Over the past couple of months, Activision Blizzard (ATVI) has given investors a stream of less-than-great news. Not only have sales of the much-anticipated Destiny failed to meet expectations, but the Blizzard studio has canceled development of Titan, the planned replacement for World of Warcraft. With earnings set to be released on Nov. 4 after the market closes, what should investors be looking for? Let's take a closer look.

Expect a long term decline of WoW

Blizzard confirmed that the WoW subscriber base increased to 7.4 million at the end of the second quarter, but it's not clear how many of these new subscribers will buy expansion packs offered in the fourth quarter. Furthermore, the long-term trend of annual declines started in 2011 may not reverse. New expansions will slow the losses and help keep the revenue coming. But expect WoW's decline to be likely in the long term.

As Foolish contributor Leo Sun wrote in September, WoW isn't the only MMORPG that's seeing a decline in players. The reality is, gamers are shifting away from that genre, and WoW is the only game of that kind that's ever had an extended run of success at both drawing in millions of users and also charging a monthly fee -- as much as $15 per month. Frankly, it's just going to be nearly impossible to recapture that success in today's gamer climate.

What happened to Titan?

Titan, while never officially announced by Blizzard, had supposedly been in some form of development for almost seven years before the company pulled the plug earlier this year. The thing is -- and Activision Blizzard investors should take note -- there were two reasons why the company pulled the plug. In a recent interview, two Blizzard executives said that they were just never happy with the product -- that they didn't find the "fun" or "passion" in the game. Blizzard, like many of the top PC game studios, has a history of pulling the plug on a game if it doesn't meet their expectations. But in some ways, this is a secondary thing. There's a bigger trend at work, too.

Destiny a disappointment?

While the sales of the much-anticipated Destiny haven't been like the blowouts we have seen from console games like the Call of Duty franchise, the company announced it had sold more than $500 million into retail, and in direct downloads, in the first day of the game's release. Furthermore, the company reported that actual sales to end-users totaled $325 million in the first five days. Sure, that's not the level of success we have some to expect from games like the CoD franchise, but it's still a very successful release by most measures.

We should get more color from management in the release, including information about how sticky the game has been so far. With the first expansion already set for release in November, the success of this new franchise -- just like WoW over the years -- will be largely based on gamers staying engaged.

But so much more content than just these two titles

This is what makes Activision Blizzard such a compelling company. Even if the early sales results of Destiny are underwhelming, and with the long term decline of WoW a reality, there aren't many game makers that have anything close to the diversity of revenue streams that this company has, including the Skylanders games for kids, Blizzard's other legendary games like Starcraft and the most recent entry in the Diablo franchise, and now the company's expansion into mobile gaming with the very successful Hearthstone games.

Bigger picture: Gaming in transition

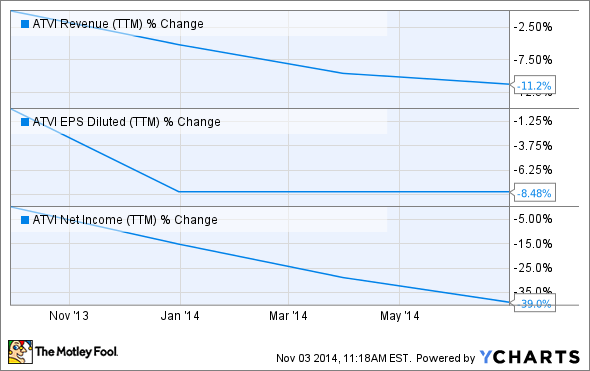

Over the past year, net income, revenue, and earnings per share have all fallen:

ATVI Revenue (TTM) data by YCharts

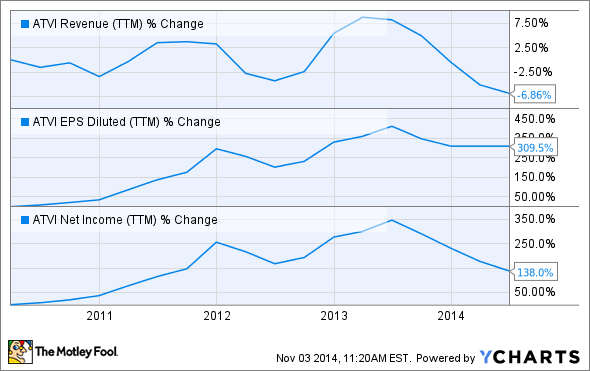

This has been a down year for the entire industry, partly due to the console transition by both Microsoft and Sony, though largely by a decline in PC game sales. However, the industry is heading into the holiday season with a lot of deals in place that should lead to strong console sales, and that's good news for Activision Blizzard. As the chart below shows, this is a regular trend in the gaming business:

ATVI Revenue (TTM) data by YCharts

This is the nature of the industry to a large extent, due to release schedules for games in development as much as anything. It's not worth getting too concerned over something that's part of the company -- and industry -- game release cycle.

Looking ahead: Expectations should go beyond Q2

Activision Blizzard management raised its guidance for revenue and earnings per share for the full year with the second quarter release:

Source: Activision Blizzard Q2 earnings release

As you can see, the company is actually expecting to report a slight loss in the third quarter, but the full-year EPS is pointing to an absolutely blowout fourth quarter. It will be interesting to see how the company actually performed in Q3, and if the early results for Destiny have altered the company's expectations for the full year.

However, much of the third quarter is about getting ready for Q4. Destiny launched with only 21 days remaining in Q3, with its first expansion pack, and the next releases in the CoD and WoW franchises set for early in Q4, and Skylanders: Trap Team released the first week of the quarter. Activision Blizzard is expecting to have its biggest second half sales ever, and it will be based on the success of four significant franchises with appeal across a wide spectrum of gamers of all ages.

At the end of the day, even if Q3's results come in below expectations, it's this massive stable of content -- and how well the company can continue to develop compelling new iterations -- that matters more than just Q3. Keep an eye on the bigger picture.