At first glance, Loews (L -0.36%) might seem like a slam-dunk investment. The company owns majority stakes in several public companies and is sitting on over $5 billion in cash. Add up all its holdings and you'll get over $50 per share -- and you can buy the stock for just $39 today.

But investors should not mistake this for an opportunity. This situation exists for good reason. First, though, let's look at why some investors get excited about Loews.

The appeal of Loews

Loews is a holding company. Most of its investments are in publicly traded businesses, so it's easy to see how the market values them. Here's the typical case for buying Loews:

|

Loews Holding |

Market cap |

Loews stake |

Value to Loews |

|---|---|---|---|

|

CNA Financial (CNA -0.70%) |

$10.2 |

90% |

$9.1 |

|

Diamond Offshore (DO) |

$4.3 |

50.4% |

$2.2 |

|

Boardwalk Pipeline Partners (BWP) |

$3.8 |

53% |

$2.0 |

|

Loews Hotels |

$0.6 |

100% |

$0.6 |

|

Cash |

$5.0 |

100% |

$5.0 |

|

Total |

$19.0 |

||

|

Loews market cap |

$14.9 |

Source: Loews' 10-K and investor presentation.

The ability to buy a company worth $19 billion for less than $15 billion might seem like a fantastic opportunity.

But this sum-of-the-parts assessment is misleading. We need to look more closely at Loews investments, which might not be worth as much as the market says. And we need to talk about what's known as a conglomerate discount.

CNA Financial

About half of Loews' value is tied up CNA Financial, which operates a bland, middle-of-the-road property and casualty insurance business. Because customers seeking P&C insurance just want the lowest price (would you pay extra for a "brand name" insurance policy?), the industry is fiercely competitive.

CNA's combined ratio (a measure of insurer profitability) has improved in recent years, but this is not a growth industry and the company has not differentiated itself in any way.

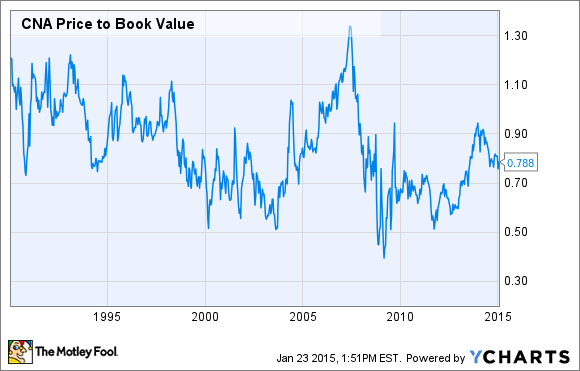

Still, CNA trades for just 0.79 times book value. Most large P&C insurers are valued between 1.0 and 1.5 times book, and you'd think CNA would be worth at least the value of its net assets. Historically, though, CNA has rarely traded for even its book value:

Source: YCharts.

In fact, since 2000, CNA has traded at an average of only 0.77 times book value -- just below its current level.

Diamond Offshore

Diamond is an offshore oil rigger. As oil prices have gone into free fall, demand for offshore oil -- which is more expensive to produce than onshore oil -- has gone with them, and riggers' stocks have fallen off a cliff. With its stock down 35% over the past six months, Diamond has actually fared comparatively well.

The problem is that Diamond is focused on all the wrong parts of the offshore drilling business. Demand has moved to deeper water and to more high-tech rigs, while Diamond primarily operates old, low-tech rigs in shallow water.

The table below shows how much of each riggers' fleet is standard (low-tech) and premium (high-tech), as well as the depths in which the rigs can drill.

Source: Each companies' 10-K and the author's calculations

As you can see, Diamond has been late to the premium and deepwater games. The company is attempting to make the transition, but rigs are expensive and take years to build. With one of the largest rig fleets in the industry, Diamond has its work cut out for it. Investors looking to buy an oil rigger have better options.

Boardwalk Pipeline Partners

Boardwalk owns natural gas pipelines and storage facilities primarily in the Southeast United States. Because it is focused on natural gas, not oil, Boardwalk has been shielded from the brunt of the oil downturn. And because its business turns on the volume, not the price, of natural gas, the business has historically provided a reliable income stream to Loews, which owns about 53% of Boardwalk .

But that is changing. Boardwalk's pipelines transport oil from south (from production in Texas and Louisiana) to north. But the explosion of production in the Marcellus and Utica shales (in Pennsylvania, West Virginia, and Ohio) has shifted the flow of natural gas from northbound to southbound.

Source: Boardwalk Pipeline Partners.

Moving a pipeline is not easy. Boardwalk is moving to reverse the direction of some its pipelines and add others in the new areas of demand, but that process will be long, expensive, and arduous. The pain is already hitting shareholders, who saw their quarterly distributions slashed by 80% in 2014.

This is not a business I'd be excited to own.

Loews Hotels

Loews operates 18 hotels comprising almost 9,000 hotel rooms. The hotel business is not publicly traded on its own, but we know it generated $380 million of revenue and $37 million in EBITDA in 2013 (the last year for which we have data).

We can use publicly traded hotel stocks to get a rough estimate of Loews Hotels' value. Hotel businesses use varying amounts of debt, eo we'll use the enterprise value to EBITDA multiple, which factors in the use and cost of debt.

|

Company |

EV/EBITDA |

|---|---|

|

Ashford Hospitality Trust |

13.8 |

|

Chatham Lodging Trust |

27.2 |

|

Chesapeake Lodging Trust |

18.8 |

|

Diamondrock Hospitality |

17.9 |

|

FelCor Lodging Trust |

18.5 |

|

Hersha Hospitality Trust |

18.4 |

|

Hospitality Properties Trust |

12.7 |

|

Host Hotels & Resorts |

16.9 |

|

LaSalle Hotel Properties |

19.0 |

|

Pebblebrook Hotel Trust |

7.0 |

|

Strategic Hotels & Resorts |

22.1 |

|

Sunstone Hotel Investors |

17.0 |

|

Supertel Hospitality |

10.1 |

|

Average |

16.9 |

Source: S&P Capital IQ.

At the average of 16.9 times EBITDA, Loews Hotels would be worth about $624 million.

The cash

In investor presentations, Loews touts its $5 billion cash position. But unless you are a forensic accountant or made it to page 176 of the latest annual report, you could be forgiven for not realizing the holding company also has about $1.7 billion in debt. Factoring the debt in, the net cash position comes down to a bit over $3 billion.

Conglomerate discount

So what if Loews' companies are a bit shoddy and it has slightly less cash that we thought? The stock still trades for less than the market value of its parts. With lots of rational investors out there, how long can that continue?

Quite a long time, as it turns out.

|

Year |

Discount |

|---|---|

|

2008 |

-53.1% |

|

2009 |

-4.2% |

|

2010 |

-10.9% |

|

2011 |

-11.2% |

|

2012 |

-11% |

|

2013 |

3.5% |

|

Today |

-10.3% |

Source: Loews' historical 10-K filings and the author's calculations.

Since 2008 -- the year Loews first owned stakes in all of its current holdings -- shares have, on average, traded for 14% less than the sum of the company's publicly traded investments. And that's not even counting the hotel business! Today's 10.3% discount is by no means out of the ordinary.

Takeaways for investors

Any investor armed with a calculator can get excited about Loews' stock. After all, the stock trades for less than the sum of its parts. But those "parts" are not that great. If you wouldn't invest in the parts on their own, why would you want to own them all together?

Worse, the stock has traded below its sum-of-the-parts value for a long time, and there's no reason to suspect this will change anytime soon. Investors looking at Loews should pack away their calculators and move on.