Banco Santander, S.A. (SAN 1.20%) is a very interesting stock. On a valuation basis, it actually appears to be very cheap. And it pays a very attractive dividend yield of almost 9%.

So, why does Wall Street seem to hate Banco Santander as an investment? Most analysts rate the stock a hold despite the fact that on the surface, it looks like a winner. Is the dividend unsustainable, or are earnings expected to take a dive? Or is Banco Santander truly a bargain?

What Banco Santander does

Banco Santander is a commercial bank based in Spain, and also has operations in the U.K., Portugal, U.S., and in most Latin American countries.

It is one of the largest banks in the world, with more than $1.5 trillion in assets, and has nearly 14,000 branches on three continents. The bank serves about 106 million customers, and earns 87% of its income from retail banking services.

What makes it "cheap"?

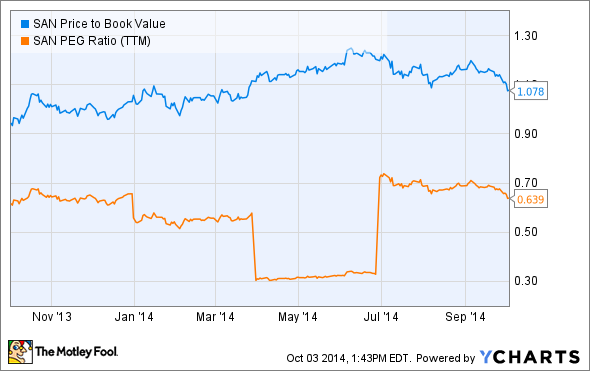

Using two common valuation metrics -- price to earnings growth (PEG) and price to book value (P/B) -- Banco Santander looks very cheap right now.

Generally, any stock with a PEG of less than one is considered to be very cheap, and Santander's is currently just 0.64. What this means is the company's earnings are actually growing pretty rapidly, but this fact is not reflected in the stock price. In fact, the consensus calls for $0.61 per share this year and $0.78 next year, which translates to 28% year-over-year growth.

And the company's price-to-book multiple of 1.08 tells us the stock is barely trading for more than the value of its assets. In other words, you're paying mostly for the company's assets, and any future growth is just a nice bonus.

Why the analysts don't like Banco Santander

Currently, the consensus recommendation of analysts is a hold. There are a few reasons that the company is having a difficult time lately.

First, weakness in the Eurozone (and especially Spain) is a primary concern, and doesn't look like it's going away anytime soon. And perhaps more importantly, much of Latin America is experiencing its own issues, such as the recent downgrade of Brazil's sovereign debt.

In fact, Moody's just recently lowered its outlook for Brazil's banks to "negative" from "stable," and although Santander is technically not a Brazilian bank, it does have an awful lot of exposure in the country.

Any cause for concern?

So, what can investors expect here? And is the dividend sustainable?

Well, for the time being, everything looks to be just temporary weakness. I wholeheartedly believe that Brazil and Europe's economies will stabilize and return to growth, it's just a matter of when it happens. In the meantime, the company has made it clear that it is well-capitalized and expects to pass upcoming stress tests.

As far as the dividend goes, there may or may not be some legitimacy to the concerns. At first glance, it may appear that the dividend might be unsustainable since its value is more than the company earns (or is projected to earn in the next couple of years). However, Santander has been able to easily cover its dividend payments, since most shareholders elect to take more shares rather than cash.

So, while this means that the dividend is definitely sustainable if Santander wants to keep it at the current level, it does have a somewhat dilutive effect on the stock if the company's earnings don't cover it.

Is it a risk worth taking?

Well, there is definitely a substantial amount of risk here. And for those investors who are willing to wait out the economic issues in Europe and Brazil, there could indeed be some profits to be had.

However, there will certainly be some volatility in the meantime, and who knows when the issues will finally blow over. Unless you have a strong stomach and a rather long timeframe to wait out economic headwinds, you may want to stay away from Santander.