Last year, I wrote about a very prominent bank stock analyst who told his clients that the nation's third-largest bank -- Bank of America (BAC 3.35%) -- was too big to manage and should be broken up. At the same time, though, he had no problem with the size of the nation's second-largest bank -- Citigroup (C 1.41%).

That analyst was CLSA's Mike Mayo, and he's at it again this week. This time though, he's changed his tune on Citigroup. In a statement to Crain's New York Business, Mayo now thinks that it's Citigroup that may need to be "aggressively broken up."

Getting the numbers right is paramount

Last year, Mayo's aggressive posturing toward Bank of America came in response to the bank's miscalculation of the capital related to a small portfolio of structured notes. That mistake led the Fed to reject the bank's planned dividend and stock buyback increase.

My opinion at the time was, and still remains, that the miscalculation was largely overblown by the media; however, it did raise questions as to management's internal controls and auditing processes.

Mayo, a very smart and respected analyst by all accounts, saw the miscalculation as much more. To him, that mistake was the final straw. He told Business Insider that "the incident ... impacts the controls, capital and credibility... I mean, banking is a business of numbers and getting the numbers right is paramount."

At the time, Mayo had as much confidence in Citigroup's numbers as he had doubts on Bank of America's. He told CNBC that Citi's stock could double over the next four years. That is, as long as Citi was able to get the numbers right.

Strike three, and Citi's out

In the past three years, Citigroup has twice failed the Federal Reserve's required annual stress tests. If the bank fails again this year, Mayo thinks it will be time to go nuclear on the bank. He said, "No more excuses, no more apologies. Either Citi gets it done, or it's time to more aggressively break up the company."

That's all well and good, and it certainly helps Mayo raise his profile with headline-grabbing quotes like these, but there's a problem with his assertions and his conclusion.

Citi's first failure was due to an inadequate quantitative model; the spreadsheets and mathematical models fell short of expectations. The numbers were not right.

Last year, though, the bank passed the quantitative testing, but failed the qualitative portion of the test. In other words, the Fed used a judgement call to fail Citi. The Fed's report states:

Taken in isolation, each of the deficiencies would not have been deemed critical enough to warrant an objection, but when viewed together, they raise sufficient concerns regarding the overall reliability of Citigroup's capital planning process.

So, the numbers were right, the Fed just didn't agree with a handful of disparate assumptions Citi management used to build the models out. It seems to me that the Fed doesn't think the bank is too big to manage; I read the report as the Fed suggesting it may just be the wrong management team in the C-suite.

Mayo's 100% right about one thing: The stakes couldn't be higher for investors

For investors, if Citi does fail its stress test once again, expect the stock to plummet. Heads will roll. Whether that includes CEO Michael Corbatt or not is to be determined. But to see this as a reason to "aggressively break up the bank" is a bit much. The bank is actually on a pretty strong capital foundation and moving in the right direction. The risk of a repeat collapse like that of the financial crisis is very, very small.

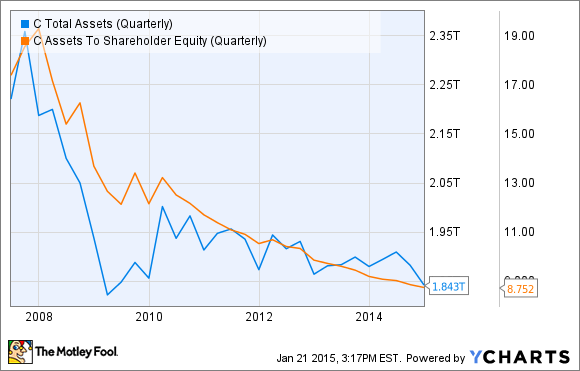

The bank reported a strong 10.5% tier 1 leverage ratio for Dec. 30, 2014. The bank today is smaller, simpler, and less leveraged than it was in 2008. Total assets have come down roughly $500 billion from the bank's peak in late 2007. The ratio of assets to shareholder equity is down from over 19 times to under nine times.

C Total Assets (Quarterly) data by YCharts.

Management and regulators deserve credit for the tremendous progress the bank has made. Citigroup is moving in the right direction; the bank is being managed pretty well in the grand scheme of things over the past six or seven years.

Whether or not the bank passes this year's stress tests or not, it is unlikely that it will be broken up. I think it is far more likely that Citi has regrouped, strengthened its relationship with regulators, and will pass this year's stress test. That's just my opinion, and anything is certainly possible.

While I don't think the existence of the company itself is on the line, it is absolutely do-or-die for the bank's management team. That reality makes Citi an exceptionally risky stock at the present time. Mayo may be right, and the stock may double in the next few years. I simply don't have the stomach to handle the uncertainty and volatility heading into the 2015 stress tests.

When the dust settles, Citi may prove to be a viable value investment. But until then, there are better options out there for bank stock investors.