With all of the volatility in the market lately, and the recent all-time high on the Dow, it's only natural to wonder whether now is the right time to buy any stocks.

First of all, to be a successful long-term investor, you just can't think this way. It's almost always a bad idea to time the market. Buy when the market is low, and buy when the market is high. In the end, you'll make money as long as you invest in good companies at fair prices.

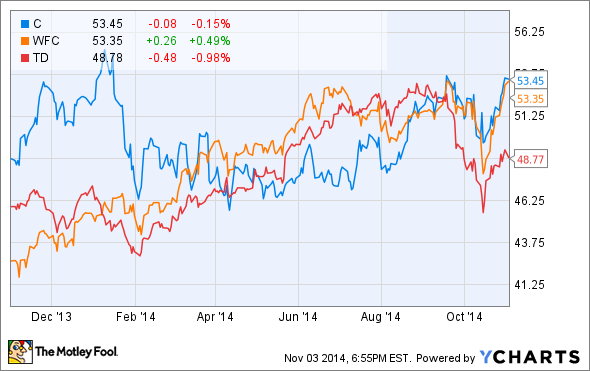

The financial sector is one area where there are still some pretty good deals to be had. Let's look at three bank stocks that I'd be comfortable buying right now.

A great bank, no matter what the market is doing

Wells Fargo (WFC -1.51%) is such an excellent company that it works in virtually any possible market environment.

Unlike the rest of the "big four" banks, Wells Fargo looks more like a smaller savings and loan, focusing most of its efforts on lending and commercial banking rather than on investment banking and other such activities.

And, even though it's the biggest U.S. bank by market cap, Wells Fargo is still growing many areas of its business. As of the most recent quarterly report, Wells showed double-digit growth in credit cards and auto lending, an area in which it recently surpassed Ally for the No. 1 market share.

One of the most compelling reasons to invest in Wells Fargo is its mastery of cross-selling its products to existing customers. Other big banks are just starting this push, but Wells has understood the importance of being its customers' only bank for some time now. It's much cheaper for a bank to sell a product to an existing customer than to go out and find new ones.

Wells Fargo's average customer household currently has about six products with the bank, but it has about 12 banking products altogether. So there's definitely room to grow, and Wells Fargo plans to do just that, aiming for eight products for every customer and a credit card in the wallet of every account holder.

A little risky, but a great price

Admittedly, Citigroup (C -3.00%) is a little bit on the risky side, but from a risk/reward standpoint, the stock looks appealing at the current price.

Citigroup just posted better-than-expected third-quarter earnings and did a pretty good job of managing expenses.

Since the financial crisis, Citigroup has done a good job of getting rid of its "legacy" assets, and its Citi Holdings portfolio has been reduced to $103 billion in assets from $290 billion in 2011. So while $103 in unwanted assets is still a lot and could easily do some damage if the economy goes sour, the number is definitely an improvement. It's worth noting that Citi Holdings produced $1.6 billion in revenue during the third quarter, a 26% improvement from a year ago.

Finally, one of the most positive recent developments out of Citi is the decision to exit its consumer business in 11 markets, such as Japan, Costa Rica, and the Czech Republic, to focus on the areas with the highest growth potential.

So the new concentration of resources toward high-growth areas and the continued winding down of the legacy assets, combined with the fact that Citigroup trades at a discount to its tangible book value, all make Citigroup worthy of consideration.

Not finished growing yet

TD Bank (TD -1.00%) is one of the largest Canadian banks and has done a great job of expanding its presence in the United States over the past decade or so.

After acquiring New Jersey-based Commerce Bancorp in 2008, TD adopted its philosophy of being "America's Most Convenient Bank." The business model is to go after customers who don't want their banks to keep, well, bankers' hours.

Most TD Bank branches are open on weekends (even Sundays), and there are drive-through banking services available until midnight in many locations. I even heard a TD Bank advertisement the other day mentioning that the bank is dog-friendly.

Aside from a winning business model, the bank's numbers speak for themselves. TD is expected to earn $4.30 per share this year and is expected to increase its earnings by 10% in 2015. And thanks to its great product, I think this growth will continue for years to come.

Which to choose?

It's completely up to you which to choose, and the right combination of stocks for your portfolio depends on your particular investment goals and how much risk you can tolerate. The point here is that these are banks that are very good values right now, even with the market at such high levels.