Clean Energy Fuels made some significant progress this quarter. Source: Clean Energy Fuels

Natural gas refueling leader Clean Energy Fuels (CLNE -0.87%) announced third quarter earnings on Thursday, beating Wall Street analyst estimates for both earnings and revenues, driven by a record amount of compressed natural gas deliveries, as well as strong growth in its LNG sales.

The company is still losing money, but has made major progress in recent quarters to lower its costs, set itself up for lower capex going forward, and leverage two major deals to grow without cutting its cash cushion. Let's take a deeper dive into the quarterly earnings report, and the earnings call, and talk about the progress made this quarter.

Fuel deliveries continue to grow

Clean Energy posted a strong 22% growth over the year-ago period. This result comes after reporting 23% growth in the second quarter, and 24% growth in the first quarter of the year. In short, that's a pretty strong trend.

Some have voiced concern about the sequential -- or quarter over quarter -- business, which only grew at about 4%. Let's dig into that next.

A point on quarter-over-quarter business

Quarter-over-quarter deliveries, on the surface, show a decline in the LNG business. Considering the importance of the LNG business, and seeing it grow as trucking customers add trucks each period, this is concerning. Luckily, CFO Rick Wheeler addressed this on the conference call (emphasis mine):

...two of our big legacy transit customers are in the process of converting their LNG buses to CNG. ... In the third quarter of 2014, this transition caused our LNG volumes to decrease by 800,000 gallons and our corresponding CNG volumes to increase by 800,000 gallons. So factoring this into our LNG gallon change between periods, and also factoring in a reduction of 800,000 gallons in our one-off LNG sales that can be lumpy; our LNG volumes were up 19% between periods. Included in this number is an increase in our LNG trucking volumes between periods of 900,000 gallons.

In short, when normalizing for the transition of the transit customers to CNG, and removing one-off LNG sales to industrial customers, the target growth business -- LNG for heavy trucking -- increased 900,000 gallons from the second quarter to the third.

The market's concerns over falling oil prices impacting Clean Energy's sales this quarter clearly were unfounded, as the growth figures show. CEO Andrew Littlefair addressed this on the earnings call, and brought up a really strong point to emphasize natural gas' strong price advantage.

Despite oil price falling, natural gas price advantage remains strong

On the earnings call, Littlefair pointed out a rather compelling statistic:

WTI Crude Oil Spot Price data by YCharts

Since the start of the third quarter, oil prices have fallen more than 20%. However, over that same time frame, the wholesale price of natural gas has also fallen 17%. Diesel, however, has only fallen about 6% over that time. The price advantage of natural gas -- and remember that the wholesale price of NG is only a portion of the price at the pump -- remains quite compelling.

On the earnings call, CFO Rick Wheeler said that Clean Energy's per-gallon margins declined by only one cent in the quarter -- well within reasonable fluctuations based on daily commodity price changes.

Two major initiatives for growth add 6 billion gallons of demand

Clean Energy's partnership with Mansfield has been in place for a couple of years, but has yet to achieve any big results. However, that could change in a big way, starting soon. The two companies announced a joint venture in September to supply the bulk fuel hauling market with natural gas fueling services.

This joint venture -- called Mansfield Clean Energy Partners, will feature Mansfield Oil Company as its first customer. Mansfield is deploying its first 12 CNG trucks to haul gas and diesel, beginning in November, to refuel at a Clean Energy station in Atlanta. In early 2015, a second station will open in Tampa, FL to support more Mansfield trucks.

Mansfield has relationships with hundreds of other bulk fuel haulers -- many of whom work for it -- that will lead to substantial business for the joint venture. Bulk fuel haulers consume 3 billion gallons of diesel annually, and operate similar to solid waste removal companies, with a "return to base" model. Very little of this refueling happens at retail stations, but is instead almost solely at private refueling facilities.

Mansfield is the largest player in this industry -- it is one of the largest suppliers of diesel to these companies -- so partnering with Mansfield here is huge.

The second initiative is Clean Energy's investment in NG Advantage. NG Advantage serves compressed natural gas to industrial and commercial users in New England that do not have access to a gas pipeline. These users are typically high-volume consumers of fuel oil, which is similar in cost and emissions to diesel.

By switching to natural gas supplied via NG Advantage's "virtual pipeline," these companies can save 40% on their fuel costs. Furthermore, because of the nature of the way these customers receive fuel in large, regular deliveries, it could help create baseload demand for further vehicle refueling station expansion into the area.

According to Andrew Littlefair from the earnings call, the New England and Upstate New York markets where NG Advantage is positioned offer huge potential for growth, with maybe 30 billion cubic feet of natural gas demand between the two.

In gallon-equivalents, that's more than 3 billion gallons of potential demand -- as much as the bulk refueling market. Combined, these two new business opportunities expand Clean Energy's addressable market by nearly 20%.

