Chesapeake Energy Corporation's (CHKA.Q) stock has plummeted 29% from its highs for the year. The plunge in oil prices has had a lot to do with that as we see in the following chart.

Clearly, falling oil prices could continue to drive the stock lower. However, that's not the only risk that could drive the stock lower. While I think there are reasons why the stock could regain its former high even if oil prices don't move higher, there are also risks outside of oil prices that could send the stock even lower. That said, some external risks could actually be a buying opportunity, which is why investors should keep an eye on what's the root cause of any future sell off in the stock.

Dominoes start to fall

The plunge in the price of crude oil wasn't anticipated by the market as many thought OPEC would intervene to support higher prices. Because of this view a lot of smaller shale focused drillers loaded up on debt to take advantage of the shale boom. At some point we're likely to see bankruptcy fears hit the sector as weaker players scramble to recapitalize.

Despite the fact that Chesapeake Energy's balance sheet is the strongest it has been in years, that doesn't mean it is immune if a rash of panic hit the energy sector. Should a debt laden shale focused driller face bankruptcy, it could take the whole sector down with it. However, if a panic like this occurs in the future, it more than likely would offer investors a compelling opportunity to buy Chesapeake Energy's stock at a fire sale price as its balance sheet is rock solid right now.

Source: Chesapeake Energy Corporation.

Warm winter weather

While oil prices might have been behind the company's most recent stock sell-off, that's not the commodity that the company is most exposed to right now. Currently, 71% of the company's production is natural gas, so that is still the fuel that drives the company. Because of its exposure to natural gas, a warmer than expected winter, which would mute demand for natural gas, could cause Chesapeake Energy's stock to cool off even more.

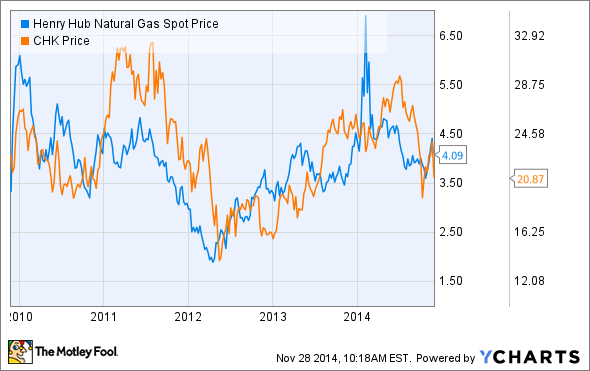

The Farmer's Almanac is calling for a cold winter in the eastern half of the nation. On top of that, snowfall is expected to be above normal in much of the Northeast. So far, these trends are playing out as winter's chill came a bit early this year and brought incredible amounts of snow with it. However, if the early start to winter turns into an early spring it could cause natural gas prices to really cool off, which has a noticeable impact on Chesapeake Energy's stock prices as we see in the following chart.

Henry Hub Natural Gas Spot Price data by YCharts

Forced to slow growth

Chesapeake Energy's management team is focused on keeping its capital spending in line with cash flow. Because of this, capital spending has fallen 60% since 2012 from $14.2 billion down to about $5.7 billion. Over that same time frame cash flow has increased by 36%. However, with the fall in oil prices, there is the potential for cash flow to slip next year, which would cause the company to cut back on spending. This would slow down production growth.

Given that one of the draws of Chesapeake Energy is its growth, this slowdown could cause growth-oriented investors to sell the stock. A rotational sell off as growth investors exit just might be a buying opportunity for long-term investors looking for a value driven catalyst from a future rebound in energy prices.

Investor takeaway

Energy stocks tend to be hypersensitive to commodity prices. However, that's just one risk investors face as everything from the weather to issues with industry peers can drive energy stocks lower. That said, not all of these risks mean its time to sell. Sometimes a sell-off means its time to buy.