Hydrogen players like Plug Power Inc (PLUG -0.73%) will happily regale you with examples of how hydrogen fuel cells have saved money while providing a clean, environmentally-friendly fuel to vehicles. And every one of those stories will be true. However, Plug Power focuses on the industrial space. Hydrogen hasn't been able to push into the consumer market... yet.

Toyota Motor Corp (TM -0.91%) is looking to change that. And if hydrogen starts to catch on, it could open up a whole new market for midstream master limited partnerships, or MLPs.

What's hydrogen?

From science class, we all know that hydrogen is an element. But it's also a key fuel source for a hydrogen fuel cell. The science is complicated; but effectively, these little wonders combine hydrogen with oxygen to create electricity through a chemical reaction. The main byproduct is water (two hydrogen atoms and one oxygen, or H20).

The idea is fabulous, but making it work cheaply enough and on a large enough scale is more problematic. So, too, is the lack of infrastructure to support mass adoption of fuel cells.

That's why Plug Power chose to take on the industrial market first. For example, it's been working with companies like Wal-Mart Stores. Plug Power provides hydrogen technology to power the forklifts that move stuff around Wal-Mart's facilities. Clean, reliable, and easy to refuel, Wal-Mart has been impressed enough to extend their original deal with Plug Power to include more sites. But these are controlled locations with fairly predictable usage patterns and hydrogen needs.

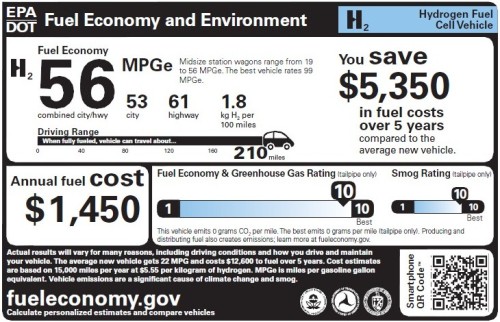

Source: National Highway Traffic Safety Administration and the Environmental Protection Agency, via Wikimedia Commons.

The idea of using hydrogen in cars faces bigger hurdles, like cost compared to gasoline autos, and a near complete lack of support infrastructure for the fuel. But that doesn't mean it isn't backed by big-name players.

For example, Toyota recently opened up its hydrogen patents to the world to spur the technology's adoption in consumer autos. That's right out of Elon Musk's playbook with electric vehicles. Essentially, Toyota is willing to forgo the benefits of its patents to jump start the hydrogen space. Why? So it has a place at the table of what could be the gasoline car's replacement.

What does the world look like?

For right now, the idea of a mass-market hydrogen car is really just pie-in-the sky thinking. After all, electric cars have been pushed for years, and have a larger support infrastructure available -- your wall socket among them -- and they are only a tiny fraction of the industry. In other words, don't get too excited by what is truly an amazing technology. It isn't ready for prime time just yet.

But that doesn't mean you shouldn't think about what the world will look like if it does take off. Clearly, hydrogen cars will be a big part of it. But what about the infrastructure? Right now, we have gasoline stations dotted across the country. It's rare that a town of any size has less than two providers, which require huge amounts of gasoline to be made, stored, and shipped around the country. Key providers in all of this are midstream MLPs like NuStar Energy L.P. (NS 0.79%) and Buckeye Partners, L.P. (BPL).

These two midstream operators, along with many others, provide not only the pipes to move oil, natural gas, and their byproducts (like gasoline) around the country, but also storage. NuStar, for example, has 93 million barrels of storage capacity at its facilities around the world. Buckeye has 64 million barrels of storage capacity. These companies know a thing or two about storing energy products.

Source: BJ Smur, via Wikimedia Commons.

Storing hydrogen

This could pair up well with hydrogen, if and perhaps when the technology catches on in a bigger way. We'll need a way to make, store, and deliver all that hydrogen. While its different than oil and natural gas, the general idea is exactly the same. Moreover, recent research from Sandia Laboratories suggests that storing hydrogen in underground salt caverns would be among the best options.

According to Anna Snider Lord, one of the study's authors, "Above-ground tanks can't even begin to match the amount of hydrogen that can be stored underground." The interesting thing here is that natural gas is often stored in similar underground formations. That puts midstream MLPs in good positions to participate because both aboveground and underground storage will likely be needed.

That said, companies like DCP Midstream Partners, LP (DCP), with around 10 underground salt-storage sites, could quickly find that they have increasingly valuable assets because salt caverns aren't exactly a common geologic formation. That could be good for DCP Midstream unitholders, and make the company a candidate for a buyout or merger.

Don't do anything right now

If you're watching the hydrogen market and waiting for the day the technology takes off, don't forget about all the support systems that have to be put in place. That could open up opportunities in places you wouldn't normally expect, like the realm of midstream operators. We're likely years away from hydrogen going mainstream; but keep in mind the storage needs that will arise if and perhaps when it does.