When building a portfolio of dividend stocks, investors need to value two components more than anything else: the dividend's stability and its potential to grow over time.

When it comes to stability and growth, few companies can match 3M (MMM 0.86%), Colgate-Palmolive (CL 1.07%), and Procter & Gamble (PG 0.54%). These might not be flashy, high-growth companies, but they're where your search for cash flow should start.

Tide is just one of the staples made by P&G in the consumer business. Image owned by The Motley Fool.

A dividend payout you can count on

These three companies have paid dividends for nearly a century or more. The shortest streak of the bunch is 3M, having paid a dividend for 98 consecutive years. Colgate-Palmolive's streak extends over 119 years, and P&G has been paying investors for the last 124 years. Those are among the longest-running dividends anywhere in the world, making them the very models of consistency investors should be seeking.

On the growth front, these companies aren't doing poorly, either. The chart below shows that 3M, Colgate-Palmolive, and P&G since the mid-1980s have all grown their dividend by more than eightfold, with Colgate-Palmolive's payout rising nearly 16-fold.

MMM Dividend data by YCharts.

Track records of long-term dividend growth make these extremely attractive stocks, but what separates them from others is the fact that their businesses won't easily be upended by a start-up or new technology. They're built to last the test of time.

What makes a dividend work

Dividends wouldn't work without one thing: Free cash flow.

This is the excess cash a business generates after paying all of its bills, including capital expenditures that may be used to drive growth. What investors want to see is the dividend payout being well covered by the company's free cash flow. This ratio can be known as the payout ratio, which is also measured as the dividend as a percentage of net income.

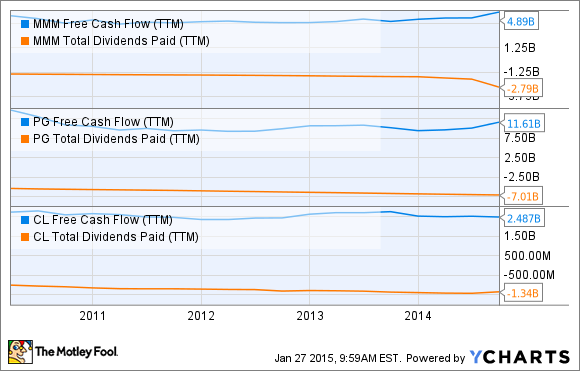

You can see below that the dividend to free cash flow ratio for 3M, P&G, and Colgate-Palmolive is 57%, 60%, and 54% respectively. This gives each company a nice cushion between cash flow and dividend payouts, allowing for slack if business weakens temporarily.

MMM Free Cash Flow (TTM) data by YCharts

A payout ratio well below 100% of free cash flow also allows companies to use cash to bolster the balance sheet or buyback shares of stock. If you have billions in free cash flow, it gives a lot of flexibility to improve the business while still paying investors a consistent dividend.

Scotch Tape may not be a high-growth product, but it has been around for decades and will be for many decades to come. Image owned by The Motley Fool.

What makes these dividend stocks you'll want to own

Dividend payouts are great, but, as we've seen in the energy sector lately, they can also be eliminated completely if business goes belly up. But this is where these three companies are positioned better than most others in the world.

All three have highly diverse businesses, particularly 3M, which has its fingers in everything from energy to electronics to consumer goods. Colgate-Palmolive and P&G are more consumer-focused, but they also offer critical staples; so unless the economy gets so bad that people stop brushing their teeth, I think their businesses will be fine.

Each company also has operations spread around the globe, meaning less exposure to the whims of any single economy. Business and geographic diversification increase the likelihood of a stable dividend; with even a little bit of earnings growth each year, investors should get a payout boost.

Dividends that would be tough to disrupt

History means a lot when it comes to dividends, but so does a business's strategic position When you think about the global reach, brand awareness, and sheer size of 3M, Colgate-Palmolive, and P&G, these should be fabulous dividends to own for decades to come. Not a lot is built to last in the investing world, but these dividends are, and I'd sleep soundly knowing dividend checks will be coming like clockwork each quarter.