The energy sector is known for its volatility, but 2014 was a bit more than most investors expected. However, the upheaval from the plunge in crude oil prices made valuations in the sector pretty compelling. That's not just the case for oil stocks, but solar and natural gas stocks are looking pretty compelling these days too. So, its not surprising that when we asked our analysts which energy stock they liked best heading into 2015, we got answers that were a cross section of the sector. Here are the energy stocks that they think will be among the best to own in 2015.

Image source: SunPower.

Jason Hall: SunPower (SPWR -8.18%) really has a lot going for it right now. The demand for solar is growing at a crazy rate, and SunPower plays in both the distributed residential market, and builds utility-scale solar plants for utility companies.

Furthermore, the company's technological edge -- its panels have been among the most efficient at turning sunlight into usable electricity for years -- mean more power out of every panel. This is a winning scenario for utility installations, which want to produce as much power as possible from the space available, as well as from residential users, who want to generate their power needs with the fewest panels necessary.

SunPower's panels also generate more usable power over their lifetime -- between 20 and 25 years -- which means that the cost-per-watt, or in other words, how much you pay for the power you get, is often lower, even though SunPower's panels can cost more up front.

The stock is down more than 40% since this summer, and it's looking like Mr. Market is giving investors a great opportunity to buy. Not only does SunPower have the best technology, but it's profitable, and its business is growing at a high rate that's likely to be sustained for years.

Matt DiLallo: I think 2015 will be tough for oil companies, but it might be a great year for natural gas drillers. A stock I think could shine in 2015 is Southwestern Energy (SWN 0.27%). Over the past few years, the company has quietly shot up the leaderboard of natural gas producers in the continental U.S., and as of the end of the third quarter, it was the fourth largest gas producer. And there's more growth ahead. So far this quarter the company has announced $5.7 billion in natural gas acquisitions that, when combined with its organic growth, could push it even closer to the top of the leaderboard.

All that being said, Southwestern Energy isn't advancing growth at any cost. The company is one of the lowest cost operators in the industry as it currently has the fourth lowest lifting cost as well as the fourth lowest finding and development cost. These low costs enable the company to generate substantial cash flow even at lower gas prices.

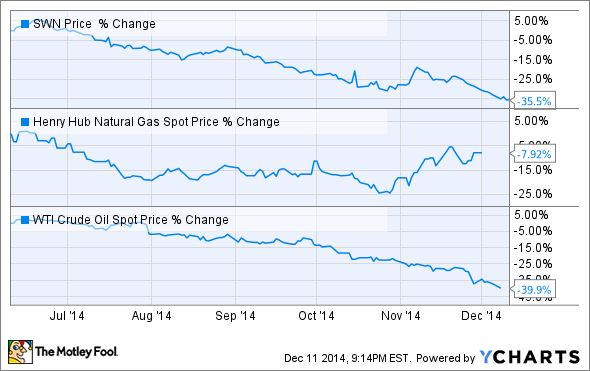

With the company's latest acquisitions, it's entering 2015 in a strong position for future growth. Even better, the stock is a real bargain these days after investors sold off in the oil rout despite being almost a pure natural gas company. As we see here, natural gas prices have barely budged, and are actually trending higher, suggesting Southwestern's profits aren't going to be affected all that much from the oil implosion.

That makes it a great energy stock to buy, especially for investors interested in the long-term future of natural gas.

Tyler Crowe: Some might say that being a fan of Big Oil stocks right now is a sign of being afraid of the recent price slumps. Sure, the vertical integration of these companies makes the bad times easier to stomach. But, the real reason I'm bullish on Big Oil right now is because you can buy these rock-solid companies for a bargain. Of the five companies most widely known in Big Oil, I'm going to have to go with Exxonmobil (XOM 0.25%) right now because of the current valuation discount. Today, Exxonmobil is the only company among its peers that is actually trading below its average 10-year historical valuations.

|

Valuation |

Today |

10-yr avg. |

|---|---|---|

|

Total Enterprise Value/Total Revenue |

1.02x |

1.11x |

|

Total Enterprise Value/EBITDA |

5.33x |

5.50x |

|

Price/Earnings |

11.15x |

11.93x |

|

Price/Tangible Book Value |

2.08x |

3.10x |

Source: S&P Capital IQ.

Exxonmobil will probably never wow you with huge earnings growth numbers from year to year, and its growth plans over the next few years look modest compared to some of its peers. But considering the company has given back over $130 billion to shareholders in dividends and buybacks in the past 5 years — almost all paid for with free cash flow — today is a great time to get in on this capital generating machine.

Investor Takeaway

As we head into 2015, the energy sector appears to be filled with bargains. Not only do we find it filled with beaten-down oil stocks like ExxonMobil, but in solar and natural gas stocks trading at discounts too. That means 2015 could be a very good year to go bargain hunting for energy stocks to own for the long-term.