Capital spending plans going forward

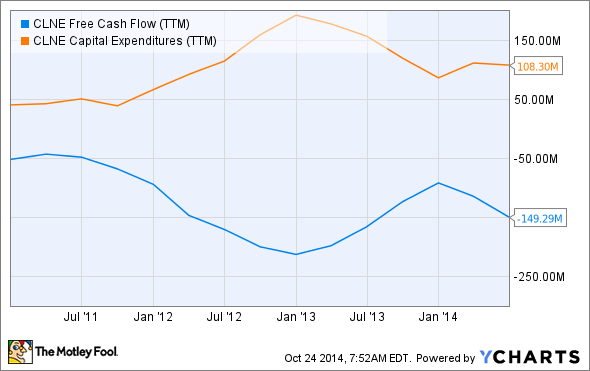

The single most important issue for Clean Energy Fuels right now is how effectively it can manage its cash position between now, and when it reaches positive cash flow. Over the past several years, the company has been burning through cash at an enormous rate:

CLNE Free Cash Flow (TTM) data by YCharts

As you can see, much of that cash burn is directly tied to capex as the company has aggressively expanded its station count.Littlefair addressed this on the earnings call.

Earlier this year, the company reduced its capital expenditures plan for the year from $145 million to $85 million, and Littlefair said that it will further decrease next year, and will likely be discretionary, and specific to customer needs.

It's likely that a lot of this discretionary spending will be tied to the Mansfield joint venture, as those stations will be largely private, "behind the gate" locations, and not refueling at public stations. However, these new stations would be baseloaded from day one, according to Littlefair, versus the "America's Natural Gas Highway," or ANGH, stations that were built out well in advance of truck availability.

As things stand, the company has around 70 completely built ANGH stations for heavy trucking co-located at Pilot/Flying J truck stops that it can open with about $10,000 in opening expense, almost all of which is in fuel loading.

In talking about the NG Advantage investment, CFO Rick Wheeler described the business as having better margins than the vehicle refueling business, and it sounds like this business will generate profits early on. Littlefair said that NG Advantage proceeds would pre-fund capex investments over the next couple of years. Whether that will be capex specific to NG Advantage or for the rest of the business is unclear at this point.

But even if capital expenditures were taken to zero, the company still spends more money than it takes in.

Rationalizing the cost structure

Rick Wheeler talked about the efforts his team has made to reduce costs, and it looks like they are having an impact already. In the third quarter, the company reduced its sales, general, and administrative, or SG&A, costs by $6.2 million versus the prior quarter. Over a full year, that's almost $25 million in cost reduction, and a major step toward bridging the cash flow gap.

The company's EBITDA numbers -- which exclude non-cash depreciation/amortization costs, as well as tax and interest -- and look at the core business' ability to be sustainable on its own, is showing a positive trend over the past three quarters, moving from -$6.8 million in the first quarter, to -$2.0 million in the third quarter. This progress is a result of three things: improved cash generated by increased fuel deliveries, reduced SG&A expense, and moderated capex spend.

However, the impact of interest expense cannot be ignored, as this will cost the company around $40 million per year until the first of the secured notes comes due in September 2016.

Capital position

At the end of the second quarter, Clean Energy had $276.8 million in cash and short-term investments on hand. At the end of the third quarter, that amount had fallen to $265 million. As a comparison, cash on hand fell from $318.8 million from the first quarter to the second-a whopping $42 million drop. So this quarter's ~$12 million negative cash burn is a major step forward.

And while it's probably not reasonable to expect every quarter for the next year to be that low -- the company will need to take advantage of opportunities to build stations for NG Advantage and Mansfield Clean Energy Partners that will be produce immediate results -- it's relatively clear that management has a number of levers it can pull to get cash outflows much more stable.

Looking ahead

Clean Energy Fuels isn't profitable yet, nor is it cash-flow positive. However, the quarter showed some significant improvements in both rationalized costs, and in reducing cash burn.

Furthermore, falling oil prices didn't have an impact on either growth, or margins in the quarter, and the LNG refueling business for heavy trucking grew 19% sequentially -- a strong result considering that many are still calling LNG for trucking a dead business.

The lack of new engines for heavy trucking remains a concern, however the Cummins and Westport Innovations partnership's ISX12 G is still selling well, and meets the needs of about 80% of the trucking applications out there, and this engine has been expected to be the only one available for the majority of 2015 for some time. More engine options would be great, but it will take time for the OEMs to become convinced that there will be demand before this changes.

The funny thing is, Clean Energy continues to grow its business every quarter, regardless. So demand is clearly there, and the company's position as the clear leader in refueling for fleets of all shapes and sizes is leading to more and more business.

Buy, sell, or hold?

My analysis leads me to the conclusion that the level of risk for Clean Energy may have fallen a little in the past few months. The stock price has taken a beating, and there has been some bad news tied to delays in new products, but through all of that, Clean Energy's business has continued to grow, and its cash burn rate has fallen on the back of increased sales, reduced costs, and moderated capex.

Factor in the upside of its two new ventures, and now looks like a great time to start a position to me, or to add to an existing one. However, I'll continue to make this clear: Until the company demonstrates that it can be consistently cash flow positive, and the trucking industry's rate of adoption ramps up in a notable way for several quarters, I intend to keep my exposure relatively small. Reduced risk isn't the same as no risk.