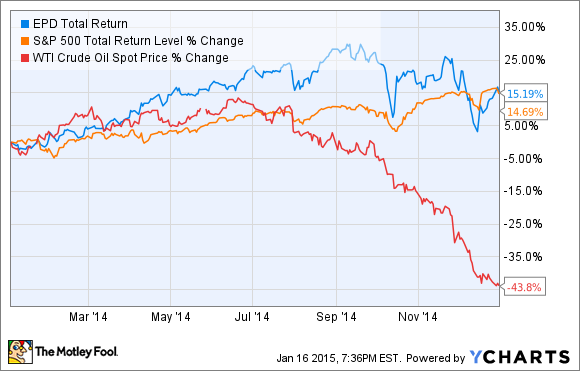

Enterprise Products Partners (EPD 0.18%) has a pretty tough reputation to live up to. In the past 15 years, its shares have beat the total return of the S&P 500 in 13 years, and the years that it lost to the S&P -- 2005 and 2012 -- it was by less than 4%. Throughout 2014 it looked like Enterprise was headed for yet another thorough trouncing of the S&P, but then oil prices decided to fall through the floor and send shares of Enterprise plunging with them.

EPD Total Return Price data by YCharts

It may not have been an impressive win, but the company continued to do the things that it does to generate market-beating returns. Let's take a look at a few things that had Enterprise on track for another great year before oil prices decided to take the company's share price in the wrong direction.

Opportunities abound

It's hard to point to one or two things that Enterprise did in 2014 to continue its market beating performance, and the reason is it did so many things that are noteworthy. Quite possibly the largest projects of note that came online in 2014 were the ATEX Express pipeline, the Seaway Pipeline loop, and its announced plan to acquire Oiltanking Partners (NYSE: OILT). These projects were part of the reason that the company was able to fire on all cylinders and increase volumes for liquids pipeline transportation, NGL processing, and ethane/ethylene exports.

Source: Enterprise Products Partners Investor Presentation.

While the company has yet to announce its fourth-quarter earnings, it would take some major surprises to see it not surpass 2013 numbers for EBITDA and distributable cash flow, meaning that anyone worried about Enterprise not being able to make its distribution payments can sleep very soundly.

Source: Enterprise Products Partners Investor Presentation.

Oil wreaks havoc, but it shouldn't

Based on the performance that Enterprise put together so far this year, the only cause that can be attributed to the drop in share price is plummeting oil prices. However, those in the know on Enterprise's business model will see that not a lot of Enterprise's revenue is dependent on oil prices. According to the company's 10-K, about 85% of the company's gross margin is generated through fixed-fee contracts, and the remaining 15% of revenue is hedged with over 7.5 million barrels of futures contracts.

The other thing that doesn't quite make sense with this drop-off thanks to oil prices is that even though drilling activity is expected to decline in 2015 as producers wind down capital budgets, U.S. Energy Information Administration estimates still see the U.S. increasing oil production by at least 630,000 barrels per day, and natural gas production is expected to increase another 3 billion cubic feet per day. As volumes increase, pipeline companies such as Enterprise should be able to grow their cash flow since so much of that product is moved on a fixed-fee basis.

When you also consider that Enterprise is one of a small handful of master limited partnerships, or MLPs, with an investment grade rating and a rock-solid balance sheet, it's really, really hard to see why oil prices should have such an effect on shares.

What a Fool believes

I guess the one thing that 2014 proved is that no one is safe from oil prices, even if a business' results have little to no correlation with oil prices. Other than a trip up from the WTI tumble, Enterprise did what it has been doing for the past 15 years, and the increasing opportunities still on the horizon for Enterprise make it one of the most tempting energy investments on the market today.