The Dividend Aristocrats -- those stocks that have increased their dividends for at least 25 consecutive years -- are well known as some of the best long-term investments you can make. And while most of the companies on this list are indeed solid investments, a few could be especially good choices right now.

Here are three dividend aristocrats that look like good buys this February.

1. Lots of great brands on sale

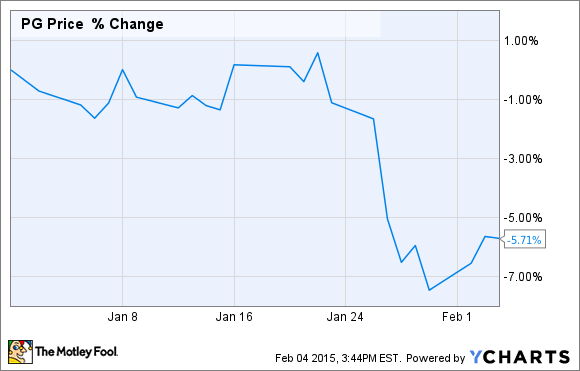

Thanks to a worse-than-expected earnings report, Procter & Gamble (PG 0.86%) is down about 6% year to date. Mainly thanks to the strong U.S. dollar, P&G's international sales have suffered, and the company was forced to lower its 2015 guidance.

Because I like to take the long-haul approach to stocks, I see this as an excellent opportunity to buy a great dividend stock at a discount.

In a nutshell, Procter & Gamble makes products that nearly everyone needs and has some of the most recognizable brands in the world. Just to name a few, I'd have a tough time thinking of a laundry detergent more recognizable than Tide, shaving equipment more popular than Gillette, or diapers sported more than Pampers.

Procter & Gamble currently yields just more than 3% per year, and it has raised its dividend for a remarkable 58 years in a row. And because the company's current $2.57 annual dividend represents just 62% of what it's expected to earn in 2015 even after the reduced guidance, there's no reason to believe it won't keep that up in the future.

2. A great play on the housing recovery

One of my favorite dividend aristocrats for 2015 is Lowe's (LOW -0.03%), simply because I feel that 2015 could be a great year for the housing market. And if it is, Lowe's stands to benefit tremendously.

First of all, I think housing will do well in 2015 because this could be the year we finally see first-time homebuyers come back into the market in large numbers. Currently, just 33% of homes are sold to first-timers -- the lowest level in three decades. Historically, this group has made up about 40% of all buyers.

Between the new low-down-payment loan options from Fannie Mae and Freddie Mac and the lower FHA mortgage insurance rates, Americans have a renewed incentive to buy their first home. Generally, the big limiting factor for first timers is coming up with a down payment, and these new options make it much easier.

I like Lowe's not only because it stands to benefit from a booming housing market, but also because it's in the middle of a fairly aggressive expansion, which includes new stores in Canada and Australia, as well as underserved domestic markets like New York City.

Lowe's has done a great job of making its operations more efficient recently, and its store pick-up business has thrived. Nearly 40% of Lowe's online orders are now picked up in-store, and I wouldn't be surprised to see this number grow.

Finally, Lowe's management expects to see return on invested capital improve from 14% to 19% by 2017, which should translate to significantly higher earnings -- and share prices.

3. It might be time to get defensive

One of my big concerns in 2015 is that the stock market is overdue for a correction. The bull market of the past six years or so has charged ahead virtually unimpeded, and the major indexes have nearly tripled from their March 2009 lows.

One excellent stock for protecting your portfolio from a correction, or even a crash, is Wal-Mart (WMT -0.65%). The company's stores have evolved into one-stop shops for consumers, and Wal-Mart offers better prices on many products than most of its competitors.

As a result, the company actually thrives during bad economic times. When times get tough, people are forced to cut back on their discretionary spending. Instead of getting their groceries from a high-end company like Whole Foods or even Kroger, many people will switch to a big-box discounter like Wal-Mart to try to save money.

As a historical example, just look at how well Wal-Mart did during the 2008-2009 crash.

The reason for this excellent performance is that Wal-Mart's sales actually improved during the recession. The company's sales rose nearly 9% from 2007 to 2008, and they climbed a further 7% from 2008 to 2009. How many other companies can boast similar performance during that time period?

With shares trading down more than 4% from their January highs, now could be an excellent time to play a little defense with Wal-Mart.

And they work great together

I especially like this group of stocks because they complement each other well in a portfolio. For example, if the economy slows down and Lowe's isn't doing so well, Wal-Mart and Procter & Gamble should more than pick up the slack. On the other hand, when the economy and the housing market are booming, Wal-Mart and Procter & Gamble may only grow slowly, but Lowe's has the potential to produce serious growth.

Now could be a great time to get into any of these stocks -- or all three. These companies are rock-solid and could deliver great performance in your portfolio for decades to come.