Macau's gaming stocks have been pummeled this year, but Melco Crown (MLCO -7.11%) has been the hardest hit of the Macau-centric U.S.-traded gaming companies.

One of the reasons is four straight months of declines in gaming revenue. The other was lofty expectations investors had put on Melco Crown's operations. A new resort in the Philippines and Studio City in Macau were expected to boost earnings; but before they could be finished, the mood of gaming in Asia darkened dramatically.

Still, according to Thomson/First Call 21, Wall Street analysts have a buy rating on Melco Crown's shares, with just three rating it a hold, and no sell ratings. So, why does Wall Street love this beaten down stock so much?

Melco Crown spells growth

One thing Wall Street loves is growth, and that's what Melco Crown has done well since its inception. You can see the company's EBITDA, or earnings before interest, taxes, depreciation, and amortization, in the chart below.

Source data: Company earnings releases.

Add to this performance the Philippines resort and Studio City, and there's reason to be bullish on growth. The growth potential is a major reason Wall Street is so excited about Melco Crown's stock.

Value is beginning to look attractive

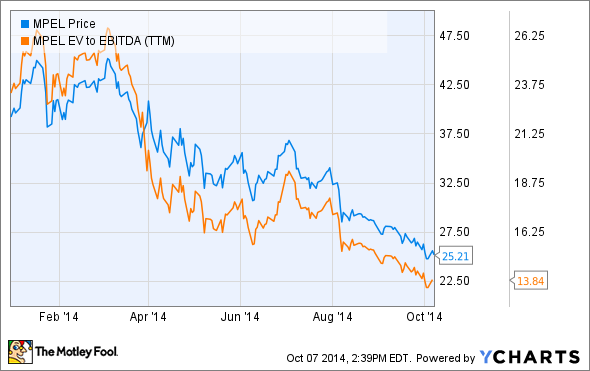

The long-term growth prospects of Melco Crown haven't changed much in the last six months, but the valuation of the stocks has. That's one reason Wall Street is bullish right now.

You can see above that the company's enterprise value/ EBITDA has fallen almost 50% since March, and now hovers just below 14. My enterprise value/EBITDA calculation, which adjusts for cash on the balance sheet, has this ratio down to 10.3.

This ratio is important for gaming companies because EBITDA is a proxy for the cash casinos spit off during operations. It's at a multiple of 10, where I think gaming stocks begin to look attractive, as long as their end market is growing. Macau has actually been slowing in the last four months -- a big reason Melco Crown's stock is down -- but long term, the fundamentals of the region are still attractive. The Chinese economy is growing, the middle class is becoming wealthier, and infrastructure to Macau is improving. Long term, that will drive growth.

It's also worth pointing out that Melco Crown is net debt free. This reduces the company's risk and could lead to a dividend in the near future.

The recent challenges in Macau could lead to a long-term buying opportunity in gaming stocks like Melco Crown. Wall Street is high on the investment, and it may be time for investors to take another look at this gaming stock.