Annaly Capital Management (NLY -0.32%) is one of the most popular high-yield dividend stocks in the market, currently paying an annual dividend of about 10.6%.

However, no stock that pays such a high dividend is without risk, so it's important for investors to know exactly what they're getting into. We asked three of our analysts why investors shouldn't buy Annaly, and here is what they had to say.

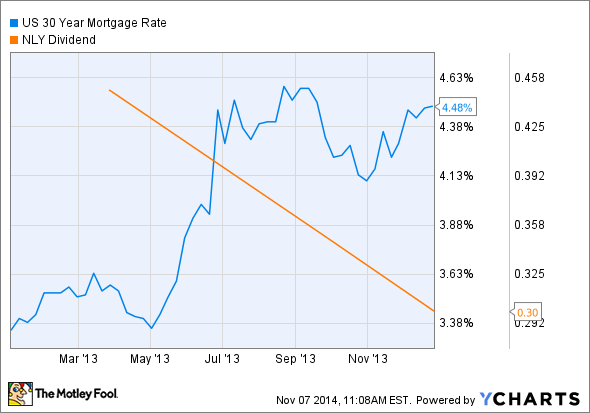

Matt Frankel: If you are uncertain about interest rates, you might want to avoid Annaly. One of the worst things that can happen to a mortgage real estate investment trust like Annaly is interest rate volatility. These companies can perform well if interest rates stay steady, or rise and fall gradually and predictably, but spiking rates can be very dangerous.

Basically, Annaly makes its money by purchasing mortgage-backed securities, which pay a fixed interest rate for a set amount of time, say 3.5% for 15 years. It finances these purchases by borrowing money at lower short-term rates (say 2%), and makes its profit from the spread between the two.

If Annaly's portfolio pays 3.5% and the short-term rate spikes to 3%, it's easy to see how the company's profits can quickly erode. Mortgage REITs hedge against rate changes, but they are still vulnerable.

In fact, the rapid spike in mortgage rates in the middle of 2013 caused Annaly's profit, and therefore its dividend, to drop dramatically.

In short, mortgage REITs work well when interest rates are stable. If you believe interest rates might spike in the near future, you should probably avoid Annaly and other mortgage REITs. Personally, I suspect interest rates will remain relatively stable for at least another year or two, but that's just my opinion.

Patrick Morris: While Annaly's high dividend yield is attractive, I'd never invest in it. Why? Well, thanks to the ultra-concentrated -- and often clouded -- nature of its business, this REIT is susceptible to incredible risk.

Unlike most companies in which you can invest, Annaly isn't much of a business at all. It takes on short-term debt to buy long-term debt in the form of mortgage-backed securities. The company then earns the difference between the interest paid on the short-term debt versus what it receives from its holdings of long-term debt.

Annaly provides neither goods nor services and, as Matt indicated, one of its biggest risks -- volatile interest rate movements -- is entirely outside of its control. Yes, Annaly can take certain actions to mitigate those risks, but ultimately much of its successes and failures have nothing to do with the company itself.

As noted previously, we mustn't view stocks as simply numbers on a screen, but as actual businesses. And I would never be comfortable putting my money into Annaly's business model, especially with so many other wonderful options available.

Jordan Wathen: Over long periods of time, mortgage REITs do one thing very well: blow up.

Going back all the way to the 1970s, mortgage REITs as a whole have failed to keep pace with the broad market. In fact, if you invested $1,000 in the sector in 1970, your principal would be worth less than $60 today.

Obviously you would have received dividends over that period, but even including the industry's double-digit yields, an index fund would have been a better choice.

In fact, you have to look at an extremely favorable period (1991-2011) to find a time when mREITs generated excess returns. During that 20-year period in which rates fell precipitously (which is the best possible scenario for any mortgage REIT) only agency mREITs outperformed the market. The rest lagged.

The returns are the result of pure risk-taking on the back of interest rates, something that rings more of speculation than investing.