High-yield investments are popular these days, and with interest rates near zero, that's understandable. Retirees especially can be drawn to such investments because the high dividend or distribution they pay out can help fund their living expenses. These income investors are right to favor a high-yield approach, as several studies show that high and growing dividends/distributions can be key to long-term market outperformance.

For example, a 2008 study by Jack Gardner (President of the Thornburg Securities Corporation, an investment management firm) showed that the highest-yielding 100 stocks in the S&P 500 outperformed the regular index by 28.4% annually between 1968 and 2007. Similarly, a 2004 study by Ned Davis (head of the Ned Davis Reseach Group, another investment management firm) found that high-yielding dividend growth stocks were the best class of equity investments between 1972 and 2004.

| Dividend Policy | Annual Return 1972-2004 |

| S&P 500 | 8.5% |

| Nondividend payers | 4.3% |

| Dividend cutters and eliminators | 5.2% |

| Dividend growers | 7.2% |

| All dividend payers | 10.1% |

| Dividend growers and initiators | 10.6% |

Source: "DIVIDENDS, METALS, AND 1960 REPLAYS," Ned Davis Research.

This historical data is so compelling that none other than William Bengen, the father of the "4% maximum draw down" retirement rule, stated that, should investors choose a high-yield dividend growth portfolio, they can safely increase that draw-down rate to 5%. That's an extra $10,000 per year in income, assuming you start with a $1 million retirement fund, which can greatly increase your standard of living during your golden years.

However, I need to warn investors about one investment class that offers tantalizing yields but is loaded with payouts that are, in fact, too good to be true. I'm referring to energy royalty trusts such as the BP Prudhoe Bay Royalty Trust (BPT -0.43%), SandRidge Mississippian Trust I (SDTTU), and SandRidge Mississippian Trust II (SDR).

What's the matter with royalty trusts?

| Company/Trust | Yield | Historic Dividend/Distribution Growth Rate | Projected 5 Year Dividend Growth Rate |

| Sandridge Mississippian Trust I | 36.3% | -29.98% | -7.29% |

| Sandridge Mississippian Trust II | 37.9% | -3.75% | -19.63% |

| BP Prudhoe Bay Royalty Trust | 9.7% | 10.72% | na |

| S&P 500 | 2.07% | 5.05% | 5.05% |

Sources: Yahoo! Finance, Multpl.com, Fastgraphs.

As this table shows, royalty trusts can offer fantastic yields, at least at first glance. However, those sky-high figures are actually an illusion.

As my Motley Fool colleague Tyler Crowe eloquently explained in a recent article, royalty trusts, though they trade on stock exchanges just like regular stocks and MLPs, are a very different kind of investment.

They are set up by parent companies such as SandRidge Energy and BP to fund the exploration and production of oil and gas resources in a fixed and finite area. These companies agree to invest in a certain number of production wells and then pay investors royalty payments derived from the value of the resources extracted. The amount paid is completely dependent on production levels, which decline over time to zero, and commodity prices that, as recently seen with oil's precipitous decline, can be extremely volatile. In addition, once the resources are depleted the trust is dissolved.

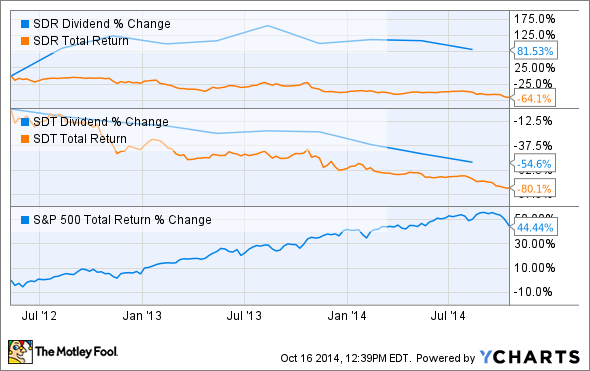

This means there are two fundamental flaws with royalty trusts. First, they have limited life spans and their units (call shares) are destined to eventually reach zero. Second, their distributions (tax-advantaged dividends) are volatile and also destined to decline over time, resulting in a plunging unit price, as can be seen in the case of SandRidge Mississippian Trust I. SandRidge Mississippian Trust II is younger than its sibling, but its distribution has also begun to decline; as the table above indicates, that decline rate is expected to accelerate.

SDR Dividend data by YCharts.

BPT Dividend data by YCharts.

BP Prudhoe Bay Royalty Trust, while able to grow its distributions over its life span, exemplifies the volatility of trust payouts. For example, during the financial crisis of 2008-2009, its distribution was slashed by 67.2% as oil prices collapsed.

In addition, BP Prudhoe Bay only has 14.5 years of estimated reserves remaining, and Crowe noted that the minimum amount of time investors would need to recoup their original investment is seven to 13 years. Thus, investors in BP Prudhoe Bay today stand a very good chance of losing money on this investment.

These two features of royalty trusts are why I believe long-term income investors, especially retirees, should avoid such investment options. Plus, there are far better alternatives for generating large investment income that actually grows over time.