United Continental (UAL -2.52%) has been one of the laggards of the airline industry rally of the past 2 years. True, its stock price has nearly quadrupled since December 2012, but all of its top competitors -- including Delta Air Lines (DAL -2.62%) and Southwest Airlines (LUV -0.54%) -- have done even better.

Airline Stock Price Chart, Dec. 2012-present; data by YCharts

In fact, United stock has only really started to gain momentum in the last few months. The company is finally on pace for strong earnings growth. But the key question is whether United can stay on this new trajectory. The answer to that question is still unknown.

A year of solid earnings growth

Last week, United Airlines reported strong profit growth for Q4 and all of 2014. In Q4, United's adjusted profit nearly doubled year-over-year from $248 million to $461 million. United's full year adjusted profit also nearly doubled from $1.04 billion to $1.97 billion.

United Airlines achieved its 2014 profit growth through a combination of modest 1.6% growth in passenger unit revenue, strong ancillary revenue growth, good non-fuel cost control, and a slight decline in its average fuel price.

More good times ahead

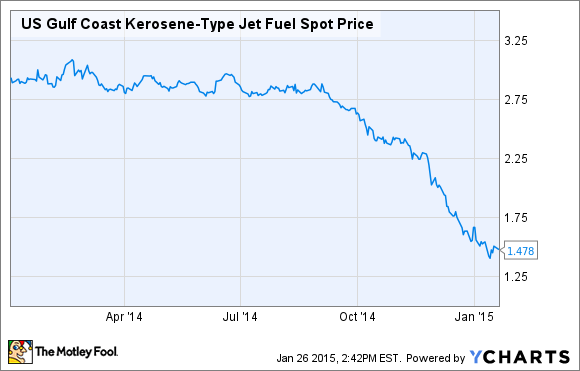

United is currently on pace for even stronger earnings growth in 2015. The main catalyst is the stunning drop in oil and jet fuel prices since September. The market price of jet fuel hovered just below $3 for much of 2014, but has since plummeted to less than $1.50.

US Gulf Coast Kerosene-Type Jet Fuel Spot Price, data by YCharts

As a result, United expects to pay about $2/gallon for jet fuel this quarter. Based on current future market prices, United's full-year jet fuel price could also be around $2, even after roughly $870 million in expected hedging losses. That would be down a full $1/gallon savings year-over-year.

Considering that United uses about 4 billion gallons of jet fuel annually, this represents a massive windfall. The average analyst estimate for United's 2015 EPS currently stands at $10.55: more than double its 2014 adjusted EPS of $5.06. This number implies that United will only bring half of its fuel savings to the bottom line, so there is additional upside possible.

Competitors are still stronger

While United is starting to turn things around, its 2014 adjusted pre-tax margin of approximately 5% was near the bottom of the industry. Delta and Southwest (two of United's top competitors) also reported full-year earnings last week, and their results were far superior.

Delta's 2014 pre-tax margin exceeded 11%, while Southwest's 2014 pre-tax margin exceeded 12%. Analysts are currently expecting both of these carriers to generate more than 5 percentage points of pre-tax margin expansion this year. This will maintain the current margin gap between United and the industry leaders.

United stock isn't as cheap as it looks

Some investors are betting on United in spite of its lower profitability because the stock seems cheap. However, United stock isn't quite as cheap as it might seem at first glance. Based on the average 2015 analyst EPS estimate of $10.55, United stock appears to be trading for just 7 times earnings.

United Airlines stock looks cheap -- but its P/E ratio could be misleading. Photo: The Motley Fool

This is misleading, though, because United isn't accruing taxes this year due to its history of losses. Beginning in 2016, United will probably need to report an effective tax rate of 38%-40% like most other airlines. Including that future tax burden, United stock trades at more than 11 times 2015 earnings, making it somewhat more expensive than Delta stock.

To merit this valuation, United needs to keep improving its cost structure and win back some of the lucrative corporate customers that it has alienated in the past few years. It will also need to fend off rising competition as Virgin America starts to grow again in San Francisco and Los Angeles and Southwest begins international flights in Houston.

Until United Airlines shows that it is succeeding on these fronts (mainly in the form of stronger unit revenue growth), other airline stocks look more attractive. United needs to catch up to the rest of the industry in profitability, or else it will be left behind when the price of oil starts to rise again -- as it inevitably will.