely driven by investors looking for yield that's not available anywhere but stocks right now. Eventually, those multiples will start to return to more "normal" levels; but it could take years for that to occur. In the interim, the steel market will rebound, and Nucor will be one of the key beneficiaries.

I think the upside is greater than the risk, but I wouldn't go "all-in" on Nucor, and would instead build out a position over several years. Furthermore, I think Steel Dynamics -- also an excellent business and with a much lower P/E multiple -- is worth a closer look, as well. It may not be a Dividend Aristocrat, but it's still a great business on the right side of its industry's cycle.